Now that PAL has bounced off the lower bollinger band, I feel it’s quite safe to assume that the bottom is set (at $1.26, which beats my expectations. I expected it to stop at $1.50).

Here is an article which I wanted to publish on SeekingAlpha.com on Nov 21st (the article is still under review):

North American Palladium (ticker: PAL) or “NAP”, is a precious metals mining company, operating in Canada. It has been operating its flagship mine Lac Des Iles (LDI) in Ontario, Canada since 1993. LDI is one of only two primary producers in the world, as palladium usually comes as a by-product of other metals (platinum or nickel). NAP also operates the Vezza Gold mine, which is located in the Abitibi region of Quebec. NAP is listed on the NYSE with ticker PAL, and on the Toronto Stock Exchange with ticker PDL.TO.

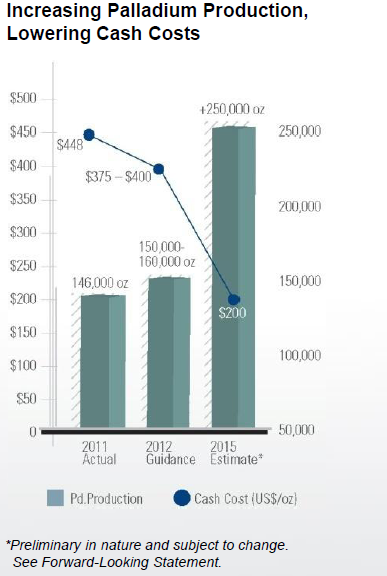

The company is currently undergoing a major expansion to increase production and reduce cash costs per ounce. The goal is to reach annual production of 250.000 ounces of Palladium in Q3 2015 at a cash cost in the low $200?s. Palladium is currently trading around $640, and the outlook remains positive.

Precious Metals (including gold, silver, platinum and palladium) remain in an uptrend, but the story of palladium in particular is interesting to me.

Although palladium is a precious metal (just like gold, silver and platinum), it is also an industrial metal, with plenty of uses (think of electronics, such as your smartphone, dentist equipment, jewelry, etc, but the main source of demand comes from the automotive industry, as palladium is being used in catalytic converters).

Johnson Matthey, recently published a report calling for a huge deficit of palladium (915,000 ounces) due to lower supplies, higher gross demand and less recycling: palladium supplies are predicted to decline to a 9-year low of 6.57 million ounces, because of lower South-African output due to the strikes which have hurt South-African production of platinum and palladium. Another factor contributing to lower supplies comes from a forecasted drop of sales of Russian state stocks by over 0.5 million ounces compared with last year, to 250,000 ounces. Recycling is expected to be constrained by subdued PGM (Platinum Group Metals) prices.

To read the full report, click here.

In a recent report, Stillwater Mining (SWC) wrote: “Palladium is facing a substantial supply deficit going forward that will likely be met by a combination of price-driven demand destruction and shifting back to platinum or using rhodium.“

Let’s have a look at those Russian state stocks of palladium.

Norilsk Nickel, the largest producer of palladium, had to send all of its metals to Gokhran, the Russian State Depository, from 1935 until 1996. The Gokhran would then sell the metal onto the market. Norilsk Nickel was only allowed to sell metal directly to the market from 1996 on. This means that the Gokhran decided how much palladium would be supplied to the market, and managed to build a huge inventory of palladium throughout the years. Those inventories are a state secret, and the amount can be anyone’s guess, as there is no transparency.

This resulted in rumors in 2000 that the Gokhran would be running out of palladium supplies, causing Ford and General Motors to stack up on palladium (at sky-high prices over $1000 per ounce!). When the rumors appeared to be just that – rumors – prices of palladium fell dramatically (from $1,100 per ounce in early 2001, to only $150 per ounce in 2003).

In October 2011, an unnamed official in the Ministry of Finance said that the Gokhran was going to dramatically reduce the amount of metal it supplied to the market.

