Step Up Your Economics Game And Learn The Transactions Approach

The problem with modern economics is that it’s obsessed with taking perfect, fitted theories and applying them to a messy and often times random world.

Think about the basis of all economics. It assumes that each player is “rational”.

Ha! A few of my ex-girlfriends would prove otherwise…

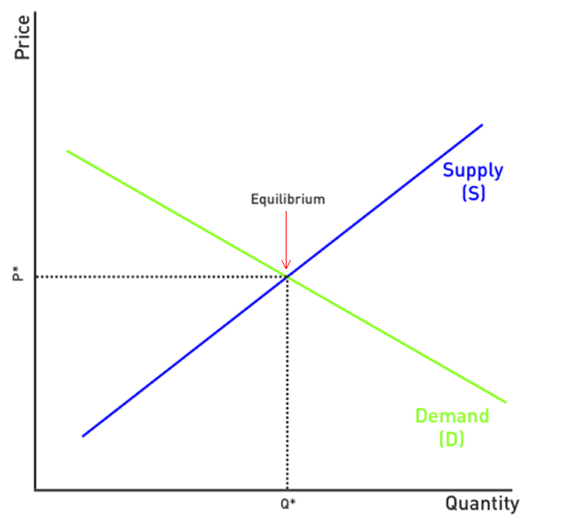

The result are models that don’t work properly in the real world. As an example, take the classic view of supply and demand:

This is taught to every single Econ 101 student around the world. It’s the basis for most economic theory. But unfortunately, it’s grossly inadequate (for reasons we’ll discuss soon).

You don’t have to stick this economic model. We don’t. Instead, we prefer to use legendary hedge fund manager Ray Dalio’s Transactions Approach.

Here’s how it works.

The first thing you need to understand is that the economy is really just made up of a bunch of transactions. A transaction is simply the exchange of money (or credit) for a good, service, or financial asset. Now combine all the transactions for a particular good and you get a market. For example, there’s one market for oil and another market for cotton. An economy is created when you combine all these different markets and their transactions.

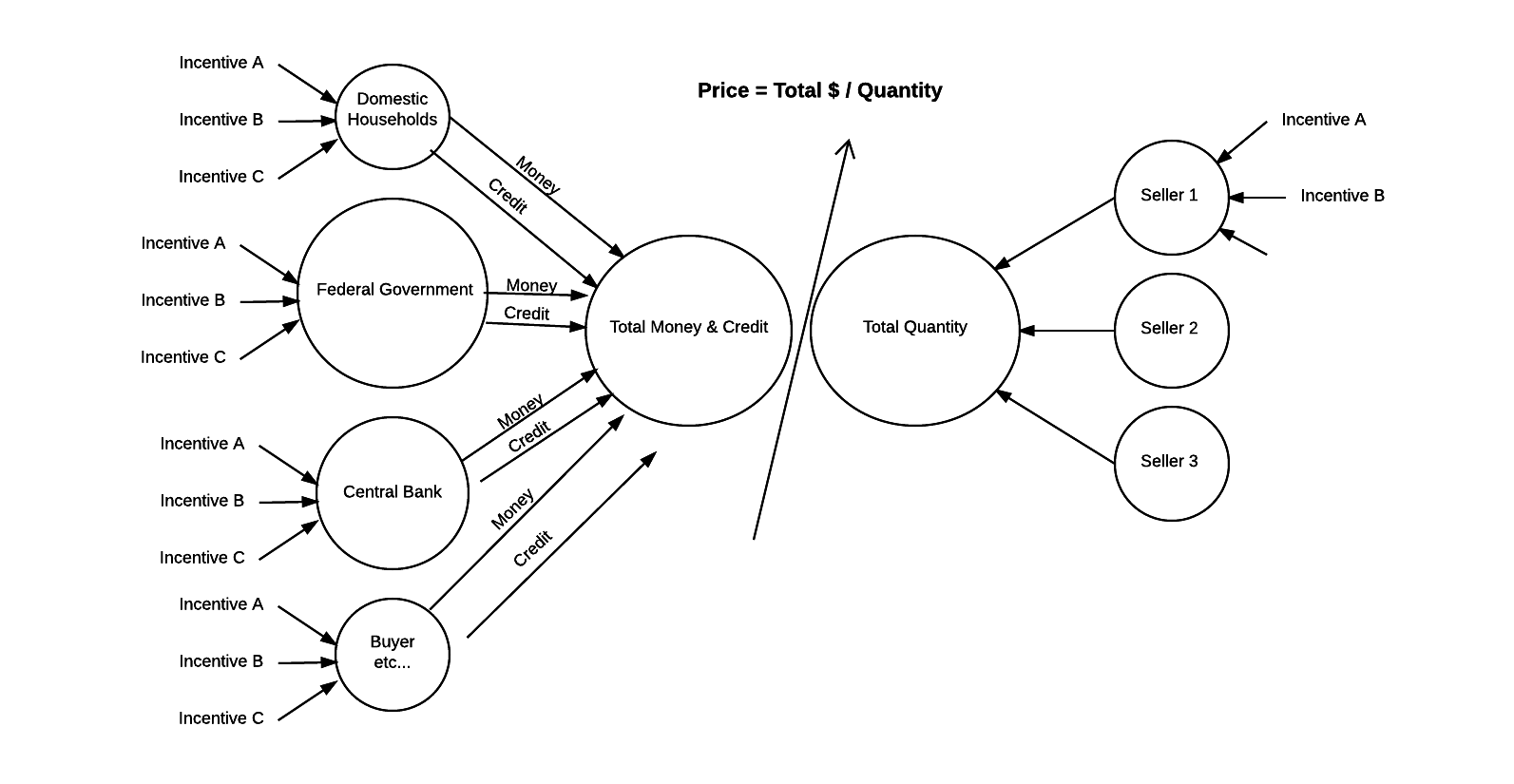

To understand any economy or market, all you need to know is the total amount of money (or credit) spent and the total quantity of goods sold. Divide the total spending by the total quantity of goods sold and you get the market price.

