Are You Using the Right Trading Style and Instrument?

Market Conditions Affect Profits

One of the benefits of the modern market structure with online trading is that anyone can trade just about any trading instrument using a variety of trading styles.

This is also one of the biggest challenges that face retail traders. There are literally too many choices and not enough reliable information to help them select the instrument and optimal trading style that best suits their unique personality, goals, and parameters.

Using the wrong instrument or trading style, or both, in combination leads to frustration, inconsistent results, and ultimately lower profitability over time. Too often, retail traders are told that it is “Okay” if they have less than a 50% success rate. This statement is promoted by vendors who make much higher profits on marginal retail traders who are less successful. If traders are not currently at a 75% or greater success rate trading over time, then it is time to consider if one is using the wrong instrument or style.

Currently, the market is in a Platform Market Condition which is highly lucrative for Position trading but can frustrate Intraday, Day, Swing, and Momentum traders due to the lack of consistent follow through. What has happened is the majority of stocks have shifted to one of the many sideways trend patterns. Platform Market Conditions can persist for months, especially during contraction phases for several industry cycles as is occurring at this time.

The chart example of Key Energy Services, Inc. (NYSE: KEG) below shows a lengthy sideways action due to the current market condition.

The stock is moving up, but spends the preponderance of time in tight sideways price action. Whipsaws are common in Platforms, and cause Swing traders a great deal of angst and disappointment. Most of the time, Day and Swing traders are oblivious to the fact they are trying to trade against the giant Dark Pools who control price, and create this particular market condition.

Platform Market Conditions occur when there is a lack of strong momentum energy or speculative trading. Often some of the Market Participant Groups are less active during this time, so momentum declines and volatility drops. This has been the case in recent weeks.

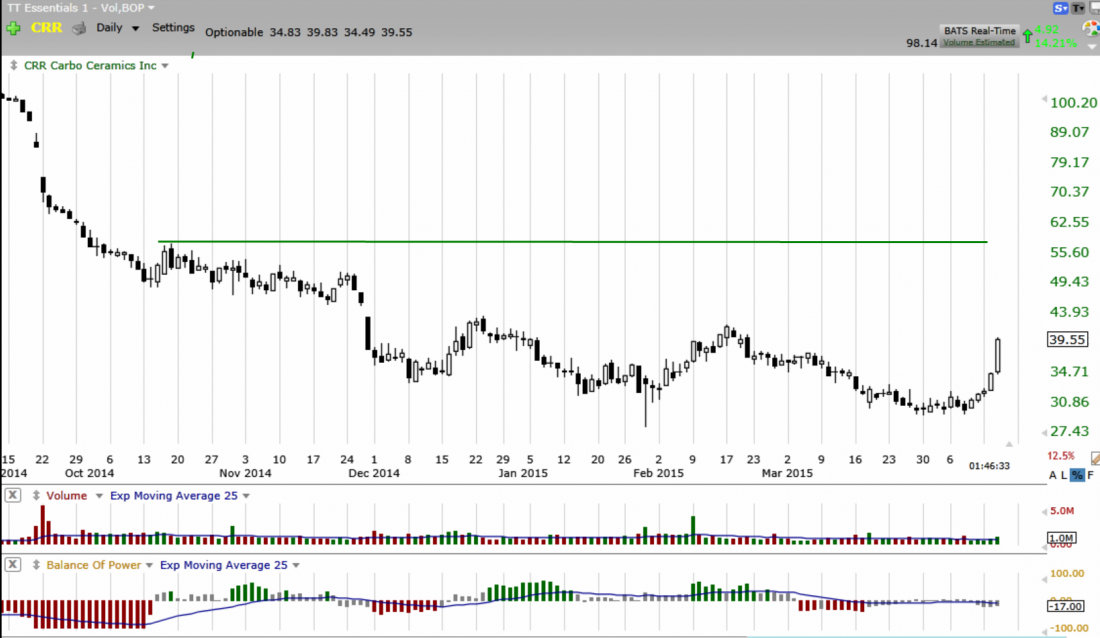

The chart example below of Carbo Ceramics Inc. (NYSE: CRR) shows how Bottoms take much longer to complete in a Platform Market Condition than in a Velocity Market Condition.

Many MACD signals cross too late, just as the stock enters a profit taking mode by professional traders using indicators that track Dark Pools. Suddenly, traders discover their favorite strategy is just not working. Sometimes they simply give up because trading has become too hard and exasperating.

The key to being successful in all six Market Conditions is the ability to cross-train trade. What this means is the retail trader quickly adapts to the changes in market conditions, trading conditions, and price action. By adapting rather than trying to force the market to their will these traders can quickly modify their trading style, use different strategies, and find excellent stocks to trade even during insipid market activity.

With the plethora of new professional and institutional trading venues and their vast library of trading orders and execution systems, the markets tend to move sideways more of the time now than in any time in the history of the financial markets.

If a retail trader depends upon high volatility or velocity momentum action and is unprepared for the slower Platform Market Conditions, their trading profits will evaporate abruptly and then it becomes a matter of trying to play catch up as losses become chronic for a period of time.

Trading any instrument requires the ability to recognize the market conditions present at that time, and then adapting and adjusting trading styles and strategies accordingly.

The modern Market Structure offers retail traders far more opportunities than ever before. However with more opportunities, more trading styles, and more trading instruments to choose from, retail traders also need a far more in-depth, broader, and more intensive education on how the market structure and market conditions will impact their trading at any given time.

Cross-training offers many advantages to retail traders who learn to use different styles and/or instruments to continue to achieve excellent profitability.

Thank You For Reading My Article

#####

Related Reading from Martha Stokes

The Detrended Price Oscillator Indicator – Leading Analysis For Traders And Investors

Advanced Bollinger Bands® Techniques – More Variations Than Most Traders Realize

Time Segmented Volume – The Ideal Oscillator For Automated Markets

*** TechniTrader technical analysis using a TC2000 chart, courtesy of Worden Bros.