Retailers were in the spotlight Thursday as many reported solid same-store sales results. Results at The Gap (GPS) showed that its turnaround remains in full effect, Limited Brands (LTD), meanwhile, showed once again why it’s one of the best-run retailers out there.

SOLID NUMBERS

A handful of retailers are firing on all cylinders at the moment, including Ulta Beauty (ULTA) which reports earnings on Sept. 6 after the close. Quarterly profit is seen rising 34% from a year ago to $0.51 a share with sales up 20% to $473.8 million.

GOOD GROWTH STORY

The beauty retailer operates 489 stores in 45 states. It has a market capitalization of $5.9 billion.

Ulta isn’t a cheap stock at 45 times trailing earnings and 29 forward earnings but its growth story is worthy of a premium valuation. Full-year profit is expected to rise 34% this year (fiscal 2013) and 27% in 2014.

BIG BOYS ARE BUYING

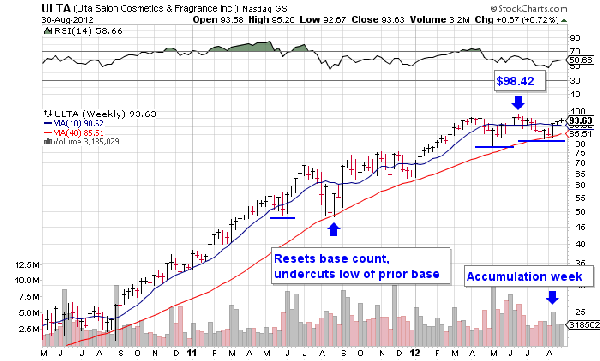

Some would argue that Ulta is a late-stage base due to a big price run already, but it reset its base count last year when it hit a low of 48.28 in late August. It undercut the low of a prior consolidation meaning enough sellers were shaken out of the stock to wipe the slate clean and reset the base count. It broke out in January and is currently working on a second-stage base. An accumulation week earlier this month strengthens its chart because it points toward institutional buying.

LOOK FOR BREAKOUT

Even though I’m wary of a 300% gain for the stock since its Sept. 2010 breakout over $27, think there’s a chance for more upside here due to Ulta’s consistent track record of execution. I’m expecting strong earnings and solid outlook next week, but I’d like to see the stock prove itself a bit more. I would only be a buyer here on a heavy-volume breakout over $98.