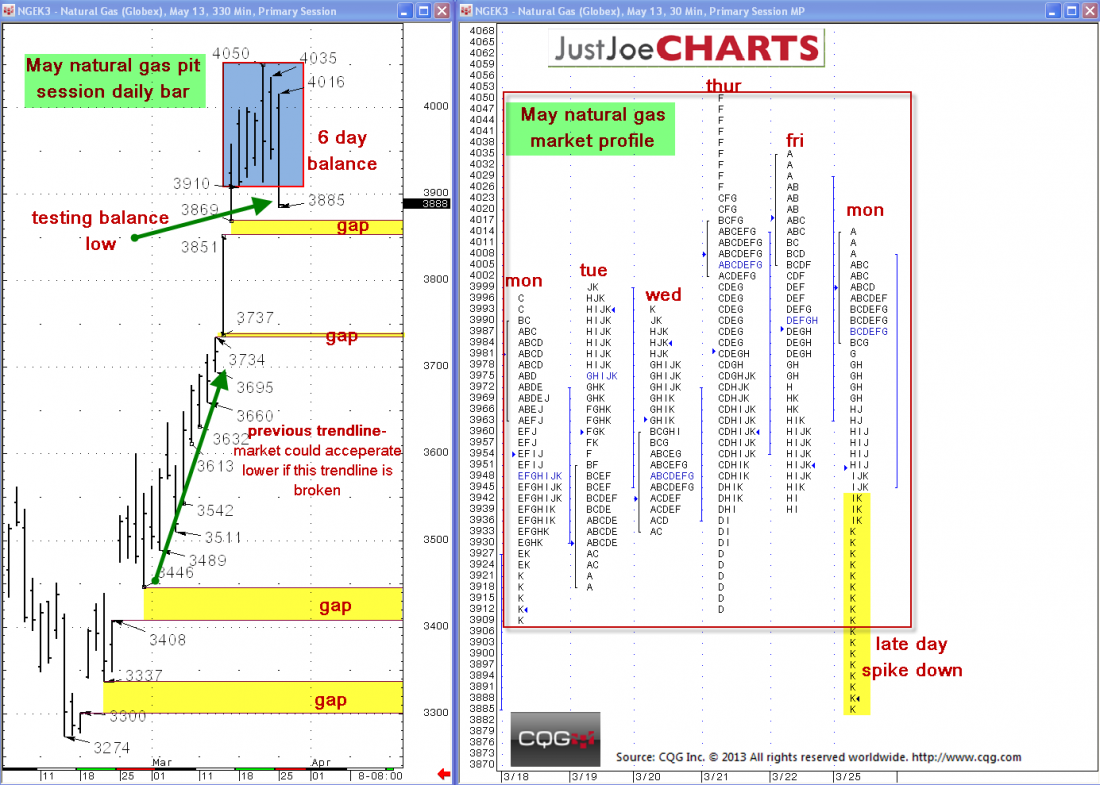

NYMEX May natural gas has been in a steep upward trend over the last several weeks.

Additionally, over the last six days, the market has found a balance bracket of $3.910 to $4.050. However, after rotating within that six day balance for much of the day on Monday, the market took out and settled below the $3.910 balance bracket very late in the day. When a volatile market such as natural gas is contained to a relatively tight range for a period of time, a significant move usually follows when the market finally breaks from the balance bracket (see Market Profile graphic).

DOWNSIDE BREAKOUT

If the market gain acceptance below the late day spike, it may test the $3.851 to $3.869 gap. Acceptance below that gap and the market may test the $3.734 to $3.737 gap. Additionally, there is a previous steep trendline from $3.696 down to $3.446. If the market reaches the $3.696 reference, it may quickly accelerate lower, taking out several lows along that trendline.

DOWNSIDE BREAKOUT FAILURE

If the market trades below the balance bracket low, and buyers quickly step in, we may see a downside breakout failure. If the market gets rejected below the balance bracket, the likely scenario is that the $4.050 balance bracket high will again be tested. Many times when a market fails a breakout at one end of balance, a breakout from the opposite end of balance occurs.

Be patient in entering a trade as it is better to be a little late then a little early.