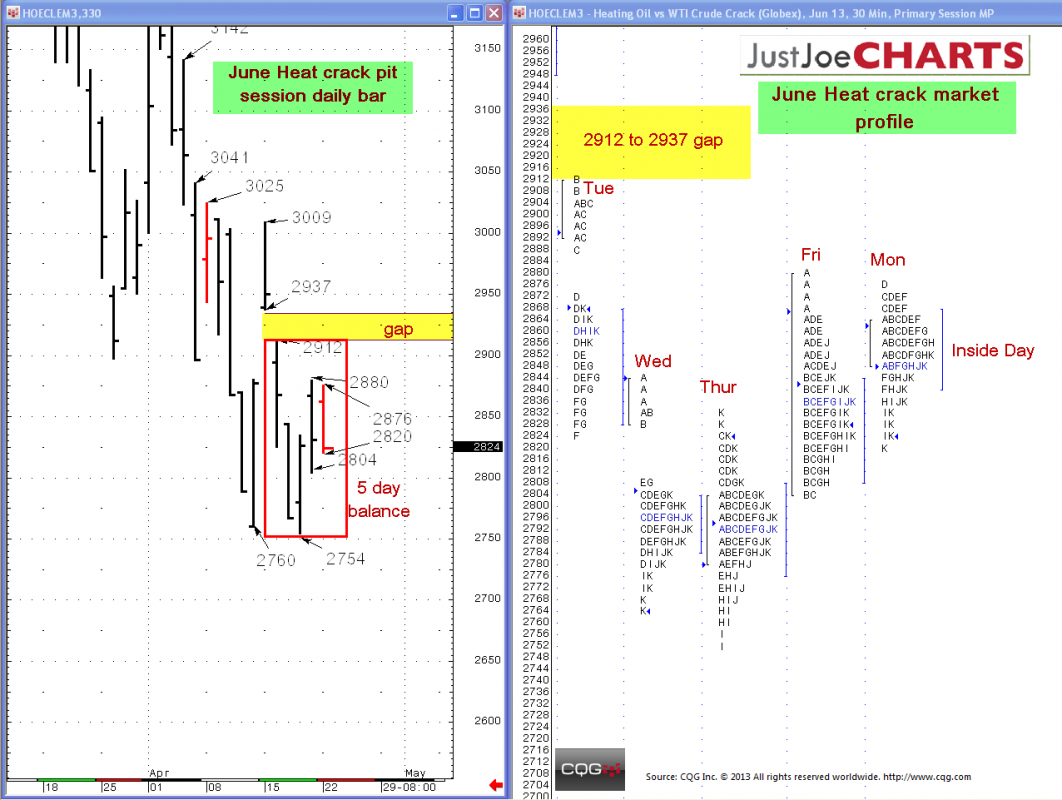

Over the past five days, the heat crack spread has been a relatively tight $2.754 to $2.912 balance bracket. Additionally, Monday’s range was within Friday’s range, making it an “inside day.”

An “inside day” is a form of balance. An “inside day” within a balance brack is “balance within balance.” When a volatile market such as the heat crack spread is contained within a balance for several, a significant move usually follows the break from balance.

[Editor’s note: For energy market newbies, the crack spread is simply the spread between crude oil and one of its products, in this case heating oil futures traded on the Nymex.]

START WITH THE INSIDE DAY

The first indicator of which way the market will move is which way it breaks from the “inside day.”

UPSIDE MOVE

If the market breaks from the inside day to the upside, it may test the $2.912 to $2.937 gap above. If the market gains acceptance above that gap, it may test the $3.009 reference.

DOWNSIDE MOVE

If the market breaks from the inside day to the downside, it may test the $2.754 five day balance low. The next downside references of the weekly/monthly charts are $2.723 and $2.628