After gold’s clear failure to rally on the Cyprus problem, Bank of Japan QE and North Korea, we realized it was only a matter of time before we saw a corrective move in the yellow metal. The drop came and it was extremely hard and painful for gold investors. Although the metals look oversold at the moment, it’s important to remember that oversold conditions can last for a considerable time.

PHYSICAL DEMAND

The physical markets seemed to have responded to the much cheaper gold price levels and this has certainly helped the market find some stability. Although physical buying may not have enough firepower to drive prices significantly higher from here, the role of this market segment has been that of providing investors with a comfort blanket that the bottom is nearby.

BIG PICTURE

The end of Elliott wave three (September 2011) was the first sign that SPDR Gold Shares ETF (GLD) was running into trouble. A powerful technical reversal pattern, known as a “negative outside month” formed. This happens when the high of one period is above the high of the previous one, the low is lower than the prior period’s low, and the closing price is below the former close. This marked the end of wave three that ran for three years. See the monthly chart in Figure 1 below.

The levels in which wave four could bottom at are $126.85 and $113 on GLD (approximating 1300 and 1145 on the gold futures contract). It is possible that once a bottom is firmly established it is usually realized only in hindsight.

DIFFERENT PERSPECTIVE

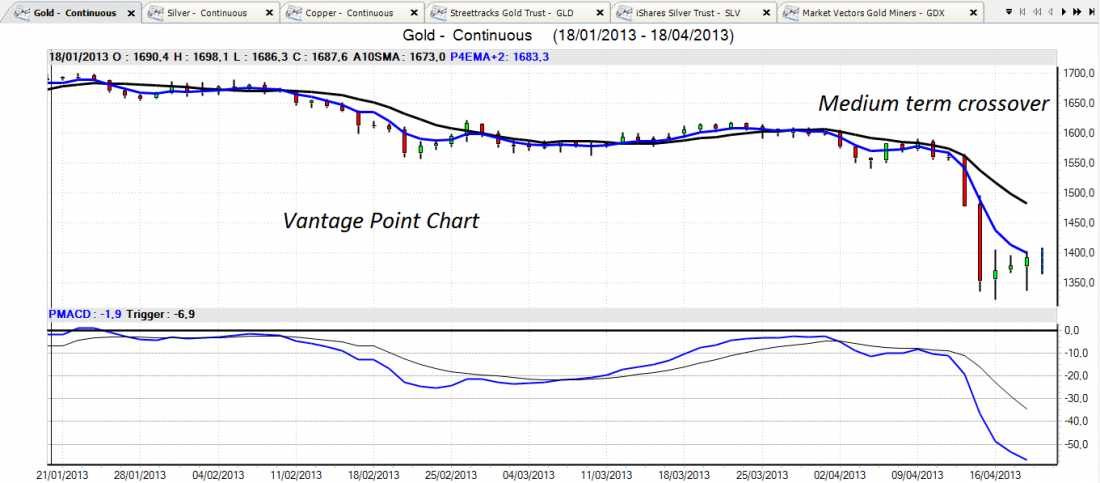

On the Vantage Point chart seen in Figure 2 below, the medium term crossover and Predictive MACD are already showing large divergences. These are the first signs that we will see a possible short term bounce.

KEY TAKEAWAYS

Gold finally seems to be settling down after the big plunge on Friday and Monday. Perhaps the CME Group’s raising of margins is stopping the short sellers from piling on more short positions.

The yellow metal has already lost so much in such a short period that I am inclined to think that the worst is likely over in terms of violent price declines. What we might see is continuous erosion or sideways to lower consolidation in its price that will take it to support levels in which corrective Elliott wave four could bottom and start a new wave five resuming the upswing for gold.