Catching Reversals with Donchian Channels

As a trader, I am interested in 2 things 1) finding winning trades, and 2) staying away from losing trades.

The first item is a given as there are many books written about techniques, methods and strategies to help you find winning trades. This piece will focus on a technique of picking tops and bottoms which can keep you out of some losing trades. It uses an intuitive yet fairly unknown price indicator called the Donchian Channels.

We know through a variety of sentiment readings (such as the COT report) that traders try often to pick tops and bottoms. We also know from industry data that the majority of traders lose equity in their account as a result of trying to anticipate reversals.

The challenge traders are faced with when positioning for a reversal is that it is difficult to pick the point where prices pivot and to confidently establish your risk on the trade. Many times, traders anticipate a reversal only to find out they were completely wrong and prices were not ready to reverse. As a result, traders end up eating a losing trade.

There is a technique to anticipate a reversal that uses the Donchian channels which can help you stay away from some losing trades.

DONCHIAN CHANNEL INDICATOR

The Donchian channel is an indicator which captures the highest high and the lowest low over the past X periods. The Donchian channels are frequently used as a breakout timing tool. For example, if a trader is looking to capture a bullish breakout on a 4 hour candle chart, they are essentially waiting for the market to dictate when it is ready to trade at new 55 candle highs.

We can incorporate the Donchian channels into our reversal strategy with the added advantage that we can insulate our account from taking on some losing trades.

Staying Away from SOME Losing Trades

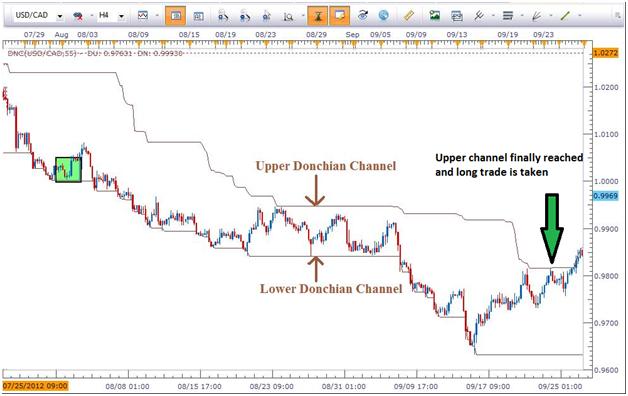

Let’s assume that a trader wanted to buy the USDCAD back in August 2012 (green box) in an attempt to pick a bullish reversal. Had the trader bought on August 1, 2012, they would have quickly seen the pair move several hundred pips against their position. Depending on where the stop loss was placed, many traders wind up buying at several points as the exchange rate continues to fall in an effort to make up for lost equity.

As you can imagine, this can be devastating to the trader’s account.

To incorporate the Donchian channels into the strategy, the trader simply needs to add the Donchian channels indicator to their intraday chart with 55 period input value.

The entry and exit of the strategy is simple. Let’s use the example of the USDCAD previously mentioned.

1) Wait for prices to break 1 pip above the upper channel.

2) Set the stop loss at the lower Donchian channel.

3) The stop loss is manually trailed at the lower channel until the stop loss is triggered. If we remain in this trade long enough, then eventually, the stop loss will get moved to break even and possibly higher.

Notice in the example above how prices never reached the upper Donchian channel until September 24. Therefore, the bullish entry would not have taken place until September 24th at 1 pip above the upper channel. From August 1 to September 24 the USDCAD dropped over 200 pips. Clearly the idea of buying was the wrong idea. However, this is an instance where the trader was wrong on the idea, but they never would have been entered into the losing trade.

Let’s look at another example and how it worked out this reversal you may have remembered.

In October 2011, the AUDUSD was moving hard to the downside as the stock market sold off with the European Debt Crisis and US debt downgrade taking center stage. A trader interested in trying to pick a bottom with many indicators showing oversold levels could use the Donchian channels for entry and exit timing. Implementing this strategy shows how placing an entry order 1 pip above the high was triggered on October 10, 2011. The stop loss is initially set to .9386 and is manually trailed at the lower channel.

This trade is eventually stopped out at 1.0202.

In closing, if you feel like a market is getting too stretched in a direction, incorporate the Donchian channels into your strategy for timing a reversals entry. The Donchian channels won’t keep you away from all losing trades, but as shown above, it can keep you away from some losing trades.