In my previous commentary I illustrated how the work of George Lindsay seems to be pointing to a high in the bull market either now or closer to the end of February. An extended basic advance from the low of the basic cycle on 7/2/10 counts 938 days to last Friday’s high. Counting from the 7/2/10 low to 2/24/13 is 968 days, also an extended advance. Both of these targeted dates were established with middle section counts described in last week’s commentary. So which is it?

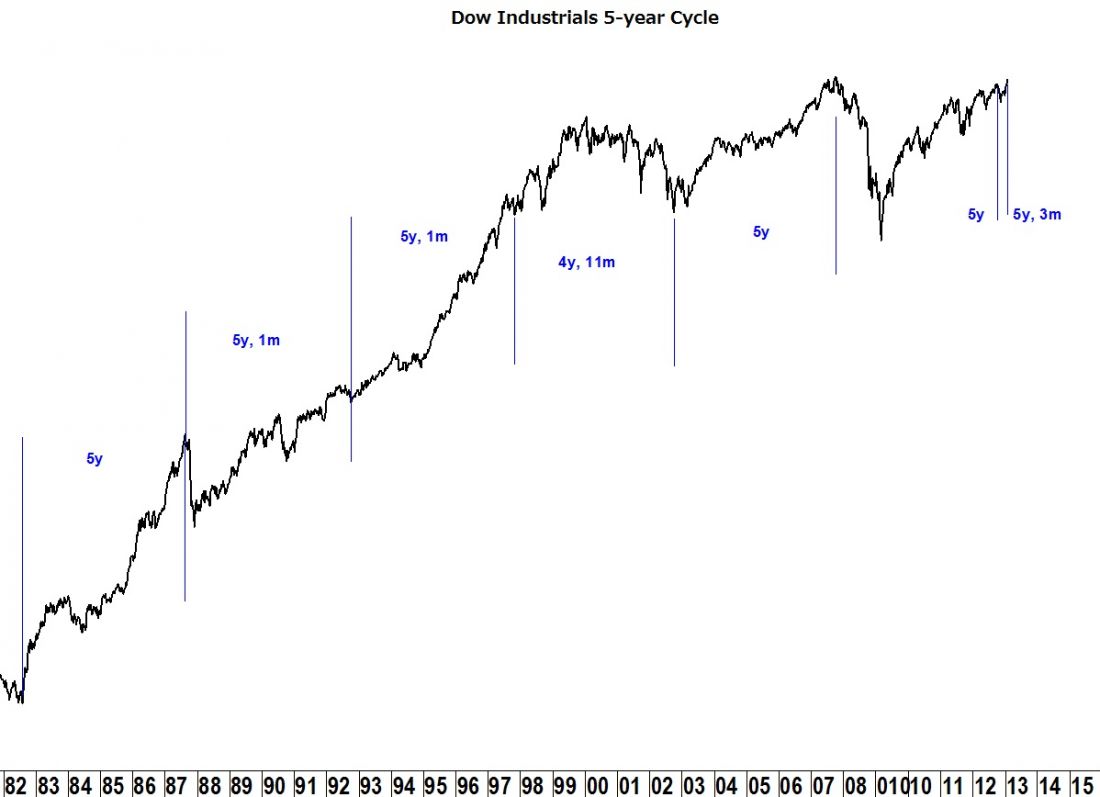

Tough call, and regardless of which date turns out to be the date we’re looking for, we really won’t know for certain until we pass the second date. At this point we need to ask ourselves what is the most probable outcome. A five-year cycle may help us to make that decision.

There exists a five-year cycle which covers the entire history of the Dow Industrial index. The latest cycle extends from the high of October 2007 and, if it had been perfect, would have terminated in October 2012. October 5, 2012 had been my original forecast for a high to the bull market as that date fit a long basic advance from the 7/2/10 low and was identified by a middle section count. Indeed we did see a nice correction in the market but not the bull market top. Interestingly, it was just about that time that the “generals” left the field. As we can see from the OEX/SPX ratio chart, large cap equities have been seriously underperforming the broader market since last October.

While the chart below of the 5-year cycle is a small sample compared to the entire 116-year history of the Dow Jones Industrials, it is fairly representative. Our question, whether the high is upon us or will have to wait until late February, may be answered by the fact that variations in the cycle have never extended beyond 5 years, 3 months. That would place a top at our current point in time, January 2013.

= = =

Editor’s note: TraderPlanet is proud to announce the release of its first quarterly TraderPlanet Journal publication. Click here to launch our multi-media publication filled with valuable trading strategy, market outlook and trading education articles.