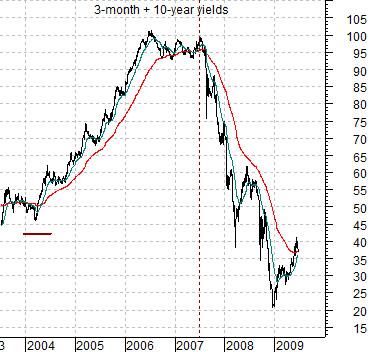

With the second quarter drawing to a close tomorrow we thought this might be an opportune time to run quickly back through the 2-year lag argument. The idea is that cyclical strength tends to lag trend changes for interest rates by roughly 2 years.

The chart below shows the sum of U.S. 3-month and 10-year Treasury yields from 2003 to the present day. The chart below features the share price of Mitsubishi UFJ (MTU) from 2005 to the present time period. The charts have been offset or shifted by two years so that 2004 for yields lines up with 2006 for MTU.

In the past we have used commodity prices to represent the trend for cyclical strength but this has muddied the waters somewhat over the past few years most likely because, contrary to the 1980’s and 1990’s, commodities are now the dominant cyclical trend.

In any event… interest rates were driven higher in 2004 by strength in commodity prices in general and energy and metals prices in particular. Heating oil futures prices broke to new record highs in 2004 which helped to push yields upwards.

The argument is that the peak for the share price of MTU in 2006 was a lagged response to yields starting to rise in 2004. If so then the break lower for yields during the second half of 2007 would suggest that cyclical strength will improve over the second half of 2009 and likely run all the way through 2010.

This is the kind of macro argument that can miss by a quarter or two and still look quite compelling when viewed over an extended period of time. When we have shown comparisons of this nature over the last year or two the point was that we had to let a couple of years elapse after credit conditions began to finally ease before swinging back to a positive view on the economically sensitive sectors. Our view was that a ‘couple of years’ would extend through into the second half of 2009 which is why we are returning to this perspective today.

In conclusion… strong commodity prices drove interest rates higher back in 2004 and by 2006 the trend turned negative for the non-commodity cyclical sectors. The trend reversal for yields in 2007 suggests that a better cyclical trend should develop through the back half of this year running through all of 2010.

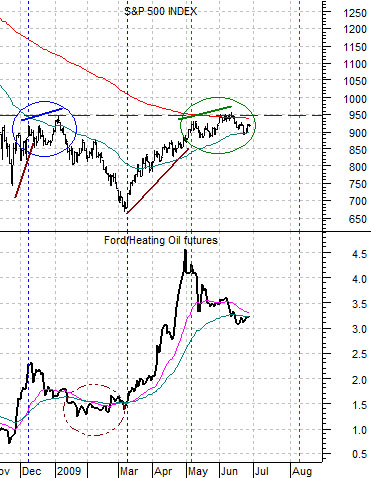

As we have mentioned almost daily of late… we are long-term equity markets positive but short-term equity markets negative. Our concern i that the equity markets may simply resolve higher so we have been showing the two charts at right in the back pages on a regular basis.

At top right we compare the S&P 500 Index (SPX) with the ratio between the Philadelphia Semiconductor Index (SOX) and crude oil futures.

Our argument was that a positive and rising equity markets trend requires a concurrent rising trend in the SOX/crude oil ratio. In other words if the ratio is declining then the stock market is simply not strong enough to warrant a positive view.

Below we compare the SPX with the ratio between the share price of Ford (F) and heating oil futures.

The base argument was that this ratio would bottom and turn higher at ‘the lows’ for the SPX but… if history were to repeat… the stock market would remain under pressure for another nine months before kicking back into gear. Put another way… the ratio bottomed last November and when it has risen (i.e. November into December of 2008 and March through April of this year) the stock market has been very strong. When the ratio falters, however, then a period of correction or consolidation begins and this has been the case for close to the last two months.

Below we show the ratio between AMR and the SPX and the ratio between Japan’s Nikkei 225 Index and copper futures. We are using AMR and the Nikkei to represent ‘commodity using cyclicals’.

The argument is that the trend favored the non-commodity sectors through the second half of 2008 and the commodity producers through the first half of this year. Our expectation has been that the markets would shift away from the commodity theme over the next few weeks.