U.S. stocks have been climbing to unprecedented levels as optimism on the outlook for earnings and the strengthening economy heartens investors.

On the European front, finance ministers meet in Dublin to discuss the crisis in Cyprus and the Slovenia situation – with extensions to bailouts for Ireland and Portugal reportedly on the agenda.

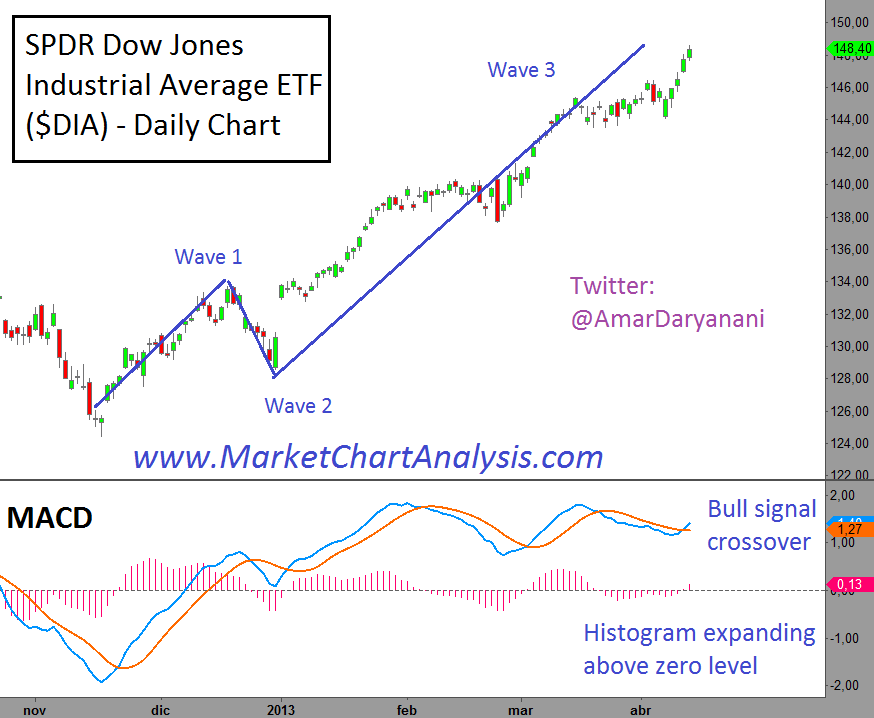

DAILY CHART

The SPDR Dow Jones Industrial Average ETF (DIA) is currently riding a very powerful Elliott Wave 3. This might seem overextended and could be due for a pullback (upcoming bear wave 4). However, the MACD indicator has marked a bullish signal crossover with a histogram that seems to re-expand above the zero level.

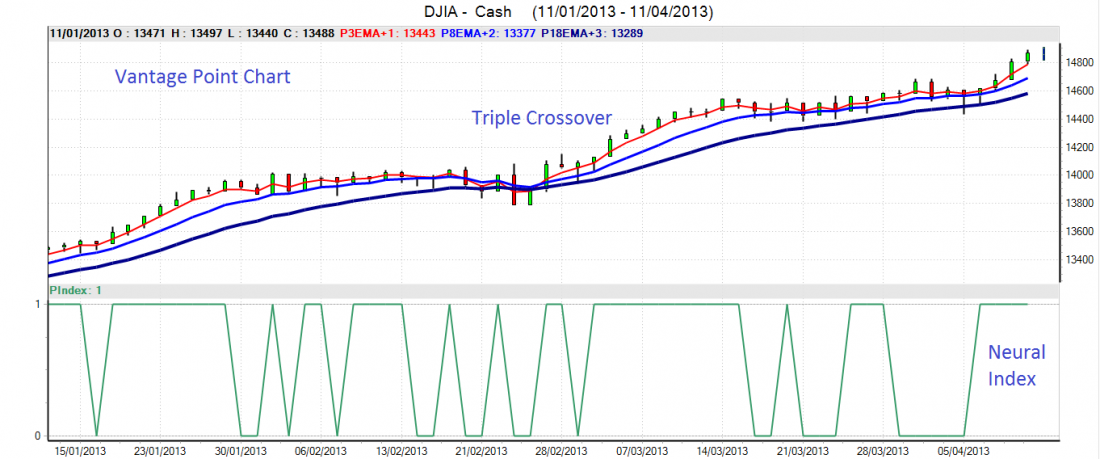

On the Vantage Point chart in Figure 2 below, we can see a triple crossover slightly below the 14.000 level with a neural index that points upwards for the next few trading sessions.

BOTTOM LINE

We’re very close to the 15,000 mark for the Dow Jones Industrial Average and 1,600 for the S&P 500. In order to cross these key levels, the market should receive good news from first-quarter bank earnings from J.P. Morgan Chase & Co. and Wells Fargo (Friday). Favorable resolutions by the European finance ministers (this weekend) will also help to fuel the possible rally.

As I’ve mentioned in my previous analysis, the stock market is due for a pullback. This could happen at any time, so trade carefully.