Understand Credit Ratings: Winners And Losers

Credit Rating agencies have become extremely influential power houses over the last five years.

The credit crunch heavily increased the attention towards the biggest names (S&P, Moody’s and Fitch) and since 2009 every time the sovereign debt of a country has been downgraded, there has been a severe downtrend in the local market.

In other words, credit rating agencies ‘outlook on sovereign debt has become so significant that the expressed viewpoint has been, and it still is, able to “manipulate” the buying / selling pressure in both equity indices and bond markets (the CDS market is also profoundly influenced by credit rating decisions).

Politicians and policy makers are now extremely worried about agencies’ decisions and try to counterbalance any negative news coming from them with speeches and ad–hoc programs (for example, remember Obama’s speech when S&P downgraded the American sovereign debt in 2011).

THE DIFFERENT LEVELS

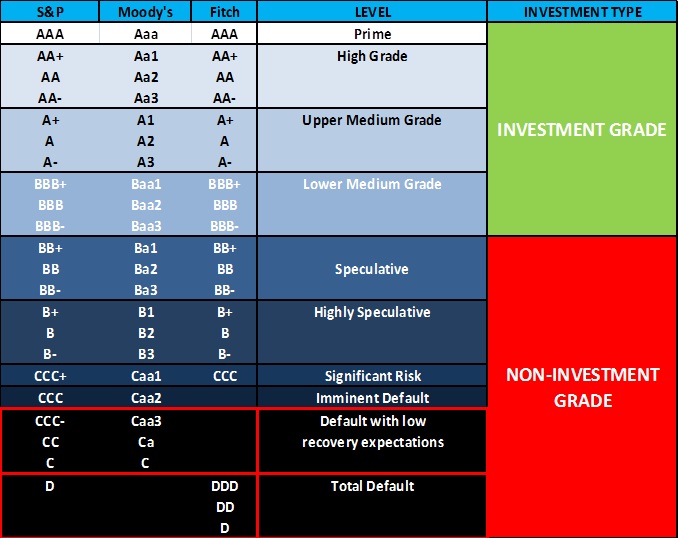

Everyone knows that triple A is as high as it goes but how many ranking levels are there? Are triple A–rated sovereign debts the only ones really worth buying? The following table will try to shed some light on the aforementioned questions by showing all the different thresholds for the three most important agencies:

The first thing to note is that there are two macro levels: “Investment grade and “Non–Investment grade.” Usually, big market players do not buy anything below the Lower Medium Grade threshold because the default risk augments exponentially as you move down. However, many portfolio managers often invest in B+/ B1 / B+ rated bonds because of their high speculative nature.

In fact, the lowest the rating, the higher will be the yield associated with that specific bond. Greece, for instance, which is rated B- (S&P) and Caa3 (Moody’s), is a country whose financial situation is notoriously experiencing major problems and its 10 year government bond offers an 8% yield.

Conversely, Germany, whose debt is AAA rated from all agencies, offers a 1.80% yield on its 10 ten year government bonds while the United States (AA+ from S&P and triple A from Fitch and Moody’s), rewards 10 year Treasury Bond buyers with a 2.90% yield. The difference is remarkable and it also makes sense: the higher the default risk, the higher the yield the market will demand for buying close–to–default securities.

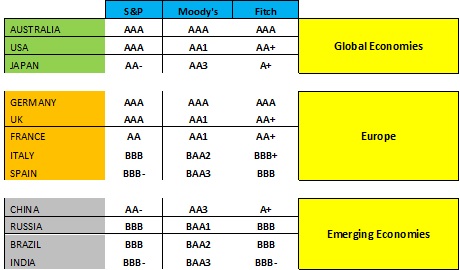

The next table reports the actual credit worthiness of the largest economies sub–divided into three macro-areas: Global Economies (Australia, USA, Japan), Europe (Germany, UK, France, Italy, Spain) and Emerging Economies (China, Russia, Brazil, India):

It is clear enough that Germany, Australia, USA, UK, France, Japan and China are the top ranked countries. Germany and Australia are by far the strongest but also USA and UK display a rather solid creditworthiness, according to the 3 largest agencies. Furthermore, it is worth noting that countries such as Russia and Brazil are ranked as high as Italy by all credit companies and these emerging countries enjoy a higher rank than Spain’s sovereign debt, which is considered to be as stable as the Indian one.