Trading Psychology: Are You Trading for Profit Or Excitement?

There is a general perception among the non-trading public that trading is a very exciting occupation, and that there is a high reward waiting for you if you know how to do it correctly.

By high reward, I mean making “a killing”, buying a sports car and a yacht, building a mansion, having a private butler, and so on.

Unfortunately, this vision is very far from reality!

The fact of the matter is that trading and investing is not exciting, and it shouldn’t be especially if you want to actually be successful. Don’t enter investing and trading thinking it will be exciting, or that you will become an instant millionaire, living in the lap of luxury. Investing and trading are processes that require discipline, and a strong understanding of the process. It requires true commitment.

Unfortunately, the fantasy of excitement and instant high returns leads traders with very low levels of capital to enter the arena, expecting to achieve instant riches so that they can quit their jobs. When they do not reach the success they hope for in a short amount of time, they are disappointed and drop out of the game all together. This is a shame.

Investing and trading are endeavours that require persistence, discipline, and patience. Most traders are not successful. In fact, it is thought that perhaps as many as 90 to 95% of traders will lose most of their capital, or even all their capital, in less than 90 days.

I feel that this number is accurate. I have met many people who would fall into this category. They are still in their regular jobs, and are no longer trading because they became easily discouraged.

These people tend to think in extremes. They start out thinking that trading and investing will be easy and they will obtain huge returns immediately, and then when their dreams do not become a reality in a short time period, they decide that trading and investing is a complete waste of time! The best way of thinking is in the middle of these two extremes.

The fact of the matter is that the best people in the field do somewhere within the range of 10-25% p.a., which is sustainable over decades.

When I refer to the “best” people, I am referring to traders and private investors who became today’s fund manager giants, such as Warren Buffett (21.6%p.a. over 50 years), Prem Watsa (22.4% over 28 years), Daniel Loeb (19.6% over 19 years), David Tepper (29.2% over 17 years), and Jim Simmons (30%p.a. over 30 years).

To people unfamiliar with the facts of trading and investing, these percentage gains might not appear to be very good, but when they are compounded over decades, their net wealth has entered the realm of the billions. The most strikingly thing is that, they were never at any risk of losing a large portion of their wealth in their journey to wealth. If they had experienced significant losses, it is likely that they would not be seen as trading titans today, and we would not be referring to them here.

There exist a small number of private traders who claim that they are able to do 100%p.a. plus returns in trading competitions, which is only possible in the short run as a result of using leverage, but are not able to sustain this over the long-term.

By aiming for such unrealistic high returns through utilizing leverage with margin lending, futures, warrants, and options, it is almost certain that you will lose the majority, if not all of your capital. It is juts a matter of time when you aim for such unrealistic returns.

My personal record has consistently been in the 15-25% p.a. range. There have been certain years that they were 35% p.a. or more, but I will readily state that that is not normality for me, and when this happens, I actually begin to think if I actually took any excessive risk without being aware.

Many people forget or don’t realize that close to 90% of professional fund managers that make their living from investing don’t even have the ability to beat their respective index. If you are able to beat the index on a continuous basis as a private trader, you should congratulate yourself as you are a member of a very small and special group.

Rather than focussing on the returns themselves, concentrate on the idea of “risk adjusted” returns.

“Risk adjusted” simply makes reference to the amount of risk you took on in order to achieve the return. Were you consistently safe from your account dropping in excess of 5-10% overnight, or did you leverage too great an amount to achieve your return?

Each individual’s tolerance level for risk is unique. Some people are willing to risk as much as 50% of their account to achieve their hoped for returns. However, it is my belief that this kind of risk is far too excessive. I prefer not to witness my account experience anything more than a 5% decline, at any single point in time. Therefore, I always try to minimize risk wherever I can, even if that means I must reduce my expectation for higher returns.

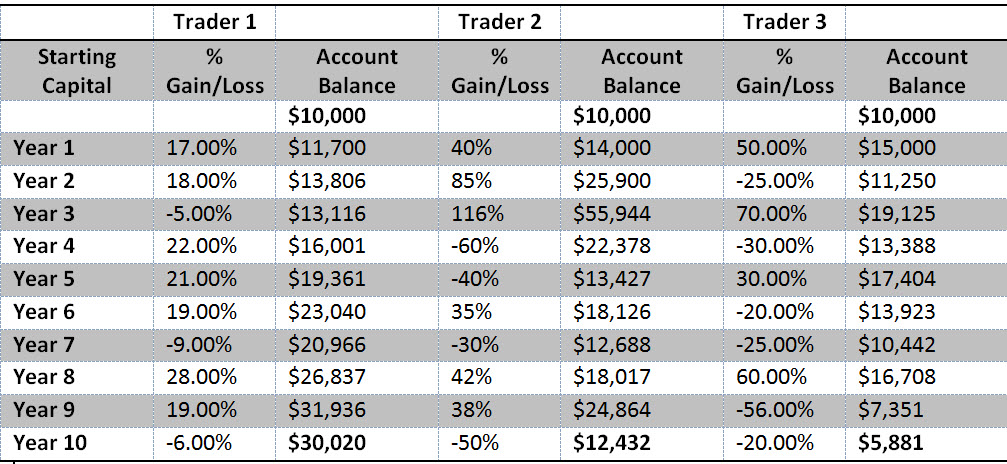

Which of the three traders described would you rather be?

I would choose to be Trader 1, without question. This is not merely because they have a dramatically higher compounded return when the 10 year time period ends, but also because their performance is much more consistent. When the majority of traders first start out, Trader 2 or 3’s scenario is often what they aim for. However, it is clear that they will in all probability never reach that kind of success.

You should seek to continuously beat the indexes, but this will occasionally not come to fruition. Even Warren Buffett has had challenges in beating the indexes on several occasions, so make sure you’re not too hard on yourself when this occurs. Once you actually do beat the indexes, you should try to achieve consistency, instead of exceptional returns in one year when you might lose everything the next year.

Over time, compound interest will work its magic. Give yourself the time required to do so!