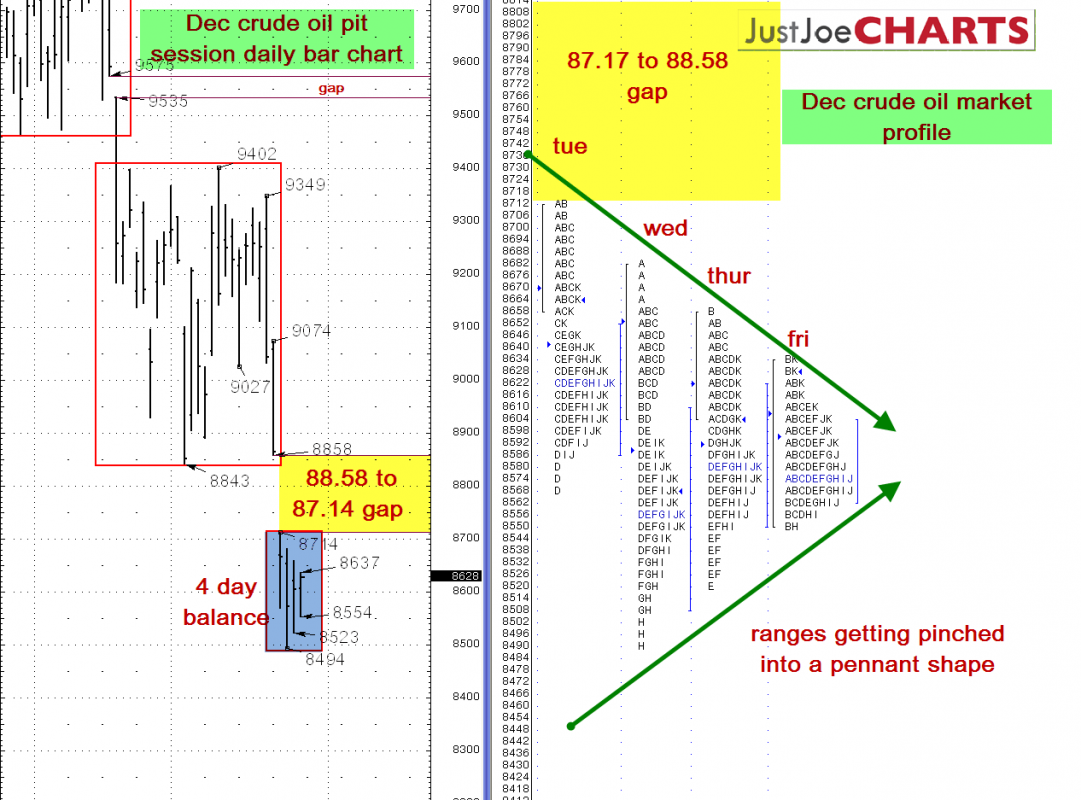

December Nymex crude oil futures have been trading within a relatively tight $84.94 to $87.14 balance bracket for the last 14 days. Additionaly, the market has consecutive “inside days”, pinching the ranges into a pennant shape.

BE READY FOR A BREAKOUT

When a volatile market such as crude oil becomes contained in a pennant shape for several days, a significant move usually follows the break from balance, which could last a few days.

UPSIDE MOVE

The 1st step is to see which way the market breaks from Fridays “inside day” range. If the market breaks from the inside day to the upside, it may test the 87.14 balance bracket high. If the market gains acceptance above the 87.14 balance bracket high, it may attempt to fill the 87.14 to 88.58 gap.

DOWNSIDE MOVE

If the market breaks brom Fridays “inside day” to the downside, it may test the 84.94 balance bracket low. If the market gains acceptance below the 84.94 balance bracket low, 83.65 and 82.10 are the next downside references on the weekly/monthly charts.

Be careful of the market fake in one direction, then rip in the opposite direction. Be patient as it is better to be alittle late entering a trade than alittle early.