There’s not much to get excited about in the chip space these days, especially when you look at a chart of the Philadelphia Semiconductor Index. It’s been lagging the market since February 2011, mostly because several components have big exposure to the PC market which has fallen on hard times due to sluggish sales.

A handful of chip stocks, however, remain well positioned for growth including ARM Holdings (ARMH). It’s a U.K.-based chip designer with a strong presence in the smartphone and tablet market. It licenses its technology to scads of large-cap tech names, including Apple (AAPL).

It has a market capitalization of $14.5 billion and it’s liquid with an average daily volume of 2.3 million shares.

Investors cheered its earnings report last week after the company said earnings rose 29% from a year ago to $0.18 a share. Sales growth accelerated sequentially, rising 24% to $233.5 million.

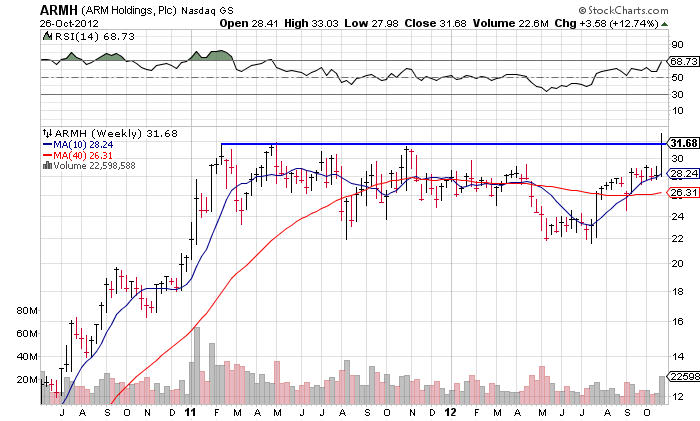

ARMH is exactly the type of technical setup to target in the early stages of a new market uptrend. A look at its weekly chart shows the stock is still within buying range — in the early stages of breaking out from a long base. That said, a potential stumbling block for the stock is that major averages remain in technical downtrends until proven otherwise. It’s tough for most stocks to make headway when the market tide is flowing negative. New buys are risky at the moment.

Support for ARM is strong in the $28 area. The only way the stock will get down to that level again is if major averages suffer another leg down. ARM will be able to hold above this level for now. When it comes to its gap up on Oct. 23, it may or may not fill the gap. A common misperception is that stocks ALWAYS fill gaps, but there’s plenty of market precedent that shows this is not always the case, especially when it comes to really strong stocks under accumulation like ARM.

I continue to sit mostly in cash. If major averages can follow through with conviction in coming days, a stock like ARMH with strong fundamentals and technicals has a solid chance of outperforming.

= = =

Read more daily trading ideas here.