Mortgage companies tried several approaches to reducing defaults in bad loans. These included:

Refinance – for those that could afford it, have refinanced at a lower rate. Must be employed to qualify and many didn’t on income requirements.

Modification – mostly reduced the rate and did not reduce principal by as much. Most borrowers who are in trouble don’t qualify for this because they lack income and have high other expenses such as credit cards and car payments. Modifications did not significantly reduce overall late payments and default accounts.

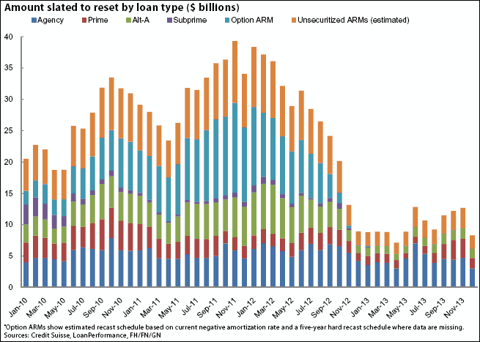

Pick a pay – most people chose to pay interest only which did not pay down their loan. Now, with falling real estate prices, a large percentage of these are either underwater or have lost equity on the deal. This makes people less likely to stay in the home and may lead to more strategic defaults.

However, few of these programs have been ultimately successful in dealing with the mortgage fiasco.

(click to enlarge)

Data Courtesy of SNL, Credit Suisse

Of 10.8 million upside-down borrowers, the average mortgage balance is $216,000 and the average underwater amount is $51,000, according to new data released from Corelogic. That equates to $2.3 trillion of impaired loans with an underwater balance of $550 billion.

The number one predictor of foreclosure is negative home equity. People have no financial reason to stay, and may turn to renting in the meantime.

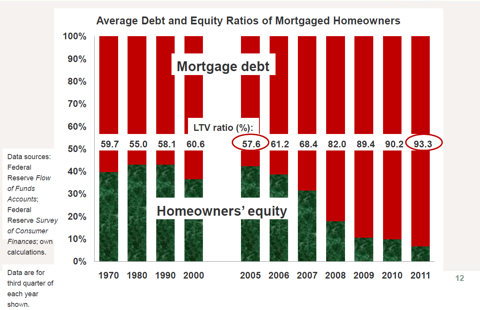

(click to enlarge)

Image Courtesy of Mortgage Bankers Association

American’s with mortgages have lost almost 40 percentage points of equity over a 6 year period of time, which is astounding.

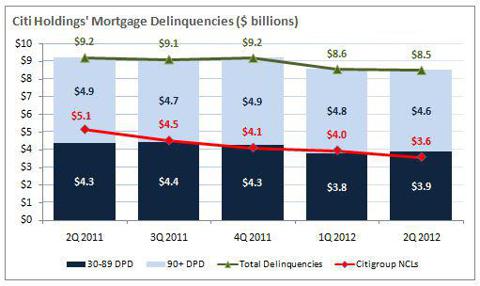

Using Citi as an example, defaults on loans are very high and the company is finding it increasingly hard to liquidate toxic debt onto the markets. Citi has hundreds of billions of delinquent or defaulted loans on the books.

(click to enlarge)

Image Courtesy of Motley Fool

At the end of Q2 this year, 17% of homeowners fit into the 80% to 125% LTV range and may qualify for government assistance, though at this pace not many of them will get modified by government programs anytime soon.

In my experience working for a mortgage lender for 2 years, the pace of modifications on bad loans meant it would have taken 15 years to fix the lender’s portfolio, assuming the economy did not get worse. That company was also more efficient at loan modifications and subscribing to government requirements than the larger banks were, so it was a rosy scenario when compared to the mortgage lending industry as a whole.

Accounting rules have allowed banks to leave the mortgages at full value despite the declines in property prices. These assets are not showing their true worth on the balance sheets which would result in larger losses and more bank going bankrupt.

However, as time has passed and unemployment has not improved, more of these loans are going delinquent over time resulting in higher amounts of non-performing loans. The Federal Reserve now has reason to participate in the mortgage market, buying up toxic MBS and moving them from the private to public balance sheet. The banks could not fix the problem themselves and had to be bailed out in 2012.

The open ended QE3 program is designed to absorb billions of these bad debts each month, which will have the effect of understating the housing problems nationally and also saves the private banks from becoming insolvent on bad loans that were destined to fail. Never has it been a better time to be a banker in the United States.

The large private banks never paid for the mortgage crisis. With QE3, they never will. Who will pay then? It will be me and you. As the Federal Reserve is saturated with more and more debt, eventually the dam will break and the central bank will be broken. What to do then? Well, most likely the bank will fail and another currency scheme will be announced by the government with backing from large financial institutions, of course. Most likely it will involve several nations tied together in a regional fiat arrangement. Will this be too politically difficult to accomplish in the US?

Recently, leadership in Europe has already begun discussing the danger of allowing separate nation states in Europe and has advanced the idea of a global power of a true European Union. This is being driven by the economic situation and pending failure of the Euro upon trillions in bad debt. Once the European Union is fully integrated into one national government, a new currency will be announced to replace the old one.

The subsequent buildup and destruction of that fiat currency will ensure therewith. It may take decades again for that currency to fail, but not before the bankers have plundered as much wealth as they can from the people by more and larger fraudulent financial schemes.

Back to the US, once the one-nation European approach is announced, similar calls will be made in the houses of US Congress. The people will dissent and even loudly, as the European people did when the Euro, Lisbon Treaty, EFSF, and finally the intent to form a single European nation were announced. But popular dissent alone has not stopped the forced European integration as it rolls along unabated.

At the end of the day, the cries of the people may not stop the runaway fascist government-financial complex from taking national sovereignty away from America and handing it to a select few technocrats intent on ruling each continent as one nation as is happening in Europe. The only thing that will stop it is the people refusing to accept the plans of the technocrats and to walk away from the corrupt system. As long as Americans accept bureaucratic collectivist solutions, whether actively or passively, the centralization of finance and government will continue until a few rule the whole of the Western world.