Below we show a chart comparison between the ratio of crude oil prices to natural gas prices and the ratio of the Japanese 10-year (JGB) bond futures to the U.S. 10-year T-Note futures.

In trading yesterday crude oil futures prices rose more than 3% while natural gas prices declined by a bit more than 3%. In other words… the rising trend for the crude oil/natural gas ratio remains intact.

We mention this because this is part of a very long-term trend that began at least as far back as 1990. At the peak for Japanese asset prices that year the crude oil/natural gas ratio hit a top while the ratio of Japanese to U.S. bond prices pushed to a bottom. From 1990 into 2000 the markets pushed oil lower against gas while elevating Japanese long-term bond prices.

The point is that markets adjusted to Japan’s deflationary trend by pushing Japanese long-term yields lower while elevating natural gas prices. By 2000 the trend shifted as U.S. long-term yields were squeezed down towards Japanese yields.

We tend to view the crude oil/natural gas ratio as a measure of relative economic strength. When the trend is falling U.S. growth is better than foreign or Asian growth. When the trend is rising Asian growth is generally stronger than U.S. growth.

The next point is that as long as the crude oil/natural gas ratio is rising then the trend that began back in 2000 remains intact. If that trend remains intact then there should be a downward pull on the JGB/T-Note ratio.

The problem is that the ratio keeps rising. It pushed up to a high in 2007 and again in September of 2008 and, based on the chart at right, is doing a good job of making yet another peak this summer.

If the bond ratio ‘should’ be falling but it keeps resolving higher… what happens to make it decline once again? Crisis. Each time the ratio rises through falling long-term U.S. bond prices one or more markets falls apart which, in turn, snaps the long end of the Treasury rather dramatically higher. This is our theme for today so we will carry on with the argument on the next page.

Equity/Bond Markets

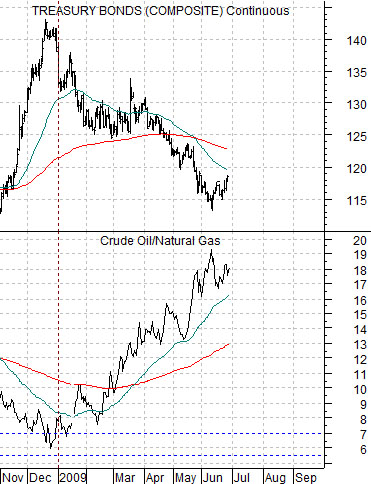

Below is a chart comparison between the U.S. 30-year T-Bond futures and the ratio between crude oil and natural gas futures.

A quick glance at the chart will leave one with the impression that as long as the crude oil/natural gas ratio is rising the trend for long-term Treasury prices will be negative.

On the other hand… our page 1 argument was that a rising oil/gas ratio actually creates an upward bias for long-term U.S. bond prices. Through the last decade the trend has been towards stronger crude oil and stronger U.S. bond prices (relative to Japanese bond prices).

At present both U.S. and Japanese short-term yields are very close to 0% but 10-year Japanese yields are last seen around 1.38% while U.S. yields are 3.5%. If the trend is still higher for crude oil then the trend is also pulling U.S. 10-year yields down towards Japanese yields and for that to happen… bond prices have to rise.

Why have bond prices been falling this year? The argument is that it has been a reflection of recovering economic strength. The chart below right shows that as 10-year Treasury yields have risen this year the ratio between the share prices of Johnson and Johnson and FreePort McMoRan (JNJ/FCX) has declined.

The JNJ/FCX ratio tends to reflect the flow of money towards more risky and economically sensitive themes. If the economy hit bottom this year as is being led to recovery by China then everything makes perfect sense. 10-year yields should be rising and the JNJ/FCX ratio should be falling.

Our problem with this? Actually we have two problems. The first was shown on page 1. If the trend hasn’t changed then there is still some chance that the ratio between the JGBs and T-Notes will decline back down to the lows of 1990 (i.e. around 1.05:1). Considering that the T-Notes are in the 116’s and the JGBs are currently trading just below 138… this argues for something like 20+ points worth of upside for the T-Note futures.

The second problem was mentioned on Bloomberg yesterday, “Investors are moving in lockstep like never before, driving up stocks, commodities and emerging markets and risking a replay of last year, when they all plunged the most since World War II.”.

Our thought is that the longer oil prices rise relative to natural gas prices the greater the upward pressure on bond prices even as the short-term trend is driving them lower.

Another thought is that it may not be THAT the oil/gas ratio is rising but rather HOW it is rising. If it is rising with strong crude oil prices then bond prices are forced lower. If it rising on falling natural gas prices (perhaps led by weakness in coal) then the bond market should resolve higher. If it is driven by Asian economic strength (rising crude oil and copper prices) the bond prices will remain under pressure but if it is driven by North American economic weakness (coal and natural gas prices declining) then bonds will be better.

The strange thing- from our perspective- is that even though a rising oil/gas ratio may lead us into another period of crisis it is likely both inevitable and, in the longer run, a major positive.