Will there be a change passed for next year? And if there’s no change, we go back to the tax rates of 2002. That means the top rate goes to 39.5% from today’s 35% and other changes increase income taxes across the board. Even if a tax bill passes, it will likely include a tax increase.

ACTION LIST

For those who want to position themselves financially for a higher-tax world in the future, there are two items to consider for action this year. First, deductions for charitable contributions are likely to shrink.

SHRINKING DEDUCTIONS

The tax deduction for charitable contributions is likely to be reduced or restricted after 2012. This could affect the advantages of using a Donor Advised Fund (DAF) for philanthropy. This tax planning strategy consists of contributing highly appreciated stock to a DAF before December 31, 2012. Under current rules, this will avoid the tax on all the appreciation and provide the taxpayer with a charitable deduction for the full market value of the stock.

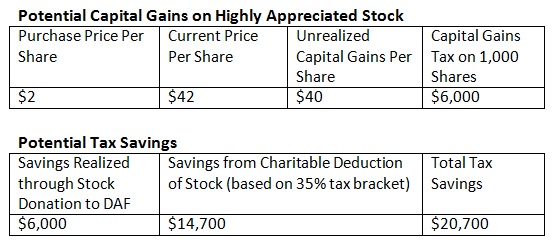

For example, suppose that a taxpayer purchased stock years ago for a low price of $2 per share and it is worth $42 per share today. There is an unrealized capital gain of $40 per share. If you hold 1,000 shares, the capital gains tax on the $40,000 based on current legislation (15% federal tax rate) will be $6,000. This tax is avoided by making the donation.

In addition to this savings, the taxpayer will also receive a charitable deduction for the full $42,000 market value of the stock. This will save a taxpayer in the top bracket (35%) $14,700 in 2012 income tax. Note that the full $42,000 does not have to be granted to a charity all at once. Later charitable contributions can be made in future years by designating grants from the DAF. Unused funds in the DAF continue to be invested and the earnings can also be used for grants.

CONVERT TO ROTH IRAS

This year, 2012, will be the best year to convert IRAs to Roth IRAs for many taxpayers who are likely to be in a lower tax bracket now than in future years. There are required minimum distributions (RMD) required from IRAs and other pensions starting at age 70 1/2. These distributions are taxable as ordinary income, and often increase the tax bill for many retirees. This year there is the opportunity to convert investments in your IRAs to Roth IRAs which reduces or eliminates the RMD. If this is done by the end of 2012, the funds converted will be taxed at 2012 rates.

For a taxpayer in the top bracket, conversions this year would be taxed at 35% by the federal government. Under proposed tax legislation, however, distributions would be taxed at up to 43.9% beginning next year. After conversion, investments in a Roth grow tax-free and are not subject to RMDs, and any distributions in future years are tax-free. Since tax rates are expected to increase substantially, our analysis shows that the taxes saved by having your retirement money grow tax-free in a Roth could fully offset the taxes paid now to convert the funds in seven to ten years. So by paying taxes on the IRA money now, you could increase your after-tax retirement income by 13% to 28% for the rest of you and your spouse’s lifetimes.

COMBINE THESE STRATEGIES

It is very advantageous for a taxpayer to combine these two strategies. The additional tax generated by a Roth Conversion can generally be offset by contributing appreciated stock to a DAF, if done by the end of 2012. In the example above, the taxpayer can convert $42,000 to a Roth and the additional taxable income would be offset by the contribution of the appreciated stock worth $42,000 to a DAF.

For taxpayers who regularly contribute to charities every year, this strategy allows the deduction for charitable contributions in future years. Based on historical returns, a DAF invested in an stock index fund would provide for about $2,500 in charitable grants each year indefinitely without exhausting the fund’s assets.

THERE IS STILL TIME

There are still several months left to implement these strategies. Since they are somewhat complex, consultation with a qualified, fee-only financial advisor who is also a knowledgeable tax advisor is recommended.

[Editor’s note: Do you have any questions for Bert? There’s still time to make changes which could benefit your tax status. Let us know your questions! ]