8 Steps for a Perfect Trading Plan

Everyone talks about having a trading plan, but what should be in it?

In the first of two part series, we will be looking into the foundational ingredients of all trading plans.

I had to think about this for a long time myself, when I first started out. I attended all the seminars, and I read all the books, and I was constantly hearing that I needed a trading plan, but no one explained what its contents should be.

My trading progress was held up by about three months as a result of the fact that I got caught up in the idea of creating the “perfect” plan before feeling ready to start.

Here is my definition of a trading plan:

A trading plan is a simple document, which sets out your purpose and mission in trading and investing, your goals, your daily actions and routine, your criteria for risk management and rules for position sizing, your systems for trading and investing, and your market analysis.

If you want to treat trading as a mere hobby, and just something to do in your spare time, please do not pursue this. Doing so will be a costly pursuit. You are highly unlikely to obtain the results you want, and it is very likely, that your account will dwindle away to nothing.

However, if you want to treat trading as a real business, in a serious manner, I wish to assist you. Trading and your trading plan are akin to running your own business, with your own business plan, with the exception of the fact that you do not have a boss to report to, or any employees you must oversee.

Like most other things in life, your trading plan will evolve with time, as you become more and more competent in trading and investing.

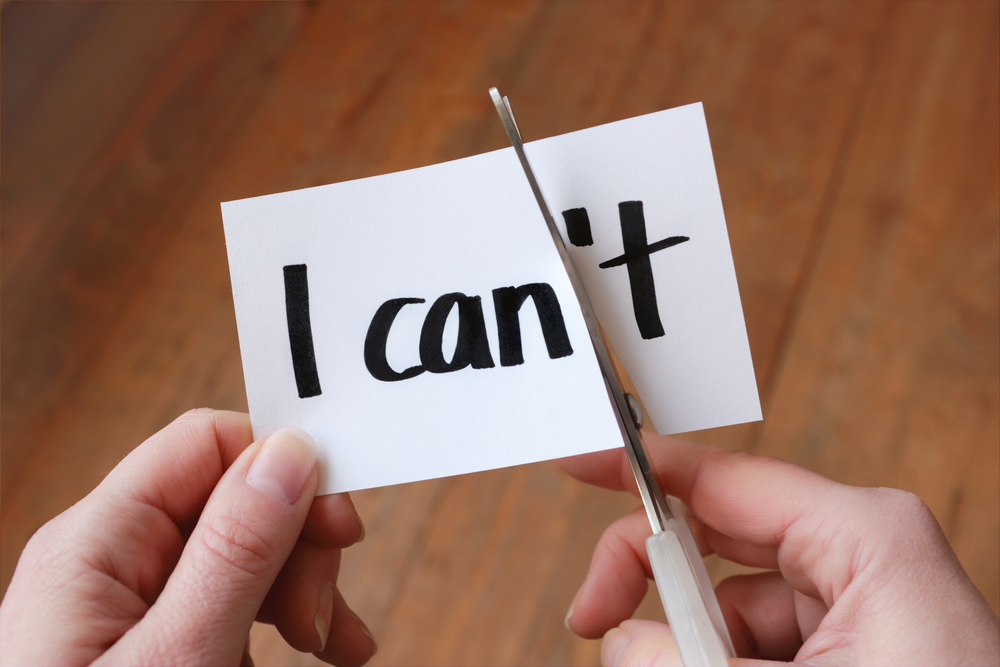

Where many people lose their way is when they spend too much time trying to make their plans absolutely perfect, thinking their plan will be the document that will govern the rest of their trading careers. This isn’t the case. Your trading plan will evolve with you over time.

Don’t let all the details weigh you down and hold you back. This will slow you down, and hold you back from putting actual money in the market, and the market is the most significant and effective teacher.

Below are the essential elements that your trading plan really needs to contain. I have come up with these as a result of my many years of experience. I have taken out non-essential elements, as they tend to weigh people down.

Your Mission and Purpose of Trading

In my “Trade Your Way to Financial Freedom” post, I talked about the concept of your “why”, or main motivation.

You need to know your “why”. If you don’t know it, you will be much more likely to simply quit when things become difficult. When I started out, my big “why” was to have the ability to create financial, time, and location freedom, and to be free from the daily 9-5 workday. This was the purpose that propelled me, and it forced me to keep on going no matter what difficulties presented themselves.

Your Trading Goals

The majority of people mistake the first purpose for their goals. Remember that your why is your mission and purpose, while your goals are your targets in the shorter-term.

For instance, when you first start out, instead of trying for outlandishly high returns and placing that kind of pressure on yourself, your first goal may be to complete a course on trading, and then your next goal might be to begin live trading.

It is with little steps like these that you will eventually reach the fulfillment of your purpose.

Your trading plan will evolve with time, because as you progress in your journey, your plan will be updated constantly, which is why you do not need to have the perfect plan.

Skill Assessment and Love

It probably seems odd to you that I included the word “love” in this title. Skills assessment makes it easy to assess yourself in an honest way, with regard to your trading and investment skills as they currently stand. You should never be too proud to admit that there is something you do not yet know. You are much better off accepting that you do not have this knowledge and taking the incentive to learn it, than pretending that you do have the knowledge and as a result of this, make huge financial errors with devastating financial consequences.

When I mention the word “love”, I am speaking in reference to the markets in which you would like to participate.

There are many different markets out there, and it would be beneficial to you to establish a sense of which one you most want to participate in, and stick to it. This is a much more productive approach than trying to learn them all at once. Eventually, you will be able to appraise your love for each market in relation to the others.

I decided that stocks and options over these stocks, was the market that I loved. While I did learn about Futures, Forex, and Bonds, I had a very comfortable feeling with regard to stocks as I could physically perceive each stock as a business of providing services and products for people. I was able to easily relate to from a business point of view.

Daily Actions and Rituals

This is an especially significant one, as this forms the basis for your potential success. I use the word rituals, from the point of view of discipline.

In all walks of life, you will discover that successful people have established a series of actions or types of behaviour for their regular working day, which gives them a way to effectively achieve their goals and fulfill their purpose. Their daily rituals and actions become ingrained in their behaviour, and after a while they do not even need to make any kind of mental reference to them.

Every person is an individual, and different rituals and actions work best for different people. You need to figure out which are best for you.

Personally, I begin my day with water hydration and a cardio or weight workout to get me physically ready for the coming day. I spend my day carrying out market analysis, in order to prepare myself for the daily trade orders when the markets are closed. After that, I will carry out visualization of myself carrying out the trades, as if I have already done them. When the markets open, it is then very easy to simply execute my plan since my mind has already had the experience once.

Look out for next week’s post as we look into the rest of the eight ingredients of every trading plan, Position Sizing and Risk Management, Trading Systems, Market Analysis and Weekly Review.

Find out how you can safely learn to trade and invest in 10 simple steps, click here