From Wikipedia:

The “ghost in the machine” is the British philosopher Gilbert Ryle’s description of Ren Descartes’ mind-body dualism. The phrase was introduced in Ryle’s book The Concept of Mind (1949) to highlight the perceived absurdity of dualist systems like Descartes’ where mental activity carries on in parallel to physical action, but where their means of interaction are unknown or, at best, speculative.

That sure looks like the stock market this week to me. One third of Wednesday’s volume took place in the “clean up” bar after the close. That is where all the late data gets dumped and from the size of it we can surmise a lot of market on close orders.

I’d like to think of it as the smart money getting out while the getting is good.

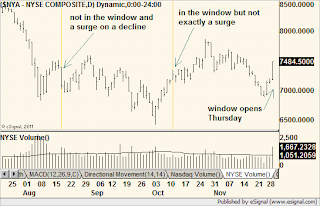

Here is a chart of the NYSE composite with volume and that ghostly current day’s volume spike. Looking at this as a snapshot of heavy volume on a big up-day belies the absurdity of the intraday action. It looks like it could be a follow-through day (FTD) too but again not when we dig deeper.

And speaking of FTDs, the three places on this chart where they could possibly appear are highlighted. Today’s rally took place before the FTD window opened – 4-7 days into a rally attempt. That means is still qualifies as short-covering.