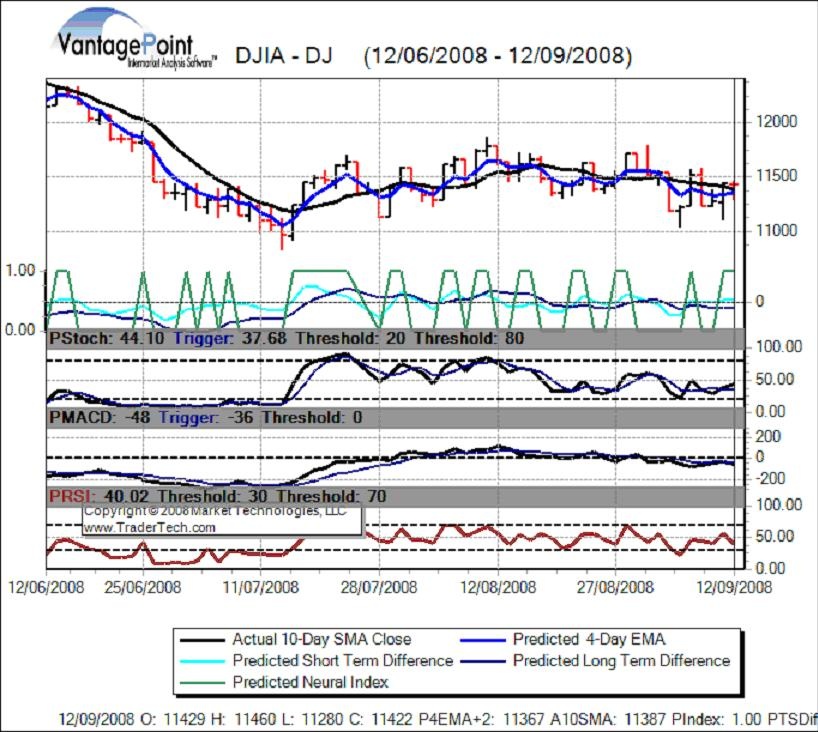

With a barrage of negative news about the economy and the news of Lehman Bankruptcy hitting us recently, it’s no wonder the sharemarket is not a pretty sight.At the moment, the overall stockmarket could move down a bit more (for how much longer no one knows) but since it has fallen a bit since 11th of August, the market could move up again in the very short term.The testing point is the previous low of 10731 of the Dow Jones Industrial Average index reached on the 15th of July this year.If the index goes below this point, then the market could move lower, however if it doesn’t, the market could go higher in the short term.Please see the 3 month VantagePoint chart of the Dow Jones index below:

The Predicted Stochastic is at 44.1 and the Predicted RSI is at 40.02.They are approximately at midpoints between their lower and higher thresholds.Thus the index could move either way i.e. up or down next.

This portfolio has sold out of previous holdings in early September and has made two new purchases betting on the market moving up in the short term.This portfolio is not for the fainthearted and is rather concentrated.Sometimes it is better to buy and sell stocks that you are familiar with so that you have more confidence in their price movements although you can never be 100% sure with any stock.So here are the new purchases:

| price | units | value | |||

| tsn | 09/15/08 | purchase | 13 | 1538 | 20000 |

| fxi | 09/15/08 | purchase | 34.84 | 2296 | 80000 |

| total | 100,000 |

Tsn is a food company and fxi is the China ETF (exchange traded fund).Food is a basic necessity and China’s economy although will be affected by the global economic slowdown, it is still growing at a rapid pace and is fundamentally sound (including the millions of middle income earners in China that is fuelling internal consumption demand), these are the reasoning behind including these stocks in the portfolio.

This is a very short term oriented portfolio with the focus on earning short term profits using VantagePoint software.

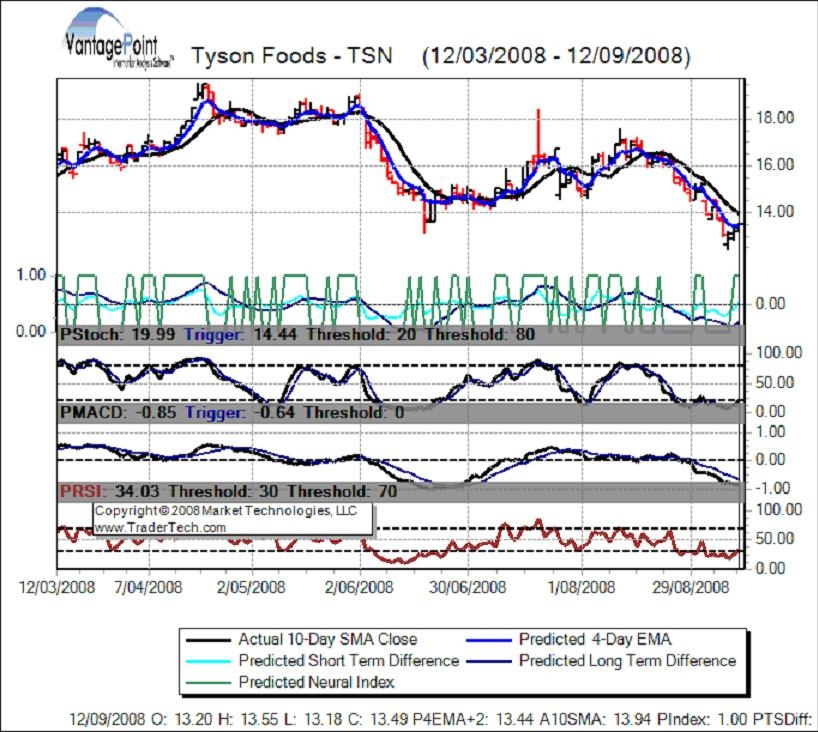

See the following 6 month chart of TSN:

The Predicted Stochastic is at 19.99 which is above its trigger of 14.44 and which is lower than the low threshold of 20; the Predicted MACD is rather low at –0.85 which is below its threshold of 0; and the Predicted RSI is at 34.03 which is just above its low threshold of 30.So since these indicators are all rather low, although TSN’s price could fall further, it is in an oversold position and so there is a greater probability that TSN would move up in the short term.

Similarly with FXI:

The Predicted Stochastic is at 27.23 which is just above its low threshold of 20; the Predicted MACD is at –0.73 which is below its threshold of 0; and the Predicted RSI is at 37.43 which is just above its low threshold of 30 so as with TSN, rather oversold and so there is a possibility of a move upwards in FXI in the short term.