A decade or so ago we were arguing rather relentlessly in favor of the commodity cyclicals. Given the relationship between the commodity currencies (i.e. Canadian and Australian dollars) and commodity prices we were also very positive on these currencies. In fact our upside target on the Canadian dollar back when it was in the low .60’s versus the greenback was something in the order of .88.

One of our subscribers called us during this time frame and, while agreeing that the Cdn currency should strengthen somewhat, noted that an exchange rate against the U.S. dollar anywhere close to .88 would bankrupt the country given the disparity between taxation levels.

The point here is that the argument was valid… unless something changed. To suggest that the Canadian dollar would rise towards parity against the U.S. dollar without a major change in the fundamentals driving capital flows made little in the way of sense. However the loonie rising against the U.S. dollar in a world where crude oil prices were pushing towards 150 was perfectly understandable and rational.

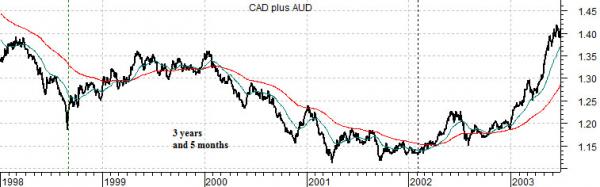

First below is a chart of the sum of the Canadian and Australian (CAD plus AUD) dollar futures from mid-1995 through 2003.

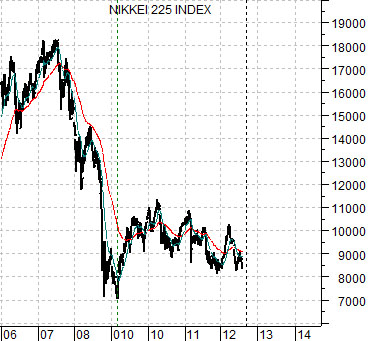

Next below is a chart of Japan’s Nikkei 225 Index from the end of 2005 to the present day.

The charts have been positioned so that the ‘spike bottom’ in 1998 for the commodity currencies is lined up with the ‘gut check’ lows for the Nikkei in March of 2009. This puts the peak the 1996 peak for the Cdn and Aussie dollars right over top of the Nikkei’s 2007 highs.

We are going to tighten up the time frame somewhat on the following page but the two points that we are attempting to make are as follows. First, the trend for the Nikkei into 2012 appears remarkably similar to the path the Cdn and Aussie dollars followed into the start of 2002. Second, while we can make a chart-based argument that the Nikkei 225 Index is poised to explode to the upside… the reality is that this will require a major change in Japan’s economic reality. It is not hard to grasp the idea that ramping the prices of crude oil, copper, and gold by 6 to 7 times would have a bullish impact on the commodity currencies but it is not quite so easy to even imagine the kind of trend change or pivot that would send the Nikkei northward over the next 12 to 18 months.

Below are somewhat shorter-term views of the charts above. We are comparing the sum of the Canadian and Australian dollar futures from 1998 into 2003 with the Nikkei 225 Index from 2008 to the present day.

We will attempt to explain WHY we are focusing on this particular relationship at this particular time. Notice that on the sum of the CAD and AUD there is a spike bottom in the autumn of 1998. Notice as well that the commodity currencies were rising quite nicely in 2002 with an accelerating ascent carrying through 2003. In fact… the bullish trend that commenced early in 2002 remained in force into the spring of 2011 so we are looking at the very early stages of a decade-long trend change.

From the spike bottom in 1998 to what could be argued to be the final low around the end of January in 2002… 3 years and 5 months elapsed. If we use the March 2009 spike bottom for the Nikkei 225 Index as a starting point and then count forward by 3 year and 5 months… we can see that, give or take a week or two, it is right about… now.

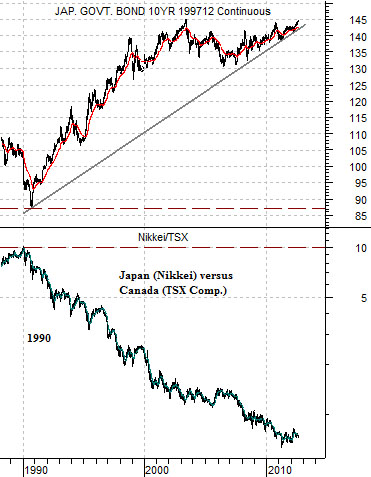

From an intermarket point of view there are two things that have to change before the Nikkei can trend higher. First, the Japanese yen has to stop rising. Second- and perhaps most importantly- the Japanese bond market HAS TO TURN LOWER. At right is a comparison between the Japanese 10-year (JGB) bond futures and the ratio between the Nikkei 225 Index and Canada’s S&P/TSX Composite Index.

The point? Break the rising trend for Japanese bond prices and just about everything related to Japan’s economic fundamentals and capital flows will change, have changed, or be in the process of changing.