The stock market has staged an impressive rally over the past 14 trading sessions. Could it be due to the fact that earnings season is upon us, or maybe the impressive leap in the housing market data over the past month? You be the judge.

We’ve seen the financials close positive for 14 straight sessions, a feat that hasn’t been accomplished in the NASDAQ for over 13 years. Has the “Plunge Protection Team,” otherwise known as “The President’s Working Team on Financial Markets,” done a good job of masking the fact that unemployment continues to rise (and is projected to hit up over 11 percent), retail sales continue to take a dive, and consumer confidence is still in very much rough shape? And, perhaps in full disguise, the positive earnings posted by some of America’s largest companies that have come in the form of the cost-cutting measures or more notably, job layoffs, in the past year.

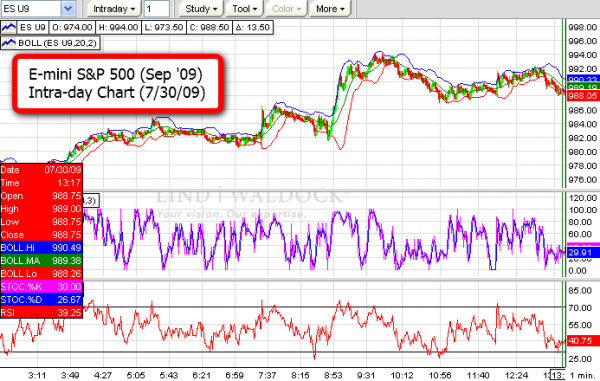

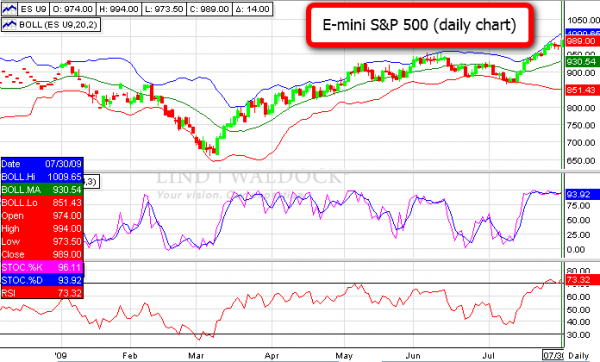

In light of stating the obvious, I am skeptical of the market’s bullishness. Friday’s second-quarter GDP report is expected to show a decline of 0.7 percent (according to a Bloomberg survey), and the July unemployment report due out next week, is likely to be another sobering set of statistics. I’m looking for a significant correction in the S&P 500, DJIA, and NASDAQ in the coming weeks. Below is a daily and intraday chart of the E-mini S&P 500.

The 200-day moving average comes in at 965.45 for the September S&P contract, which I see as the first major obstacle. Below here, the next major level of support appears to be between 952 and 948. This would be a good short-term profit objective on correction. For longer term-bears, there is a 3-point gap in the charts all the way down at 903.50.

Recommendation

Sell S&P 500 and/or E-mini S&P 500 futures on a test of 1,000. Your profit objective should be down at 956. I recommend utilizing a 10- to 15-point stop-loss and/or to hedge a short futures play, consider selling September 940 puts for 17 points. Selling the puts allows you to collect approximately $850 in premium for E-mini, and $4,250 for the full-sized S&P contract, not including commissions. Feel free to call me with any questions you have about the markets, and how to develop a strategy appropriate for your particular situation.

John Caruso is a Senior Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division.He can be reached at 800-445-0567 or via email at jcaruso@lind-waldock.com.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

You can hear market commentary from Lind-Waldock market strategists through our weekly Lind Plus Markets on the Move webinars, as well as online seminars on other topics of interest to traders. These interactive, live webinars are free to attend. Go to www.lind-waldock.com/events to sign up. Lind-Waldock also offers other educational resources to help your learn more about futures trading, including free simulated trading. Visit www.lind-waldock.com.

Futures trading involves substantial risk of loss and is not be suitable for all investors. 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604.