Traders flock to the grain markets as planting begins in the spring, drawn by the historical price movement typically seen this time of year.

Opportunity is at its greatest as farmers are deciding what they can plant and the markets are trying to discover a fair price for grain prices as the data rolls in from the USDA and other outside sources. There are a lot of factors and variables that come into play through this process and things can change very quickly, adding to volatility and by extension to potential speculative opportunities.

CORN SPOTLIGHT

In this article I am going to focus on the corn market. I will discuss what factors drive corn through the growing season. Also, I will detail what numbers traders need to focus on, as these factors will be the fundamental forces that drive the corn trade.

Although the percentages have changed over the years, the United States is still the world’s top producer in corn. Given the dominant share of corn is produced in the United States, local factors will come into play as traders are trying to determine the forward prices in the corn market.

CORN AROUND THE GLOBE

United States (39 percent of world production)

Planting: Corn crops are planted beginning in April and last into June.

Harvest: Corn is mainly harvested in October and is finished by the end of November.

China (21 percent of world production)

Planting: Corn is planted in mid-March through early June.

Harvest: August through October.

THE BASICS

In early April most of the corn seed goes into the ground in the Midwest. For most areas the thaw has given way to fertile soil ready for seeding. Ground moisture is a good thing as it is necessary for the growth of the seed. However, too much moisture can be problematic as it can create difficulties for the seed to take root, further delaying the planting. The window of opportunity for producing a big summer yield begins to wind down in late April to mid-May. It can be planted later, but that will normally contribute to a crop with a smaller yield.

MOTHER NATURE

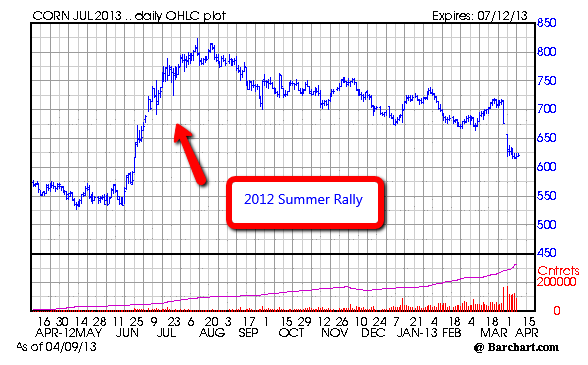

Weather in the Midwest is often the foremost driver of prices during the summer months for corn. Extreme heat in the Midwest can cause the most damage for corn, as we saw in 2012 as prices reached all-time highs. The main states for watching the weather on these crops are Illinois, Iowa, Nebraska and Indiana. It normally takes heat in the high-90s for several days in a row to cause damage. There is a greater chance for crop damage if the soil is already dry going into a heat wave.

Rain is normally beneficial for crops, but it can also cause damage. Rain can cause problems for farmers by disrupting the planting or harvest process, but damage can also be done during the summer in the form of excessive rains. The rains usually have to be well above the average levels for weeks to cause deterioration in crops. Floods tend to cause the most damage, but they are often not widespread enough to have a significant impact.

KEY REPORTS

The grain markets are usually on edge during the summer months and violent rallies can occur at any time. A simple change in a weather forecast can ignite a 15-20 cent rally in corn. Rallies can also fizzle in a hurry, so it is important to protect profits. The main report to watch on crops is the USDA Weekly Crop Progress report. It is released every Monday and it provides an updated estimate on the condition of the overall crops. The markets will often rally if the USDA lowers their crop ratings as that translates into lower yields and thus less supply. Also, the USDA releases a monthly Crop Production report that will give a global look at production for the year. This can create very large swings in the market.

RIDE THE MOMENTUM

Markets tend to trade on momentum during the summer. Crops are much heartier today than they were 30 years ago, so they can withstand more adverse weather. The grains will often hit a high for the year during the summer off some type of weather scare. Once the weather scare abates, the markets can head lower in a hurry. The summer can provide many trading opportunities in the corn market, but a trader often has to be nimble and not greedy. Remember that buying ahead of the summer months and hoping for a weather scare is usually just considered gambling. A typical year has some minor weather scares during the summer that cause short-lived rallies. Every five to ten years, there seems to be a major weather disaster that causes a lasting rally in the grain markets.

GETTING STARTED

All of these factors will help guide you through this year’s crop cycle. Like all markets, technical factors will also contribute to market action, so try to combine your newfound knowledge of where we are in the cycle along with the technical factors of the market and make this year a profitable year in the corn market.

[Editor’s note: If you have any questions about trading the grains, please leave them for our author below.]