China has garnered a great deal of attention lately with more reports of China’s economy slowing. Most recently it was announced that China’s industrial sector grew just 5.3% year-over-year in March, which is much lower than the growth experienced in the first two months of 2013. If we turn our attention to China’s Shanghai stock exchange, we can see the impact of these slower growth reports are having on Chinese equities.

A NEW DOWNTREND

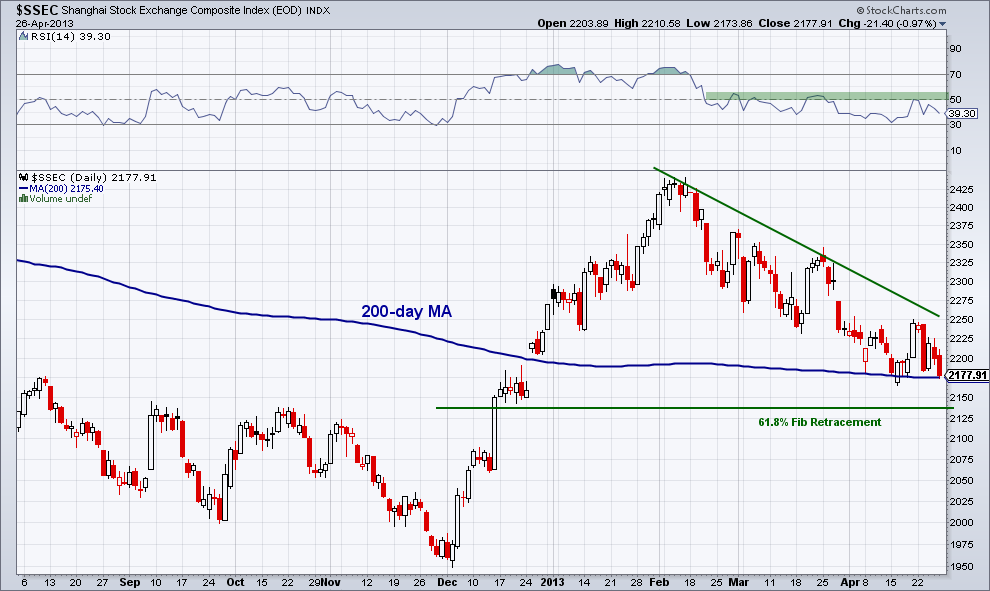

Below is a chart of the Shanghai index, which has been falling since the start of February – putting in lower highs and lower lows as a new downtrend emerges. With this weakness we can see the equity index falling to its 200-day moving average, which has been acting as support since early April. If the moving average is unable to hold back the sellers then the potentially last level of support before we get to the Dec. ’12 lows would be the 61.8% Fibonacci retracement ratio.

MOMENTUM OUTLOOK

Turning our focus to the relative strength index (RSI), we can see a bearish setup in momentum. Once the Shanghai broke its rising trend line in February the RSI indicator broke below 50 and has been setting lower highs as price has weakened. With bear market momentum, it appears it may be difficult for buyers to hold the moving average support. Chinese equity bulls need to get momentum back above 50 to get a better footing for an attempt to end the current down trend.

IT’S DIFFERENT

It’s important to note when discussing the Shanghai index that it is not the same as the popular China ETF – iShares FTSE China 25 Index (FXI). The FXI tracks the largest 25 companies in China and while it often draw a parallel with the Shanghai, it doesn’t not always mirror its moves. The China ETF is not making similar lower lows like the Shanghai but is instead testing resistance at its 50-day moving average.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.