From the report above, Johnson Matthey expects them to reduce supplies by about 0.5 million ounces, down to 250,000 ounces.

If we combine the (potentially) lower Russian sales with the lower South-African production and steady demand, we have a nice cocktail for higher palladium prices.

Those who would like to have exposure to the physical metal, can buy PALL.

That’s the reason why I am bullish on palladium (and have been since late 2008-early 2009, when price bottomed around $180 per ounce). NAP is a growth story, and it is currently going through some “growing pains”.

For this year (2012), NAP has planned a $116 million investment for the expansion of its LDI mine, of which about $93 million had been spent by the end of Q3. This expansion will – according to the company – lead to annual production of 250,000 ounces of palladium, at a cash cost of $200 per ounce by 2015, compared to 150,000-160,000 ounces at a cash cost of $400+ currently. If they realize this expansion within budget and on time, this would increase their operating margin significantly, even if palladium prices remain at $640 per ounce.

The company has a quite large short-interest (on October 31st, there were 7,424,673 shares short, compared to an average daily volume of 1,556,402 shares and total shares outstanding of roughly 175 million).

So the hedge funds have been shorting the stock, and are likely anticipating that NAP needs to raise capital, in order to pursue its growth strategy.

On September 30th 2012, the company had cash & cash equivalents of CAD$ 23,462,000, and receivables worth CAD$ 78,090,000. Part of those receivables are double smelter payments, estimated at $25 million, which will be converted into cash (October and November). This is the result of switching smelter agreements from Xstrata to Vale, which would lead to higher smelter costs, but also earlier payments for NAP, which is a positive.

On top of that, NAP gets cash flow from its LDI mine, so even though the expansion plan involves an additional (roughly) $23 million for Q4, the cash balance at the end of the year shouldn’t be very different from the end of Q3.

In addition, NAP had acquired several gold properties throughout the last couple of years, but because of higher cash costs and lower grades, the board has decided that they want to go back to a palladium-focused mining company, so the gold properties are up for sale right now. Either they get sold, and NAP gets a nice cash-inflow; OR, they don’t get sold. What happens then, remains to be seen, but NAP then has the choice to explore the properties (and possibly mine them if that would be economically viable), it could keep them up for sale, or it could just keep the properties without doing anything with them (and wait for higher gold prices to materialize).

Whether they get sold or not (and at what price) remains to be seen, but in my opinion, NAP should get at least $35-40 million for its gold division. That would be a nice cash boost, which could be set to work for the mine expansion plans in 2013, of which we will get an update in Q1 2013.

Now let’s have a look at some charts:

(click to enlarge) Chart courtesy stockcharts.com

Chart courtesy stockcharts.com

The first chart shows the share price of PDL.TO (which has a longer history than PAL) throughout the last 17 years. We can see that the share price has been very volatile during those 17 years, ranging from below CAD $1 to as high as CAD $19. Price is now at the lower end of this range, currently trading at CAD $1.35, close to major past bottoms.

The second chart shows roughly how many shares of PDL.TO you can buy with 1 ounce of palladium. Never before has this ratio been this high, as it is currently at 473.33. Please notice that the ratio is going parabolic, just like in 1999, right before it came back down at the speed of light. In my opinion, parabolic moves always end badly. If history is any guide, I expect PAL/PDL.TO to start outperforming palladium prices very soon.

The third chart shows the ratio of PDL.TO over the CRB Commodity index. It tells us that NAP is at its cheapest level in the last 17 years when compared to a basked of commodities.

And last but not least, we can see the ratio of PDL.TO over the SP500 index. A rising ratio means that NAP outperforms the SP500, while a falling ratio means you would have made more money investing in the SP500 then in NAP.

I am not saying that the above charts are rocket science, but one should get the point: if history is any guide, NAP is cheap.

The future of the company (and the share price) are in the hands of Management. If they can prove the market that they can raise production and reduce cash costs as expected, I think PAL/PDL.TO will become a very rewarding stock for medium- to long term holders.