Planning For Retirement? Plan Again

It’s Christmas time. Everyone has been good little boys and girls, working diligently these past 40 years or more, marching toward America’s promise, the golden years when one can lay down the work tools and enjoy the comforts of retirement.

A False Promise

The post-war generation – World War II – came back and raised families based on a simple promise –work hard, buy a house, save money, and when old enough, retire, as in stop working. Now, their children are ready to realize that promise and guess what? It just might not happen, at least not as comfortably as imagined or, worse case, many retirees might end up in poverty.

Somewhere between 7,000 and 10,000 Americans reach retirement age every day, and for many of these people, retirement is a dream that will never come true. People who thought they were solidly part of the great American middle class, people with decent jobs and retirement savings and pension plans, will have to work after they “retire” – that is the lucky ones, who can still work and can still get a job.

Bad News for Many

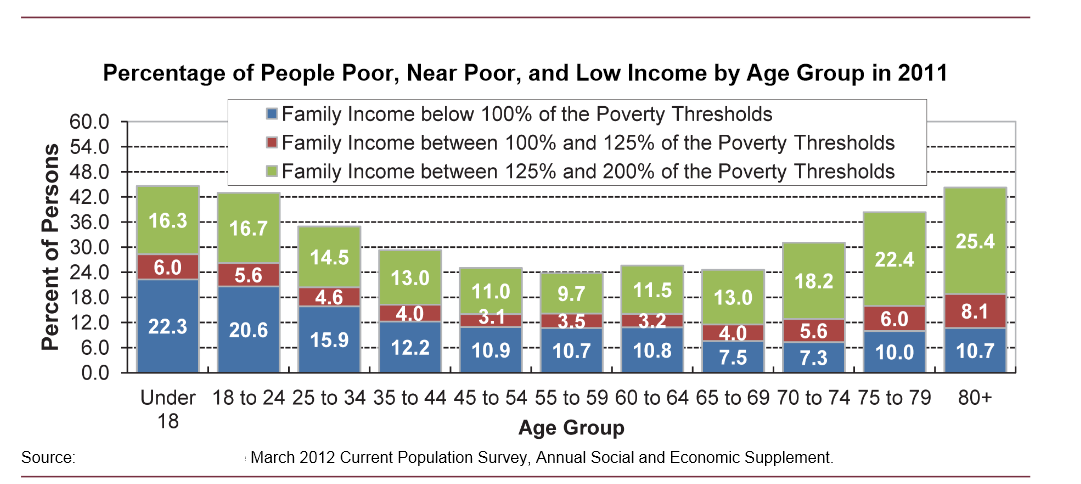

The bad news is a too-large proportion of those who cannot work will live in the poverty that now characterizes old-age for too many in “the world’s richest country.” According to the U.S. Census Bureau, about 9% of people over age 65 live in poverty, defined as less than about $14,000 a year for a family of two, and $11,000 a year for an individual. By the more reasonable standards, the Census Bureau’s Supplemental Poverty Measure suggests 15% of American seniors live in poverty.

By the still more realistic standards adopted by the Organization for Economic Cooperation and Development (the standard is total income less than half of the median income for the entire population) almost 25% of American seniors live in poverty. These numbers are for families. If one is old, female, and living alone, the poverty rate is much higher.

The Practical Implications

The practical implications of this are many. The American Association of Retired People (AARP) publishes a handy little calculator on their website that estimates how much money one will need to retire. It is unsettling.

It shows that an above-average couple heading for retirement – age 55, no kids to support, no mortgage to pay, a family income of $65,000 a year, $111,000 in retirement savings – will need $19,000 a year more than they receive from all sources, including Social Security, by the time they reach 75, and the best that will afford them is “a more modest lifestyle.”

In effect, more than few Americans retiring now, or recently retired, can look forward to a gentle slide into poverty as they age; the older one gets, the more money needed to retire comfortably.

Steadily-rising healthcare costs make a big contribution to the dismal picture. A couple now entering retirement will probably have about $240,000 in healthcare expenses in their remaining years, up from $202,000 in 2002. In response, earlier this year the U.S. senate proposed to cut $275 billion from Medicare and Medicaid, which would shift a larger portion of the cost of healthcare to individuals.

Help Wanted – Seniors and Young People Only

To deal with this miserable prospect, a lot of seniors – the lucky ones – get jobs. Not good jobs, generally, but a steady pay check to supplement inadequate pensions.

Since December 2007, the start of the Great Recession, US workers aged 55 to 69 have filled 5.5 million new jobs. By comparison, the prime working age population, age 25 to 54, have lost 2.04 million jobs. Last September, for example, virtually all the increase in employment came from seniors. The September jobs report, one of the best in 2014, was released with blaring headlines touting the economic recovery, but almost all the job gains went to workers aged 55 to 69. The only other age group showing an increase was teenagers 16 to 19. The main working age demographic, aged 20 to 55, actually lost jobs.

