One of the more common questions that I tend to get at this time of the year deals with whether a trader should switch to IRC Section 475(f), or mark to market accounting.

Does it make sense to change your accounting method for your trading business? This decision is not an easy one to make because it varies from trader to trader due to different circumstances. When it is fits your trading business, it can be your best friend. But when it doesn’t, it can be your worst nightmare, costing you thousands in additional taxes.

Since it is such an important decision for a trader to make, I thought I’d cover the pros and cons of mark to market accounting and, most importantly, what type of trader would benefit the most from electing it.

WHAT IS MARK TO MARKET ACCOUNTING?

Mark to market accounting is one of the benefits of qualifying as a trader in securities with the IRS. It is not available for someone who is treated as an investor for tax purposes. When a trader elects mark to market accounting, they are changing the taxation of their trading from capital gains/losses into ordinary gains/losses. This change does not affect the taxation of the gains for traders. Short term capital gains are taxed as ordinary income, which is the same as under mark to market.

The benefit comes for traders in how the losses are treated. Under capital loss rules, a trader can only deduct a maximum of $3000 on their tax return. Any remaining loss has to be carried forward to the next tax year. However, a mark to market trader can deduct the FULL AMOUNT of their loss on their tax return, providing there is other income to off set it. If there is any remaining loss, it can be carried backward up to 2 years and/or forward up to 20 years and deducted from ANY INCOME, not just capital gains!

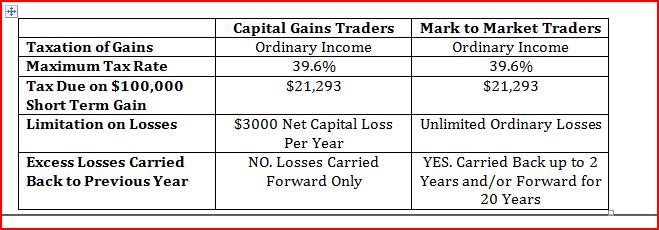

It might be easier if I compared the two methods side by side.

KEY BENEFIT

The key benefit, in my opinion, is how the losses are treated under mark to market. You can see by the table above that the taxation on the gains is the same under both methods. However, ordinary losses are extremely valuable, especially if you have other income sources on your tax return. Capital losses are very restrictive in that they can only offset capital gains. If you lose money trading under mark to market, you can use that loss to offset your (or your spouse’s) wages from an employer.

As an example, I helped a client switch to mark to market at the beginning of 2012. They didn’t have a good year trading, losing about $50,000 for the year. The good news in their situation is they are able to use 100% of the loss in 2012 against their W-2 wages of $160,000, saving them approximately $13,000 in taxes this tax year! If they had not made the switch, they would have only been able to deduct $3000 of the capital loss against the W-2 income. The remaining $47,000 in capital losses would then have to be carried forward into 2013.

One other benefit to electing mark to market accounting for your trading business deals with wash sales. Or more specifically, the lack of wash sales! Traders who elect mark to market accounting are not subject to wash sale rules. If you’ve ever had to deal with wash sale rules on your tax return, you’ll understand what a huge advantage this is to active traders.

WHO QUALIFIES?

What type of trader should make the switch to mark to market? In my opinion, any trader who actively trades stocks, options, or ETFs should definitely consider making the change. The taxation is the exact same on the gains, but the treatment of the losses and not being subject to wash sale rules make mark to market a no brainer in most cases.

If you actively trade commodities or futures, mark to market might not be right for you. Commodities and futures contracts have a built in tax advantage. Capital gains are taxed at 60% long term rates and 40% short term rates, regardless of the length of time the contract was held. The top blended rate works out to around 28% vs. 39.6% top rate on ordinary income. Switching your accounting method to mark to market if you are a futures trader means you are increasing the tax rate on your trading gains. For this reason, most profitable commodity and futures traders do not elect mark to market.

Switching your accounting method isn’t a decision to take lightly. I’ve given you some of the reasons why it may make sense for your trading business to convert but would encourage you to seek professional help in making this decision. Every trader’s situation is different and it may or may not make sense for you to switch. There are also specific steps to take in order to make the election and if you mess up, you can face taxes, penalties, and interest on your mistake.

[Editor’s Note: Do you have any questions for Ribble? If so, leave them below. Tax day is just around the corner!]

Watch his video here:

= = =

Read trading ideas in our daily Markets section.