By FXEmpire.com

USD/JPY Weekly Fundamental Analysis April 2-6, 2012, Forecast

Introduction: In the USD/JPY trade, trying to pick tops or bottoms during that time would have been difficult. However, with the bull trend so dominant, the far easier and smarter trade was to look for technical opportunities to go with the fundamental theme and trade with the market trend rather than to trying to fade it.

Against the Japanese yen, whose central bank held rates steady at zero, the dollar appreciated 19% from its lowest to highest levels. USD/JPY was in a very strong uptrend throughout the year, but even so, there were plenty of retraces along the way. These pullbacks were perfect opportunities for traders to combine technicals with fundamentals to enter the trade at an opportune moment.

- The interest rate differential between the Bank of Japan(BoJ) and the Federal Reserve

- Japanese government intervention to maintain their currency sends USD/JPY lower

Analysis and Recommendation:

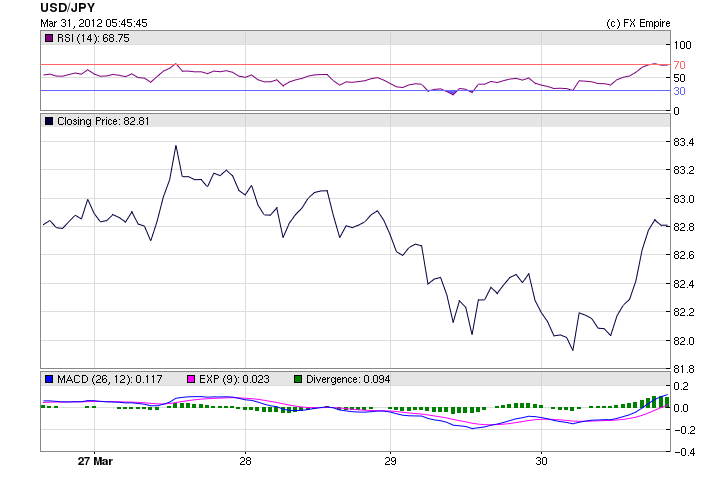

The USD/JPY ended the month at 82.87 climbing from the low of 81.35.

The yen rose towards the end of the week and then fell as the month closed, not just as a traditional destination for safe-haven seekers but potentially as Japanese companies and investors may be selling foreign investments and repatriating profits as the end of the nation’s fiscal year is at hand.

Risk aversion continues to be the main theme in the foreign-exchange market towards the yen. Exporters need the yen to trade higher than 82.00? to be profitable.

Japan had some strong economic reports this week with unemployment dropping and Industrial Production exceeding forecast.

This one is a tough call for the beginning of the month. The pair are sitting right about where they should be

Economic Reports March 25-30, 2012 that affect the AUD, JPY & NZD actual v. forecast

|

NZD |

Trade Balance |

161M |

153M |

-159M |

|

AUD |

RBA Financial Stability Review |

|||

|

JPY |

Retail Sales (YoY) |

3.5% |

1.4% |

1.8% |

|

NZD |

Building Consents (MoM) |

-6.7% |

8.1% |

|

|

KRW |

South Korean Industrial Production (YoY) |

14.4% |

3.4% |

-2.1% |

|

KRW |

South Korean GDP (QoQ) |

0.3% |

0.8% |

0.4% |

|

JPY |

Unemployment Rate |

4.5% |

4.6% |

4.6% |

|

JPY |

Tokyo Core CPI (YoY) |

-0.3% |

-0.3% |

-0.3% |

|

JPY |

Industrial Production (MoM) |

1.9% |

1.4% |

1.9% |

|

AUD |

HIA New Home Sales (MoM) |

3.0% |

-7.3% |

Last week’s market highlights

The Good Stuff

- Eurozone Finance Ministers finalizes the temporary combination of the EFSF and ESM. Italy and Spain get to contribute to their own bailout fund if needed

- German unemployment falls more than expected and rate falls to lowest since reunification

- German IFO business confidence up slightly to the highest since July

- Italian business confidence up slightly from lowest since Dec ’09 and consumer confidence rises to 8 month high

- Consumer confidence rises a touch to best since Feb ’11

- Personal Spending in Feb rises .8% m/o/m, above estimates of up .6%

- UK said purchase apps rose 3.3% to a 10 week high.

- Crude finally drops but not enough

The Disappointing

- Inflation expectations in both the Michigan (3.9%) and Conference Board (6.3%)confidence figures rise to the highest since May,

- Chicago, Richmond, Dallas and KC manufacturing survey’s all fall more than expected in Mar from Feb

- Real income falls in Feb by .1%, savings rate drops to 3.7%, the lowest since Aug ’09

- Initial Jobless Claims 4 week avg 365k after benchmark revisions vs 355k prior

- Feb Durable Goods orders grow less than expected after Jan’s weakness

- UK said refinances fell 4.6% to lowest since early Dec

- Home price index falls to cheapest since Jan ’03

- Pending Home Sales in Feb unexpectedly falls .5% but from most since Apr ’10

- German retail sales in Feb fall for 4th month in past 5

- Shanghai index closes down for the 3rd straight week due to continued concerns with economic growth

- Bernanke Feds will do more, possible monetary easing

- Gasoline prices rise another .035 on the week to $3.93.

Economic Highlights of the coming week that affect the Yen, the Aussie and the Kiwi.

|

Apr. 02 |

00:50 |

JPY |

Tankan Large Manufacturers Index |

|

Apr. 03 |

02:30 |

AUD |

Retail Sales (MoM) |

|

05:30 |

AUD |

Interest Rate Decision |

|

|

05:30 |

AUD |

RBA Rate Statement |

|

|

Apr. 04 |

02:30 |

AUD |

Trade Balance |

Summary of this week’s highlights for the Asian Markets

On Monday, the ABS will announce building approvals data for February, while TD Securities and the Melbourne Institute will release their monthly inflation gauge for March.

Analysts are tipping the data to show approvals fell by 3 per cent in the month.

The Reserve Bank of Australia will again come under close scrutiny this week when it meets Tuesday to vote on the level of the official cash rate.

Investors will watch proceedings closely, but recent comments from the RBA suggest the bank is happy with the current cash rate level.

The central bank said in its financial stability report last week that global financial markets have stabilized since last year and local banks are in a good position to address any future turmoil.

Analysts are expecting the RBA to leave rates on hold at 4.25 per cent, which would be the third consecutive month the level has been left unchanged.

February retail trade data is due from the ABS on Tuesday, and experts are tipping the figures to show a 0.5 per cent rise in sales.

Wednesday brings February trade balance data from the ABS, while Commonwealth Bank of Australia and the Australian Industry Group will release their performance of services index for March.

In China, HSBC will release its March performance of manufacturing index for Services in China, which will captivate investors’ right across the globe.

On Friday, most western markets will be closed for the Good Friday public holiday.

Government Bond Auctions this week

Apr 03 09:30 Belgium Auctions 3 & 6M T-bills

Apr 03 09:30 UK Conventional Gilt Auction

Apr 04 08:30 Spain Bono auction

Apr 04 14:30 Sweden Details T-bill auction on Apr 11

Apr 05 08:50 France OAT auction

Apr 05 15:00 US Announces auctions

Apr 05 15:30 Italy Details BOT on Apr 11 & BTP/CCTeu on Apr 12

Originally posted here