How Did This Happen to Us?

There are four main factors that will prevent many Americans from getting the retirement they were promised.

- Workers are earning less in real money than they did seven years ago. The median income for middle-class families has not increased since 2007. Median household income in 2013 was about $51,900, or eight percent lower than in 2007. People think they are doing OK, but they are not even standing still.

- Retirement savings are smaller and less valuable. Federal data show households age 55-64 have median savings in their 401K/IRA retirement plans of $111,000, less than it was in 2007. At best, that will provide roughly $500 per month in income; not indexed for inflation, it will be worth less every year retirees live.

- American households are actually getting poorer. According to the New York Times, the “typical American household” is now worth 36 percent less than it was a decade ago.

- Since the Great Recession that began in December of 2007, the American work force has not returned to full participation. There has been marginal growth of jobs with full-time salaries large enough to support saving for retirement, pensions, and healthcare benefits.

But there is another element of this retirement debacle that is frequently ignored – the role of U.S. government policies that have enriched a minute proportion of the population at the expense of everyone else.

Since 2008, the official actions of the Federal Reserve – nominally a private corporation, but in reality an arm of the U.S. government – have been designed to keep interest rates at the lowest level for the longest period in American history.

For much of the last six years, the effective interest rate has been as close to zero as the Fed could manage. The mechanism for doing this was buying U.S. government bonds in massive quantities, which kept bond prices high and, conversely, interest rates low.

The Fed paid for the bonds by creating new credit (inflating the Fed’s balance sheet) and much of the money the Fed created ended up in the stock market. Stock prices soared, and the people who owned stocks got their money back and more, much, much more for many.

Most middle-class Americans have almost all of their net worth tied up in their homes, which might be equal to or worth less today than they were five years ago (depending on where one lives). According to a poll conducted by Bloomberg, 77% of respondents say the biggest bull market in recent history has had little or no effect on their financial well-being, aside from assets held in retirement accounts.

Furthermore, the money retirees scraped together for retirement is declining in value – no matter what the official statistics say, adding to the broad money supply debases the Us dollar. On top of that, low interest rates prevent retirees from earning enough on their investments to finance their retirement.

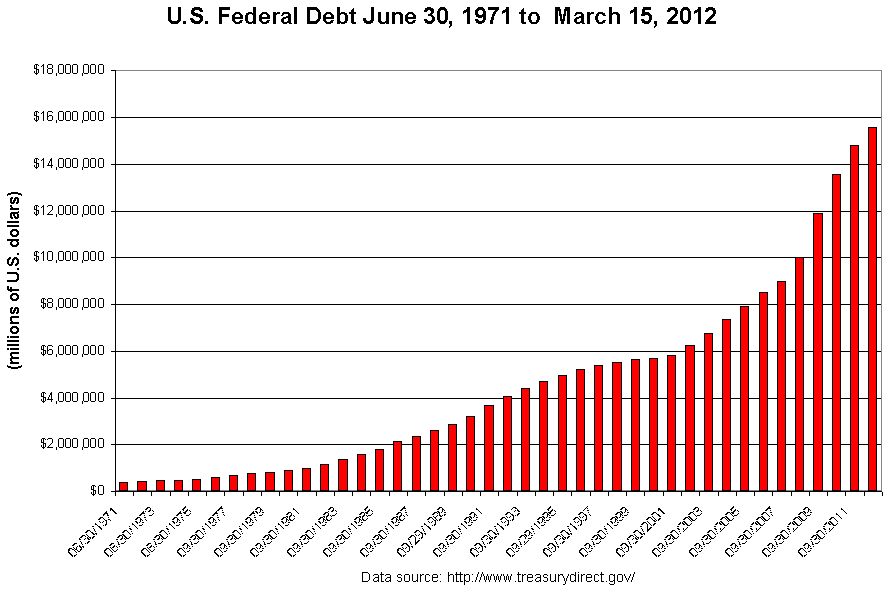

Both inflation and low interest rates hurt savers and benefit debtors. And, of course, the world’s largest debtor is the U.S. government, which is in the fortunate position of being able to set its own interest rates. So don’t expect them to change, no matter what the Fed says.

The U.S. government has to roll over about $7.5 trillion in debt each year. In fact the US Treasury issued $1 trillion in new debt in the last eight weeks alone. If interest rates ever rise to the level that the pay a decent return on retirement investments, the U.S. government will go broke.

So there it is. The Federal Reserve’s creation of new money to buy bonds, arguably, saved the economy from disaster in 2009, a noble and necessary measure. It is too bad about the collateral damage – the broken promise of the American dream of retirement.

#####

To receive the mailing list for our free preview of the US equity markets each weekend, click here

http://www.2.naturus.com/naturus-free-market-preview-subscription-form/