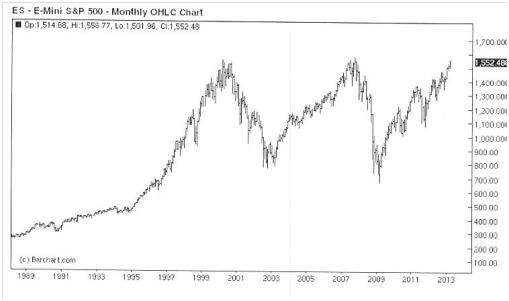

The two previous times the E-mini S&P traded up to these elevated levels, we have seen steep sell-offs. Will the sloppy bailout deal of Cyprus predicate another round of selling?

In my view, the market is hypersensitive to any headline it perceives as bullish or bearish, and while stock indices have showed an impressive year to date rally of late, a potential banking sector flare-up or crisis in the euro-zone may induce profit taking or selling across the board in the indices.

It is important to keep in mind that we are nearing the end of the first quarter as well. Fund managers may want to show profits, as sometimes this will indicate earned bonuses for profits gained. The 25-year historical chart provides more of a long term bearish scenario for the indices in 2013.

END OF QUARTER PLAY

There may still be room to the upside for the E-mini S&P, but for an end-of-the quarter position trade, I am looking at the following position. For a conservative position trade for exposure to the downside in the mini S&P’s, I am looking at buying the May E-mini S&P 1520 put and selling the May E-mini S&P 1450 put for a purchase price of 12 points, or in cash value, $600.00.

The risk on the trade is the price paid for the spread, which in this case is $600.00, plus all commissions and fees. The maximum profit you could collect is $3,500.00, minus what you paid for the spread (premium) and all commissions and fees. If the June futures contract finishes below 1450.00 at expiration, you could collect maximum value. However, I would propose that if the E-mini S&P’s traded down to 1500.00 in the next two to three weeks, potential profits should be taken.