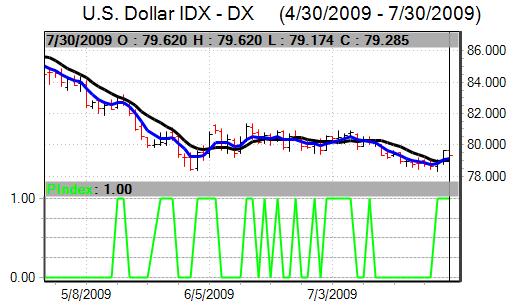

The dollar survived a test of 2009 lows over the first half of the week and was able to regain some ground as stock markets turned more cautious. The US currency was unable to generate strong momentum and drifted lower late in the week as markets still looked to take an optimistic stance towards the global economy.

US consumer confidence weakened slightly to 46.6 in July from 49.3 the previous month. This was the second successive decline with the sub-index for job availability falling to the lowest level since 1983. The data impact was measured, but tended to increase unease over the economic outlook.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

Elsewhere, the Richmond Fed composite index rose to 14 in July from 6 the previous month while the housing data was also positive with prices edging firmer in June according to the latest Case-Shiller index reading which helped stabilise confidence.

The US new home sales was stronger than expected with an increase in annualised sales to 384,000 for June from a revised 346,000 the previous month. There was also a significant decline in inventories over the month which pushed the number of unsold homes down to the lowest level for over 10 years. The sharp decline in inventories boosted optimism that construction will recover over the next few months.

Initial US jobless claims increased to 584,000 in the latest week from a revised 559,000 the previous week as the distortions caused by the auto sector persisted. The continuing claims data was lower than expected which provided some relief.

GDP contracted 1.0% for the second quarter after a revised 6.4% decline the previous quarter.

Regional Fed President Yellen was optimistic that there were the first signs of a recovery from recession, but she was also very cautious over the commercial real-estate market and uncertainty will be a key feature.

The Fed’s Beige Bok reported that the downturn was easing in most districts. There were, however, still very important areas of weakness with labour markets being reported as being very soft while there was also a deterioration in the commercial property sector. Bank lending also declined in most categories which maintained speculation that any recovery in the economy will stall very quickly.

The Euro secured an initial boost from a stronger than expected increase in German consumer confidence to the highest level for over 12 months. There was a seasonally-adjusted decline in German unemployment for July, although the data was distorted by a change in the calculation method and the underlying figures reported an increase.

There was a further recovery in industrial and consumer confidence. The prices data was weaker than expected with a provisional 0.1% drop in German consumer prices for July to give an annual 0.6% decline. The IFO institute also reported that lending was more restrictive during July which maintained fears over a credit crunch.

The currency was undermined by a spike in risk aversion as the Shanghai equity markets declined sharply by over 5%. The IMF stated in comments on Thursday that the Euro was overvalued by around 15% and this put some near-term downward pressure on the currency, although the impact was transitory.

The Euro attempted to make 2009 highs against the dollar during the week, but was unable to sustain the advance and weakened back to the 1.40 region before finding support before consolidating near 1.41.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 80% accurate. 800-732-5407

If you would rather have the recent forecasts sent to you, please go here.

The yen strengthened to the 94 level against the dollar, but failed to break this level with further reports of institutional dollar support at lower levels and the yen retreated back to beyond the 95.50 level in cautious markets. There was some evidence of month-end repatriation in to the Japanese currency and there was also speculation that there was a repatriation of funds as European bonds matured.

The dollar weakened to lows near 1.0650 against the franc before finding firm support and rebounding to the 1.09 region. There was another warning over franc strength from National Bank member Jordan with comments that the bank would continue to intervention to push the currency weaker.

The Bank of England reported that credit conditions had improved during the second quarter, but doubts over bank lending persisted. The mortgage approvals data recorded a small increase for June which pushed the total to a 15-month high. The bank lending data was very weak with the increase in lending held to GBP0.4bn for June which was the lowest since the series was introduced in 1993.

The latest CBI retail sales survey recorded a figure of -15 compared with -17 the previous month. Although markets had expected a slightly larger improvement, the data suggests that consumer spending is still holding relatively firm. Overall consumer confidence was fragile given the massive debt burden.

There was a monthly increase of 1.3% in house prices according to the latest Nationwide survey with prices now having risen for three months in succession which cut the annual decline to 6.2%.

Sterling proved broadly resilient over the week as international risk appetite remained solid which provided important support. The domestic fears were kept at bay as the housing data was firmer and the UK currency strengthened to above 1.65 against the dollar while it also appreciated to near 0.85 against the Euro.