We have three explanations for Friday’s stock market decline. Well, perhaps four.

First, it was Friday, October 19th- the anniversary of the Friday, October 19th, 1987 stock market crash. Second, the seasonal trend argues that cyclical bottoms are typically made during the month of October. October, by the way, ranges from September into November so this is the time of year when things should look the most bleak. Third, whenever the U.S. jobless claims numbers rise the stock market tends to trend lower into the following week.

Our fourth explanation has to do with the position of the Canadian dollar. With the currency still north of parity with the U.S. dollar this is a difficult time to start a new cyclical rally. We have argued that our expectation is that the recovery will come off of a stronger U.S. dollar but the reality is that commodity price strength and cyclical strength have been synonymous for many years. If there is a cyclical shoe left to drop we still believe that it will come from weakness in the commodity markets and commodity currencies.

In recent issues we have argued that today is somewhat similar to 1997. If were to fine tune this somewhat we would suggest that it may, in fact, be a little closer to late 1996.

Below is a chart of the U.S. Dollar Index (DXY) futures and Japanese yen futures from 1994- 97. The bottom for the dollar was made in the spring of 1995 at the speculative peak for the Japanese yen.

Below is a comparison between the U.S. Dollar Index futures and silver futures from 2010 to the present day. We have set the charts up in an attempt to show that the dollar’s bottom was made in the spring of 2011 at the speculative peak for silver prices.

The trend for the markets changed in 1995 when the dollar began to rise and we are arguing that the same will be true over the next few years as money continues to flow away from the BRIC, emerging, Asian, Latin, commodity-type themes back towards the dollar.

If history were to be kind enough to repeat what we have to look forward to either later this year or into 2013 is… even more dollar strength and downward pressure on metals prices.

Above we showed a comparison between the dollar and yen from 1995 and argued that the peak for the yen was generally the start of the bullish trend for the dollar.

We also showed a chart of the dollar and silver from the current time frame in an attempt to show that the beginning of dollar strength should be marked around the spring of 2011.

In other words… if the trend from the spring of 2011 for the dollar is similar to the trend post- spring of 1995 then we may be able to draw some broad comparisons and conclusions to help understand what has been and will be happening with the markets.

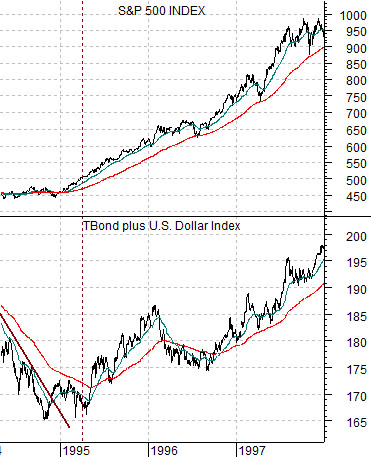

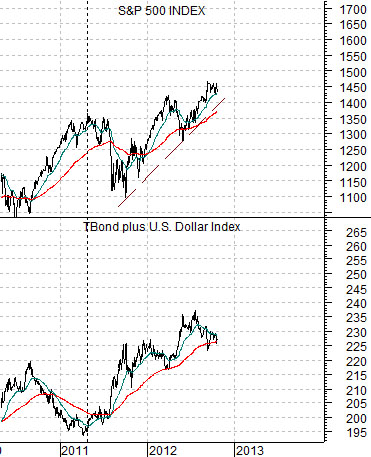

Below is a chart of the S&P 500 Index (SPX) and the sum of the TBond futures and U.S. Dollar Index from 1994- 97. The same chart for 2010 to the present day has been included at bottom right.

The dominant theme from 1995 through 1997 included both dollar and bond market price strength along with a steadily rising stock market. This was a time period that favored large cap growth-oriented equities. The true cyclical pivot that led to the Nasdaq’s price explosion didn’t take place until the final quarter of 1998.

The offset to a rising dollar and bond market was downward pressure on base metals prices and energy prices. Copper futures peaked in 1995- 96 while crude oil didn’t turn lower until the start of 1997.

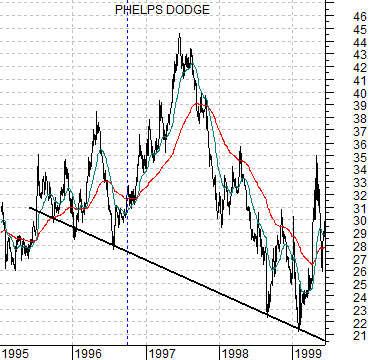

So… would it make sense to abandon the mining stocks here? The answer is, as one might expect, less than clear. The chart below shows copper producer Phelps Dodge from 1995- 99. Notice two things. First, the down trend began at the peak for copper in 1995. Second, similar to crude oil futures in 2008 prices are capable of diverging from the bearish trend for a considerable length of time. PD’s share price rose with the stock market from 1996 into 1997 before eventually collapsing once Hong Kong’s Hang Seng Index ‘crashed’ in the summer of 1997.