Score Big: Be Patient When Hunting For Trade Exits

“I am a great believer in luck, and I find the harder I work, the more I have of it.”-Thomas Jefferson

Every now and then, it’s good to reflect on a trade. So, like any good analyst, I’ll pick one of my winners to talk about and at least for this week, ignore all the loosing trades that I could have used as examples.

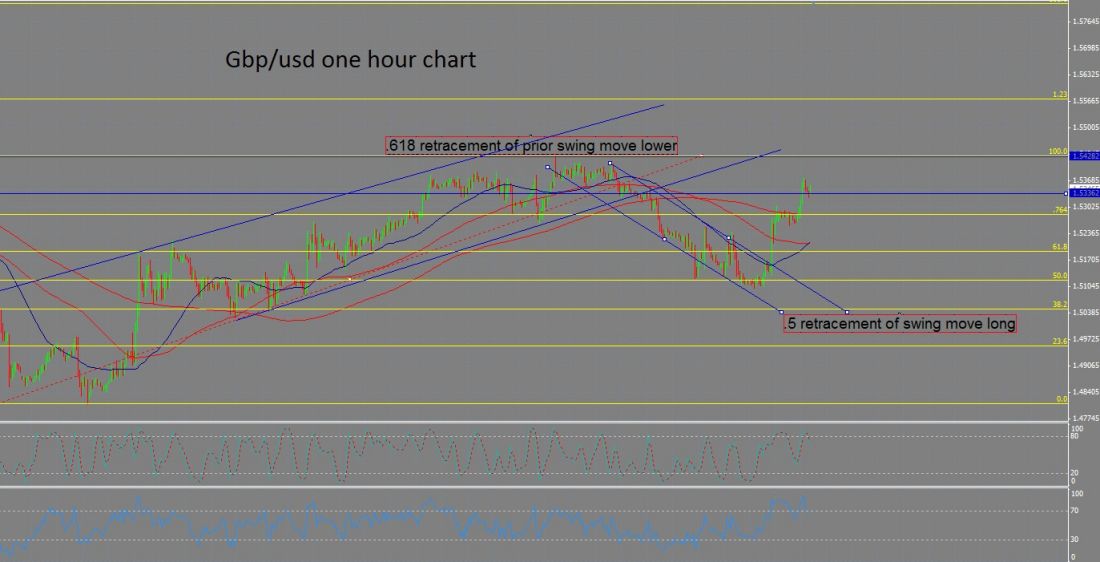

Last week, I recommended selling the pound. It turns out, in my own trading, price moved against me a total of three pips before falling over 200 throughout the rest of the week. Now, the three pips part is just luck, but like I said last week, we had a pretty solid trade setup going on.

A QUICK RECAP

I gave two options last week. The first: was to short near current levels. This could be considered more risky, because in effect, I was recommending picking a top. There were some good reasons at the time as to why that level may have been a top. Prior support / resistance, strong Fib level, oscillators overbought, RSI price divergence on the one and four hour charts and a few more. And, the added benefit of limited risk if you trade off a level.

Of course, there are a lot of drawbacks as well. Past levels don’t mean anything unless price wants them to. “Traders can’t consistently pick tops in the market” (or whatever that means). If you insist on picking tops, you need to be ready to be wrong a lot or have a solid money management plan. So, this is kinda risky. That being said, if you can hone in on lower timeframes and turn a scalp entry into a swing trade, no harm no foul.

THE SAFER TRADING APPROACH

The second was to wait for a trendline / trend channel break before getting in short. We had a well established trend channel, a solid break and a few areas to get in short. This trading style is generally considered safer. You don’t trade an initial selloff (or an anticipation of an initial selloff), but rather a retest, or consolidation of a verified selloff and break of a level. The problem with this trade as with many others is money management stop placement and exit. More about this later.

TAKING PROFITS

Regardless of entry, you still have to get out of a trade. Too many traders are content taking small profits when they finally get a trade to go in their direction that they don’t make any money in the long run.

Patience is key in hunting exits as well as entries. On this trade, I simply got out at the 50% retracement of the prior swing move higher. But, one could also: trail a stop lower; watch price action around previous support / resistance levels; watch for moving average or trendline breaks to the north for exits; or use my favorite method and simply get lucky. But then again, like Tom says…