Boyd Gaming (BYD) was a ferocious stock back in 2006.

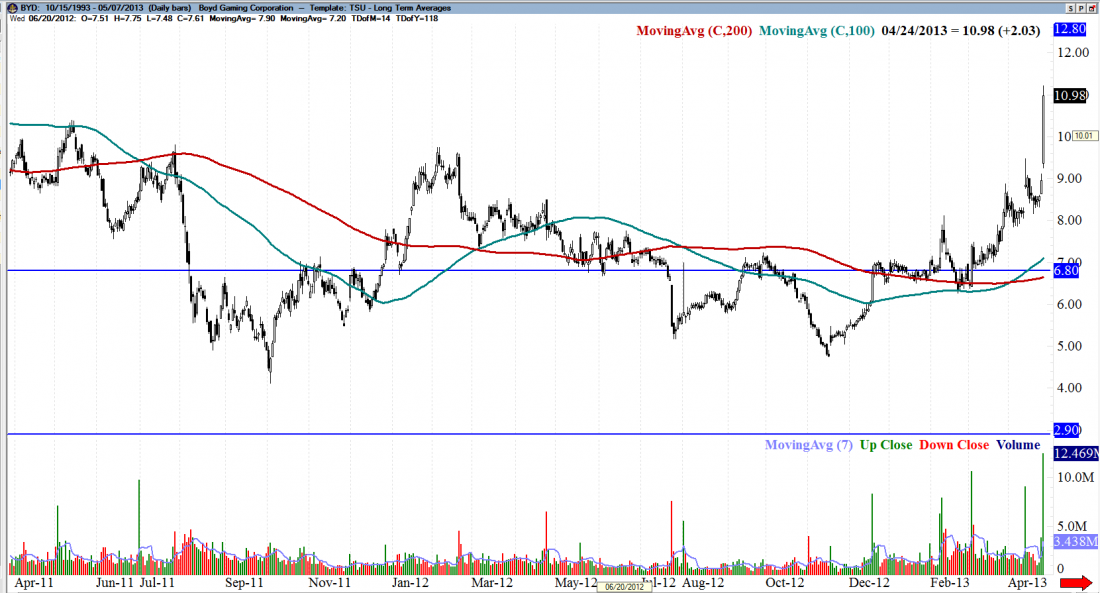

I know, “many were” you say. And this is true. As a company they stopped paying dividends back in 2008 but there is a rumor they could resume again soon. I rarely do this type of analysis but on a bigger picture, BYD has bottomed out at this location once before. The amount of volume this stock has recently, especially bullish volume, is truly immense.

RELATIVE ACTION

Las Vegas Sands is a very similar company and compared to its fall in 2008, has regained almost 50% of its share price. BYD is very far from that goal. If you consider the chart formation that occurred in BYD between 2005 and 2007, one could make the argument of a triple top on a longer fractal time frame. If that’s truly the case, technical analysts would argue the neckline of that pattern should be tested around $40.00.

KEY LEVELS

If a longer term investor were to consider owning BYD shares, $15.00 would be the next target. $15.00 will be a great location to consider selling some covered calls and once/if that resistance is broken; BYD could really see some strong upside potential.

HUGE VOLUME

As of right now, the astonishing bullish volume, mixed with recent higher lows, suggests this could be the first sign of life this stock has had in years. The volume and the candle that we have on BYD on the date of this writing (April 24, 2013) is massive and suggests, at least in my opinion, a recovery of sorts for this stock.

[What do you think about Boyd Gaming? Ready to roll the dice? Share your thoughts or ask Newsome questions below.]