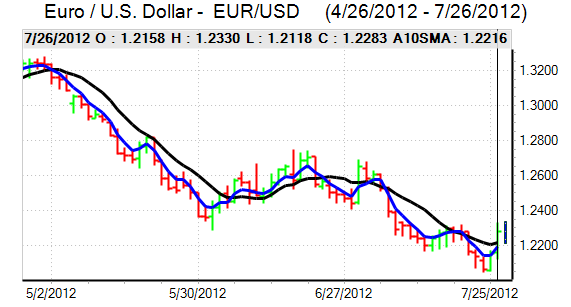

EUR/USD

The Euro found support on dips to the 1.2110 area against the dollar on Thursday and spiked sharply higher ahead of the US open.

The trigger for the Euro’s advance were comments from ECB Chairman Draghi in a pre-olympic London investment conference. The ECB chief stated that the bank would take whatever it takes to protect the Euro and in forceful comments he stated that ‘ believe me, it will be enough’. Potentially the most important part of the remarks were comments that if borrowing costs hampered the transmission of monetary policy then this would come under the bank’s mandate. This suggested that the bank would consider some form of quantitative easing in the form of bond buying or a resurrection of the dormant SMP programme to drag peripheral bond yields lower.

Market optimism that the ECB would take action triggered a sharp decline in Spanish and Italian bond yields. The benchmark Spanish yields fell back to below the 7.0% level as yield spreads over bunds also narrowed sharply. The IMF is due to announce its latest report on Spain on Friday and sentiment could deteriorate again rapidly.

There were further concerns surrounding the Greek situation with expectations that the troika would report major misgivings over fiscal policy. A research report from Citibank also stated that the chances of Greece leaving the Euro-zone were now around 90% on a 12-month view.

There were mixed US economic reports as jobless claims fell to 353,000 in the latest week from 386,000 previously while there was a headline 1.6% increase in durable goods orders. In contrast, there was a decline in core orders which maintained unease over the underlying investment trends. There was also a small decline in pending home sales according to the latest release. There were still expectations that the Federal Reserve would move to additional quantitative easing which stemmed US dollar demand ahead of next week’s FOMC meeting.

In this context, the Euro rallied to highs above 1.23 against the dollar before consolidating in the 1.2280 later in the New York session with little change on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar struggled to make any headway against the yen during Thursday and dipped to lows close to the 78 level following the US economic data before a recovery back to the 78.30 area. The Euro advanced strongly on the crosses with a high above the 96 level.

The US currency was unable to gain any significant support on yield grounds following the latest US data and there were further doubts surrounding the Federal Reserve outlook.

Domestically, the latest inflation data was weaker than expected with national core consumer prices falling by 0.2% in the year to June while Tokyo prices fell 0.8%. The trend for falling prices will increase speculation of further Bank of Japan action to relax monetary policy. The yen also edged weaker following gains for regional bourses, although the gains were broadly limited.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

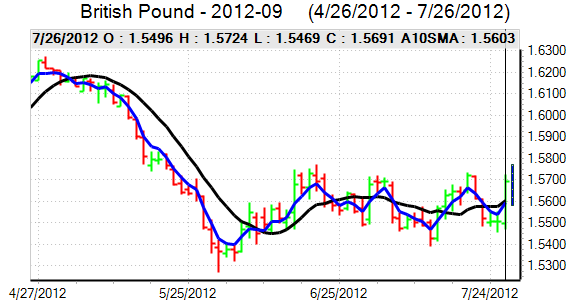

Sterling

Sterling found support on dips to the 1.5470 area against the US dollar on Thursday and pushed sharply higher during the European session with a 3-week high above the 1.57 level. There was a wider US currency retreat which pushed Sterling and the UK currency was able to hold a small advance against the Euro at around 0.7835.

There was further speculation that the UK AAA rating would be in jeopardy following the much weaker than expected GDP data release on Wednesday. Although the immediate market impact was limited, there will be the threat of a reduction in capital inflows into Sterling as institutional flows decline.

There will be the threat of increased market volatility as domestic and international factors clash with the UK currency consolidating just below 1.57 in Asian trading on Friday.

Swiss franc

The dollar hit resistance above the 0.99 level against the US dollar on Thursday and dipped sharply to lows below 0.9750 before staging a slight recovery. Despite a strong Euro advance against the dollar it was trapped close to the 1.2010 level against the Swiss currency.

Any alleviation of stresses surrounding the Euro-zone and more aggressive policy easing by the ECB could ease immediate pressure on the 1.20 minimum level. There were no initial signs that capital inflows had eased which will maintain pressure on the National Bank as reserves continue to rise rapidly.

Australian dollar

The Australian dollar found support on dips towards the 1.03 level against the US currency on Thursday and pushed sharply higher to a peak around the 1.0420 level before consolidating just below this level.

The currency drew support from an improvement in risk appetite as equity markets rallied strongly following ECB Draghi’s remarks on the Euro. There was a further rally in Asian stock markets on Friday, although the gains were still generally cautious and the Australian currency was capped in the 1.0420 region on Friday.