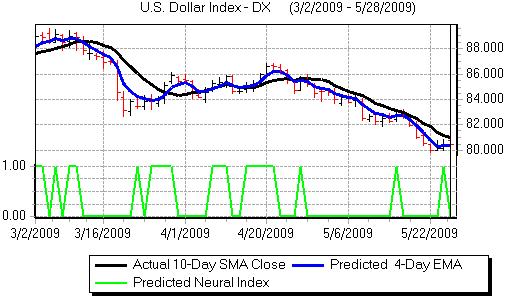

Sentiment towards all the major currencies was generally cautious over the week, but the US currency was still the currency which found it most difficult to gain support and generally remained under pressure as funds continued to sell the currency.

The dollar weakened to 7-month lows on reduced confidence in the US economy and an overall reduction in defensive support. Rallies quickly attracted selling pressure given the underlying lack of confidence.

The US consumer confidence data was stronger than expected with a sharp rise to 54.9 in May from a revised 40.8 the previous month. This was the highest figure since October 2008 and the Richmond Fed data was also stronger than expected.

The headline US housing data was close to expectations with existing home sales rising to an annual rate of 4.68mn in April from a revised 4.55mn the previous month. Prices continued to decline over the year while there was a rise in inventories. Although there is evidence of interest in buying foreclosure-related properties, the rise in inventories dampened expectations of more than a limited recovery in the sector.

The sales data was overshadowed to some extent by a further reported rise in mortgage delinquencies for the first quarter of 2009 with 12% of mortgages either behind in payments or in a foreclosure proceedings. The further increase in delinquencies increased fears over the housing sector.

The US jobless claims was close to expectations with a decline in initial claims to 623,000 in the latest week from 636,000 previously while continuing claims continued to increase to a fresh record high. The stronger headline durable goods orders report was offset by a large downward revision.

The dollar was unsettled by speculation that the US Federal Reserve would move to increase the scope of asset-backed securities buying which increased fears over the bond-market outlook and triggered further fears over the underlying US fundamentals.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The latest Treasury auctions of bonds received strong demand and immediate fears over the US credit rating also eased which helped support the dollar to some extent on reduced fears over the immediate risk of reserve diversification.

The General Motors situation was watched closely amid strong expectations that the company would file for bankruptcy probably at the beginning of June. Optimism that that uncertainty would be removed was offset by fears that there would be renewed stresses in the manufacturing sector following any bankruptcy filing.

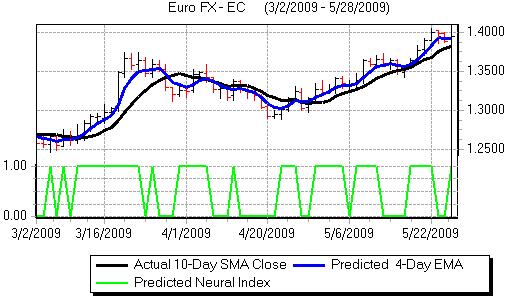

The German IFO index rose to 84.2 in May from 83.7 the previous month, but this was slightly below expectations and Euro-zone industrial orders fell again. The underlying tone created some caution over recovery expectations. There were also comments from an ECB official suggesting that interest rates could be cut again.

German unemployment rose by a less than expected 1,000 for May which boosted Euro sentiment slightly, although the impact was limited as the data may have been distorted. Elsewhere, the Euro-zone business and consumer confidence data was slightly weaker than expected which dampened the mood of optimism to some extent.

There were also renewed fears over the German banking sector which increased unease over the Euro-zone outlook. Internal bond-yield spreads also widened which was a negative factor for the currency with fears over the weaker regional economies.

The Euro was mixed overall, but did push to 2009 highs against the dollar and also secured a significant advance against the Japanese currency. The dollar found support close to the 94 region against the yen during the week and then advanced strongly with a high around 97.20.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The latest Japanese investment trust launches attracted strong retail interest and this increased speculation that there will be strong capital outflows from Japan in search of higher yields which would also tend to weaken the yen. There was still some caution, especially as any renewed increase in risk aversion would curb selling pressure.

The UK currency continued to gain protection from the lack of attractive alternatives, especially given the renewed fears over the Euro-zone bond markets and US debt

The BBA mortgage approvals data recorded a small monthly improvement, but was below market expectations with a 15% annual decline. Mortgage lending also fell to GBP2.7bn in April from GBP3.4bn the previous month which suggested that there are still important structural vulnerabilities in the housing sector. Elsewhere in the housing sector, the Nationwide reported a 1.2% increase in prices for May.

The CBI retail sales index weakened to -17 in May from +3 previously and the expectations index for June was weaker. The April data had, however, been distorted by seasonal factors and the data indicated that conditions are slightly less severe.

Bank of England MPC member Besley stated that the government budget position would have to be tackled in the medium term, but he stated that there was some short-term room for manoeuvre.

Sterling again proved resilient over the week and strengthened to 7-month highs against the dollar with a challenge on resistance levels above the 1.61 level. The currency also advanced to 2009 highs beyond 0.87 against the Euro.