By FXEmpire.com

USD/CAD Weekly Fundamental Analysis April 2-6, 2012, Forecast

Introduction: The Canadian Dollar moves in reaction to the US Dollar. Movements are small and easy to track and trade. The Canadian Dollar also responds to economic reports within Canada. It has little action against foreign currencies except during major moves or crisis.

The USD/CAD is the single biggest beneficiary of rising oil prices. Canada which is already the biggest exporter of oil to the US will experience a boost to its economy when oil price continue to increase. Therefore, if oil rises the Canadian dollar is likely to follow. Over the past years, the correlation between the Canadian dollar and oil prices has been approximately 81%.

Analysis and Recommendation:

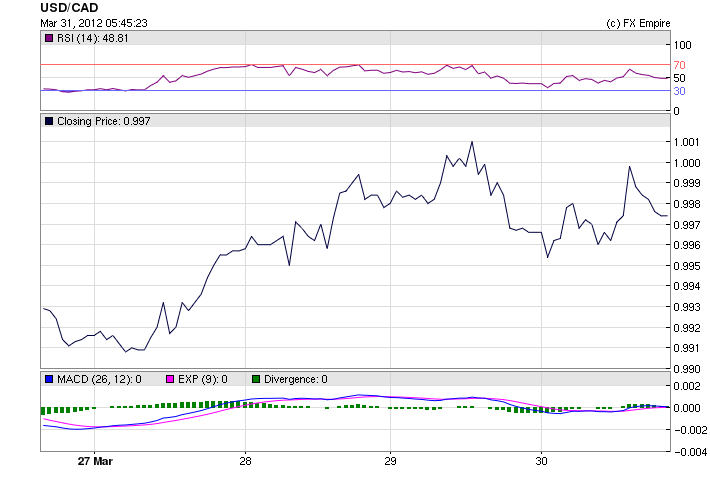

The USD/CAD ended the week just about where it started, throughout the week the pair hit a high of 1.0019 after comments from Fed Chairman Bernanke and then fell to a love of 0.9901.

News from Canada this past week was fairly negative, but high crude and gold prices should have supported the Looney, but did not seem to do so.

Crude has begun to fall, which is the major export of Canada.

The USD is expected to gain strength in the earlier part of the week.

Economic Highlights of the coming week that affect the Canadian Dollar.

|

Apr. 05 |

13:30 |

CAD |

Building Permits (MoM) |

|

13:30 |

CAD |

Employment Change |

|

|

13:30 |

CAD |

Unemployment Rate |

|

|

15:00 |

CAD |

Ivey PMI |

Last week’s market highlights

The Good Stuff

- Eurozone Finance Ministers finalizes the temporary combination of the EFSF and ESM. Italy and Spain get to contribute to their own bailout fund if needed

- German unemployment falls more than expected and rate falls to lowest since reunification

- German IFO business confidence up slightly to the highest since July

- Italian business confidence up slightly from lowest since Dec ’09 and consumer confidence rises to 8 month high

- Consumer confidence rises a touch to best since Feb ’11

- Personal Spending in Feb rises .8% m/o/m, above estimates of up .6%

- UK said purchase apps rose 3.3% to a 10 week high.

- Crude finally drops but not enough

The Disappointing

- Inflation expectations in both the Michigan (3.9%) and Conference Board (6.3%)confidence figures rise to the highest since May,

- Chicago, Richmond, Dallas and KC manufacturing survey’s all fall more than expected in Mar from Feb

- Real income falls in Feb by .1%, savings rate drops to 3.7%, the lowest since Aug ’09

- Initial Jobless Claims 4 week avg 365k after benchmark revisions vs 355k prior

- Feb Durable Goods orders grow less than expected after Jan’s weakness

- UK said refinances fell 4.6% to lowest since early Dec

- Home price index falls to cheapest since Jan ’03

- Pending Home Sales in Feb unexpectedly falls .5% but from most since Apr ’10

- German retail sales in Feb fall for 4th month in past 5

- Shanghai index closes down for the 3rd straight week due to continued concerns with economic growth

- Bernanke Feds will do more, possible monetary easing

- Gasoline prices rise another .035 on the week to $3.93.

Economic Reports March 25-30, 2012 that affect the Americas actual v. forecast

|

USD |

Fed Chairman Bernanke Speaks |

|||

|

USD |

Pending Home Sales (MoM) |

-0.5% |

1.0% |

2.0% |

|

CAD |

BoC Gov Carney Speaks |

|||

|

USD |

CB Consumer Confidence |

70.2 |

70.3 |

71.6 |

|

USD |

Fed Chairman Bernanke Speaks |

|||

|

USD |

FOMC Member Fisher Speaks |

|||

|

USD |

Durable Goods Orders (MoM) |

2.2% |

3.0% |

-3.6% |

|

USD |

Core Durable Goods Orders (MoM) |

1.6% |

1.5% |

-3.0% |

|

USD |

Continuing Jobless Claims |

3340K |

3365K |

3381K |

|

USD |

GDP (QoQ) |

3.0% |

3.0% |

3.0% |

|

USD |

Initial Jobless Claims |

359K |

350K |

364K |

|

USD |

GDP Price Index (QoQ) |

0.9% |

0.9% |

0.9% |

|

USD |

Fed Chairman Bernanke Speaks |

|||

|

USD |

Personal Spending (MoM) |

0.8% |

0.6% |

0.4% |

|

CAD |

GDP (MoM) |

0.1% |

0.1% |

0.5% |

|

USD |

Core PCE Price Index (MoM) |

0.1% |

0.1% |

0.2% |

|

USD |

Chicago PMI |

62.2 |

63.1 |

64.0 |

|

USD |

Michigan Consumer Sentiment Index |

76.2 |

75.1 |

74.3 |

Originally posted here