In markets there are number of different buyers and sellers, all with different motivations. It’s impossible to identify them all, but isolating the biggest buyers (largest drivers of demand) is easy. The reason these buyers (and not sellers) can be evaluated is because much of their demand is based on how much credit and money is available in the economic system. More credit and money leads to more demand, while less credit and money leads to less demand.

The concept of money vs credit goes much deeper, but we’ll save that topic for another discussion. For now, it’s important to understand that the transactions approach does take the difference between these two into account. The approach reveals that changes in total buying have a much larger impact on prices than changes in total selling. This is due to the fact that the supply of money and credit is far easier to adjust than the supply of goods.

Buyers in an economy can be split into two categories. They can either come from the private sector or the government sector.

The private sector is made up of households or businesses, both domestic and foreign.

The government sector is made up of both the Federal Government and the Central Bank. The Federal Government produces demand through public spending and the Central Bank produces demand by creating money and spending it on financial assets.

You can see a model of the transactions approach below:

The transactions approach lets us do two things:

- Establish market prices by dividing total spending by total quantity of goods sold.

- Identify the biggest buyers in the market.

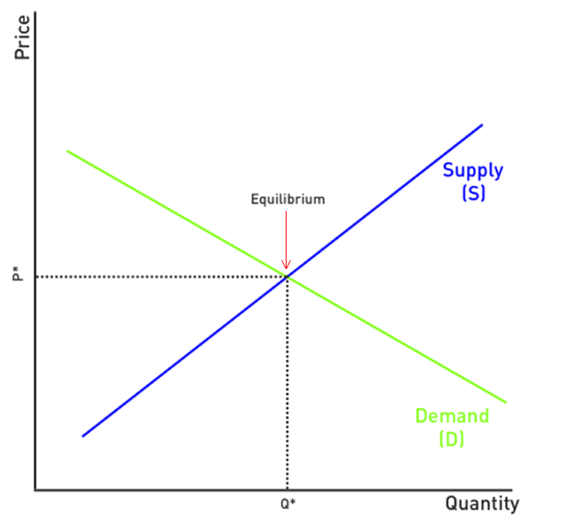

Now compare this to the traditional economic model:

The standard model doesn’t look at the economy through the lens of transactions. Instead, it measures supply and demand through a single quantity. This model completely fails to identify the amount of spending, which buyers the spending comes from, and their motives. It groups all buyers into one and focuses on quantity bought instead of how much was spent. It also doesn’t distinguish between money and credit.

These are all extremely important pieces of the puzzle that deeply impact the relationship between quantities exchanged and the resulting change in price. Without these factors, it becomes very difficult to predict future prices. No wonder standard forecasts are so far off…

But again, this theory is baked into every level of economics. It’s not going to be changed by the institutions promoting it.

Now one of the most interesting aspects of the transactions approach is the disaggregation of buyers in the economy. This can be done on both the macro and micro scale. The approach is useful for both.

Recently in the Macro Ops Hub Comm Center, Operator Jamie took us through his process of identifying buyers in equity markets. He broke them up into 5 categories:

- Dumb Money: Mom and pop investors that buy on good news after prices have already run up. Jamie anticipates their thinking by running through the headlines of major financial publications (Time, Businessweek, Yahoo Finance, etc.) and also by evaluating various sentiment indicators like the AAII. Dumb money usually serve as a contrarian indicator. “When good news about the market hits the front page of the New York Times, sell.” – Bernard Baruch

- Dumb Funds: These are large retirement and mutual funds such as Fidelity, Vanguard, American Funds, etc. The managers of these funds aren’t necessarily dumb, but they’re trapped in a system that forces them to always be long and fully invested. These restrictions have the effect of turning them into dumb money. It’s important to watch these guys because they make up a large part of the big money flows in the markets.

- Technical Players: This group ecompasses everyone from classical chartists, to trend followers, to breakout (IBD / William O’Neil) style traders. These players don’t necessarily cause turning points, but instead serve to amplify a trend that’s already started. You’ll see them jump into an asset after a major technical break. Their actions are easy to see by just looking at a chart.

- Smart Hedge Money: This group combines many types of analysis including fundamental, technical, quant, sentiment, etc. These are guys like Stanley Druckenmiller that pay attention to things like macro liquidity, business cycles, and the actions of the Fed. Many of them don’t speak in public too often, so a good way to see their holdings is through 13F filings.

- Smart Value: This is the pure fundamental group you can piggyback off of to find the best deals in the market. They’re focused on value with a margin of a safety. You can follow value investors like Seth Klarman right through their 13F filings.

This is just one example of buyer profiles you can create in the market. Being able to identify buyers and establish their motivations is very useful to determine liquidity and capital flows. These flows are what drive prices.

So the next time you want to understand why an asset’s price is moving, make sure you use the Transactions Approach.

For more information about the Transactions Approach and how it’s used in a trading strategy, please click here.