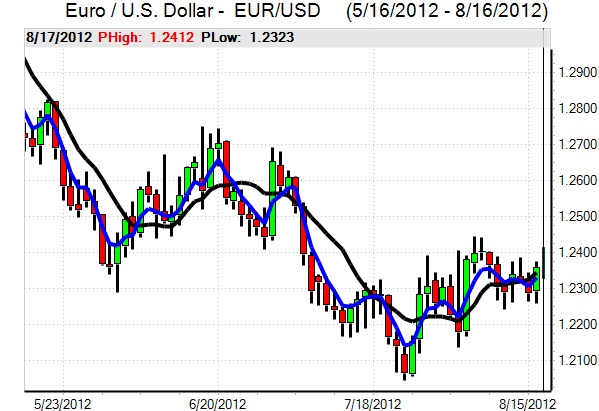

EUR/USD

The Euro found support on dips towards the 1.2250 area on Thursday and edged higher during the European session with an initial move to the 1.2280 area. There was a significant decline in Spanish bond yields during the day with 10-year yields declining to a 1-month low which helped underpin Euro sentiment, especially with advances for European equity markets.

German Chancellor Merkel repeated that all measures would be taken to protect the Euro and also reinforced the necessity of conditionality. These comments maintained pressure on the Spanish government to apply for EFSF support which would be one condition before the ECB could consider buying bonds.

There were still very important underlying political stresses and unease surrounding the Greek situation with Prime Minister Samaras due to meet Euro-zone leaders over the next few days in an attempt to secure easier loan terms and further financing.

The US housing starts data was slightly weaker than expected with a decline to an annual rate of 0.75mn from 0.76mn, but there was a rise in permits to a fresh five-year high of 0.81mn which provided some degree of support.

Initial jobless claims were little changed at 366,000 from a revised 364,000 while the Philadelphia Fed index was weaker than expected at -7.1 from -12.9 the previous month. The Bloomberg measure of consumer confidence also dipped to a nine-month low.

There have been mixed data releases over the past week and the overall analysis has been that the Federal Reserve is less likely to move to additional quantitative easing in September. Markets, however, seem reluctant to believe this analysis as equity markets maintained a firm tone during the day. The Euro pushed above resistance in the 1.2330 area with a peak above 1.2360 as trading volumes remained thin before a measured retreat in Asian trading on Friday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was initially blocked in the 79.40 area against the yen on Thursday and retreated back towards the 79.10 area before finding fresh buying interest. There was net support from a further significant rise in US Treasury yields which helped underpin the dollar. The relationship between the dollar/yen rate and US yields remains very important and there will be reduced interest in yen buying if US yields remain a higher levels.

There will be further concerns surrounding the regional economy and pressure for China to maintain competitiveness which will also maintain pressure for the Bank of Japan to resist any yen gains. There will still be an increase in exporter selling as the dollar rises, especially if it moves towards the 80 level.

Sterling

Sterling dipped lower in Europe on Thursday before finding support below 1.5650 with reports of central bank buying support.

The headline retail sales report was stronger than expected with a 0.3% gain for July while there was a significant upward revision to the previous month’s data to 0.8%. The data helped boost optimism towards the UK outlook to some extent, although the main feature was still a high degree of uncertainty over the outlook given diverse indicators. There were also further uncertainties surrounding the Olympics impact which could potentially distort near-term economic releases.

Sterling continued to gain net support from buying support on the crosses as the Euro retreated to two-week lows near 0.7810 before a tentative rebound. Sterling did hit resistance near 1.5750 and retreated again during the Asian session on Friday.

Swiss franc

The dollar was unable to make a fresh challenge on the 0.98 area against the franc on Thursday and retreated to lows near 0.97 on a wider loss of US traction while the Euro remained in extremely narrow ranges around 1.2010.

The ZEW business confidence index improved slightly to -333.3 for the August from -42.5 previously which may ease economic fears slightly, although there will still be significant concerns surrounding the export and tourism sectors which will maintain pressure for franc gains to be resisted.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar found support on dips towards 1.0450 against the US currency on Thursday and pushed significantly higher during the US session with a peak in the 1.0520 region.

The currency drew support from fresh gains in oil prices as well as a firm tone in global equity markets. The Australian Treasurer stated that direct intervention to weaken the currency was unlikely. There were further concerns that the currency was overvalued given the recent price trend in key export commodities and the Australian currency weakened back towards 1.0470 in Asia on Friday.