‘TARP’, ‘QE1’, ‘QE2’, “Dollar Swap Line”, ‘LTRO’ –

These are acronyms for liquidity injections into the financial market place since 2009. Liquidity to the down and wavering financial markets is like VIAGRA to a similar category of down and outs. And I am not trying to make fun of those who (think they) need such a pill.

It is uncanny though that people use it under similar emotional stress as financial markets do, gasping for more ‘injections from Dr. FED’. The first time round it worked, the second was a flop, the third one? A 50/50 chance it will work again? And create what exactly? The right environment for lasting economic resurgence? Or just another splash of Asset Inflation? Hot air? Just like Viagra does for manhood, liquidity does not create NORMAL conditions for the stock markets.

SINCE WE ARE TALKING ‘MEDICINES’…

If I may say so, the real medicine would need to ensure that wealth is transferred to those who manage it properly; debts transferred to those who know how to utilise and service them to the benefit of all. As to the rest, take the ‘haircut’, and don’t complain if the barber’s knife takes a chunk of the brain in the process: it was not of much use anyway. If this comment offends you, don’t worry. It is a sign that there is still life in your grey cells and hope for better choices. Smile. Because the battle rages on: none of those who have and control wealth are easily convinced that they should pass it over to those who proclaim they can do better, without a good fight.

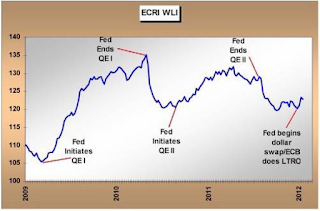

|

| liquidity rules – source ContraryInvestors.com |

My friend, Flo, sent me an article by www.contraryinvestor.com, dated February, 2012., titled “It don’t mean a thing, if it ain’t got that swing”. And no, it’s not talking it about Tiger Woods’ time out as a result of too much Viagra. It is taking a hard look at financial markets since the crisis in 2008. To give you a flavour, here is a chart they produced.

It’s worth a good, contemplative read. Indeed, contemplation, reflection, moderation in fair doses could be helpful, natural medicines the market really could do with at the moment. Yet, the ‘patient’ rejects all natural products and goes for ‘adrenalin’ instead.

“No More Free Markets, Just Interventions”

That’s another quote from the said article. I have observed and commented from time to time about cycles projecting one direction and markets taking a different turn, – and each time it was due to some interventionist activity. The distortion created often lead to a much higher volatility and – when turning down, a huge velocity breaking through even the strongest of support levels.

But cycle analysts are learning fast. That is how we ended up with two totally opposing views about what 2012 has to offer:

REALISTS WITH AN EYE FOR CONSENSUS

One party, the ones considering themselves – the realists, the down to earth, look at the longer term bear trend since 2000,and – using imaginative tools like inflation, the gold standard, global currency adjustment, etc – are eager to show graphically how bad things are, and how it has to get much worse before it gets better. They have plenty of ammunition and support from the fundamental analyst camp. We face the toughest of tasks of any economic cycle: DELEVERAGING.

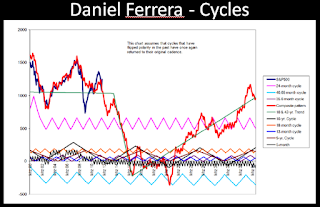

|

| the misery of a bear market trend – S&P 500 below 000? |

Guys like FERRERA, a renowned Cycle Expert, then produce charts, which show 2012 as an extension of the bear market trend, a repeat of 2008 or worse, and a large destruction of the capitalist system as we know it. According to them you should not be investing in anything riskier than cash, though they aren’t specific as to which currency we should use.

HANDS-ON REALISTS

The other party work on the assumption that consensus opinions, straight line trajectories and chaos theories are illusory in that they are almost always proved wrong. Another friend of mine used to like the idea that mankind can only stand 6-9 months of bad news, before they see themselves compelled to face the battles of life – with renewed vigour. These guys are often contrarian in outlook, unfettered by norm and consensus. They view the need of rising and falling values from a different perspective and perceive the signals in the markets with an intuitive sense of what does or does not make sense in the global context.

|

| True Money Supply in the US |

Guys like Henning Schaefer, of Cosmos-Trend in Germany, are telling us that none of the doom-mongering makes any ‘sense’, because it brings no positive aspect into the picture. As much as some people would rub their hands with glee in seeing bankers scalped for their misdeeds, it does not carry any positive weight in repairing the damage. That is why they think that – as far as the leadership is concerned – the world is best served for an extra dose of ASSET INFLATION. This appears to be the least painful option in dealing with the enormous debt issues, recapitalising our banks, shoring up the financial system – and avoid upsetting more already high strung, high taxed, rioting voters. Leaders want to be re-elected, after all.

|

| gold price rise to infinity in 26 months? |

So, the HANDS On REALISTS advise us to start taking risks as risk asset prices will continue to rise, at least in line with the exponential curve of the money supply chart, (Source: www.goldmoney.com) denoting the tremendous loss in the dollar’s buying power.

Of course, such discussions also require a sense a realism, as the gold chart on the left shows. If prices continue along the red trend line, we will see gold values rise infinitely within 26 months, according to Armand Koolen, a Dutch physicist. He also reminds us, that between 1919 and 1935 – and also after the decoupling of the USD from the gold standard – gold prices saw similar percentage rises as we see today.

Staying with the topic – but taking a short term view: GOLD…

Price Shock At Dawn

|

| gold prices in USD – short term correction likely! |

Lest we forget in all the theory, – we are trying to make money here. The shock hit me this morning when gold prices fell of the cliff again. Not because I was invested! I exited on January 19/20, 2012. Since then gold prices rose from a lumpy 1660 – to yesterday’s peak of about 1770, and I am sure some of my concerned investors – gritted teeth – looked on in exasperation.

During the same period, our Singapore dollar rose from US$1.29 to US$1.24, or about 4%. ‘While you were sleeping’, gold prices quite suddenly fell by the same 4% in the US markets to $1720s prices. I am not justifying my trade decision here, I am just pointing to a mirror move as they so often happen in the markets.

Moreover, turns in price trends for gold tend to be reciprocated by sharp stock price swings in the same direction. Prick your ears, it must, and could be the precursor to the corrective turn we have been waiting for patiently. Rather than a punch in the groin, the gold surprise move is a gentle, exhilarating jolt for me and my investors!

Enough for today, – enjoy the rest of the weekend.