It was disappointing to index futures, which sold off late Tuesday, after House Republican leaders canceled an evening vote on Boehner’s tax-cut plan. Apparently, it didn’t have the support needed to pass.

The market uptrend isn’t dead yet, though. An increasing number of technical breakouts in recent days make me feel good about the prospects for more gains. I continue to be encouraged by the number of compelling setups out there — growth names getting into position for possible breakouts.

Names like Equinix (EQIX), FMC Corp. (FMC) and Urban Outfitters (URBN) all have a good chance of outperforming in 2013, but my top pick is Michael Kors (KORS). That’s right, a stock with an already-lofty valuation of 40 times trailing earnings and 34 times forward earnings could see multiple expansion in 2013. A lot of top-performing growth fund managers already own KORS, and I’m expecting more to jump on board in 2013.

A stock tends to appreciate the most when a company’s still in the early stages of growth and this certainly applies to Michael Kors. It went public in December 2011 at $20 a share. The company sells clothing, footwear and other apparel and accessories through luxury department stores and its own company-operated shops.

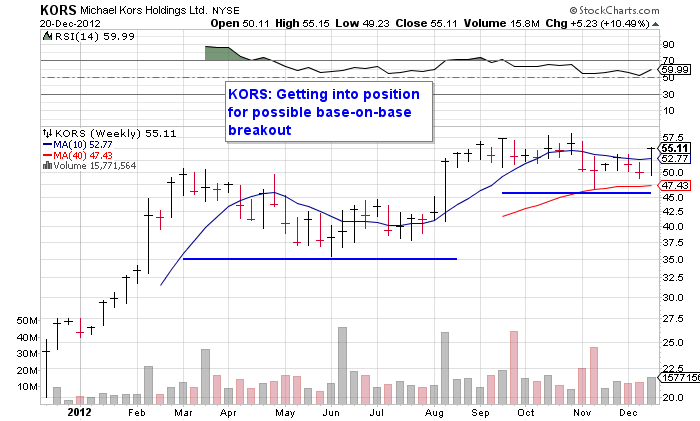

Its current technical structure is a second-stage base-on-base pattern. Big earnings and sales growth in recent quarters and strong growth prospects should fuel more gains for the stock.

Last month, KORS reported fiscal second-quarter profit of $0.49 cents a share, up 96% from a year ago. Sales growth accelerated for the second straight quarter, rising 74% to $532.9 million. Overall, same-store sales rose an impressive 45.2%. Michael Kors is no stranger to strong same-store sales growth. In the first quarter, same-store sales rose 37%. In the fourth quarter of fiscal 2012, they rose 36%.

Michael Kors’ next earnings report isn’t due until mid-February. The consensus estimate calls for profit of $0.41 a share, up 105% from a year ago. Sales are seen rising 46% to $543.6 million.

With such a solid track record of execution, there’s no reason to think that KORS won’t continue to execute going forward. I think this name has the potential to be a big winner in 2013.

[Editor’s note: What are you looking at for 2013? Share your top picks with us!]

= = =

Feature Stories:

How Fantasy Football Can Make You A Better Trader

My Spouse Doesn’t Know I Trade

The January Barometer–Learn How To Use It To Gauge Stock Direction In 2013