Winning Trades Don’t Equal Retirement Income

It’s just easier to be a pessimist. Nobody will laugh at you if you insist that something really, really bad is bound to hit markets at any time. Nouriel Roubini, Harry Dent, Marc Faber – they get their mugs on TV by being permabears, and get cutesy nicknames like “Dr. Doom and Gloom.”

Sure, there are some who understand that markets do function efficiently, and that they go up over time. Warren Buffett is probably the most well known in that category, but more traders seem to line up behind the “woe is me crowd.” You don’t hear many pundits on CNBC whistling a happy tune, assuring you that on a day-by-day basis, markets rise 51% of the time. Extend that out on a weekly, monthly and yearly basis, and you see where the bullish case begins to make sense.

The truth is: Yes, bad things happen in markets. The events of 2008 are fresh on all our minds. Even the sharp downturn in the summer of 2011, when Standard & Poor’s downgraded U.S. debt, looms large.

So it always seems smarter and more sophisticated to take the bear case. After all, you’ll certainly be right at times!

And there’s always something to worry about. The debt ceiling debate came and went, but as I write this, there’s a headline that reads, “Wall Street Week Ahead: As Fed taper debate goes on, retail vies for attention.”

See? There’s the taper to worry about! And goodness, let’s try to bet which sectors will rise in the next day, week, month, quarter – whatever time frame you pick. It really doesn’t matter.

The dirty little secret is that it’s impossible to accurately pick which stocks, sectors or regions will lead or lag at any given time. Sure, momentum is real, and you can get lucky and ride a wave higher for a while. But over time, a balanced, globally diversified portfolio allows you to always participate in markets that are rising, and gives you the wherewithal to buy low when other asset classes are correcting.

Some people don’t like to hear this. I get hate mail insisting that I am talking down to people and calling them stupid. That’s being extremely thin skinned, since all I’m doing is pointing out the research (some of it done by recent Nobel Prize winner Eugene Fama) showing that markets are efficient, and that it’s impossible to predict, with any consistency, how various asset classes will perform.

Too many Americans make the mistake of focusing only on the U.S. markets. It’s understandable, since we live here, and U.S. stocks make up 46% of world market cap. Some even take the mistake further, and are overweighted in U.S. large cap – in other words, the S&P 500.

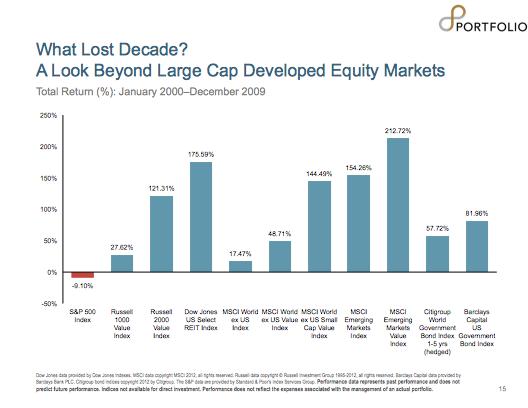

But neglecting world asset classes will hurt. Remember the so-called “lost decade” between 2000 and 2009? The S&P 500 suffered a total decline of 9.1% during that time.

According to data from Dimensional Fund Advisors, even U.S. small caps and REITs finished that decade with solid gains. International asset classes fared even better.

Chart source: Dimensional Fund Advisors

But investors (and traders) who limited themselves to U.S. large caps saw half their wealth evaporate in the financial meltdown of 2008. Not a week goes by that my firm, Portfolio LLC, doesn’t meet with a client who was either self-directed or working with a stockbroker in 2008, and who today has a fraction of the capital he or she had five years ago. It’s sad, mainly because it was so unnecessary. But Wall Street, and their media accomplices, convinced many Americans that large U.S. stocks are the only vehicles available to them. Turn on the financial media. What are they talking about? The S&P 500, the 30 stocks in the Dow, or maybe a sprinkling of Nasdaq Composite. But even in the latter case, the focus is on the heavily weighted members. Apple (AAPL), anyone?

So yes, bad things happen, and they affect markets. But even in a year like 2008, when equity markets around the globe posted losses, diversified investors were able to draw from the fixed-income portion of their portfolios.

I come from a trading background. I spent a decade teaching people how to use basic technicals, such as chart patterns and moving-average lines. I understand the idea that “winners” can be identified through market timing.

But that has absolutely nothing to do with a person’s retirement income needs. These days, when I hear people boasting that such-and-such a trade resulted in some eye-popping return, I think, “That’s great. Congratulations. Now how much income do you need in your non-working years?”

Pet theories about trading strategies, market direction and world economies are all well and good. But the investors who find calm and clarity amid the chaos, amid the inevitable changes in market conditions or personal situations – these investors understand that a diversified portfolio, not a so-called “winning” trade is the key to financial security. Ask yourself: Would you rather win, or would you rather be financially secure? They are not the same thing.