Gold futures are at a crossroads. From here it may – may – fly like an eagle. But, the most likely outcome is that it sinks like a stone. Here’s why.

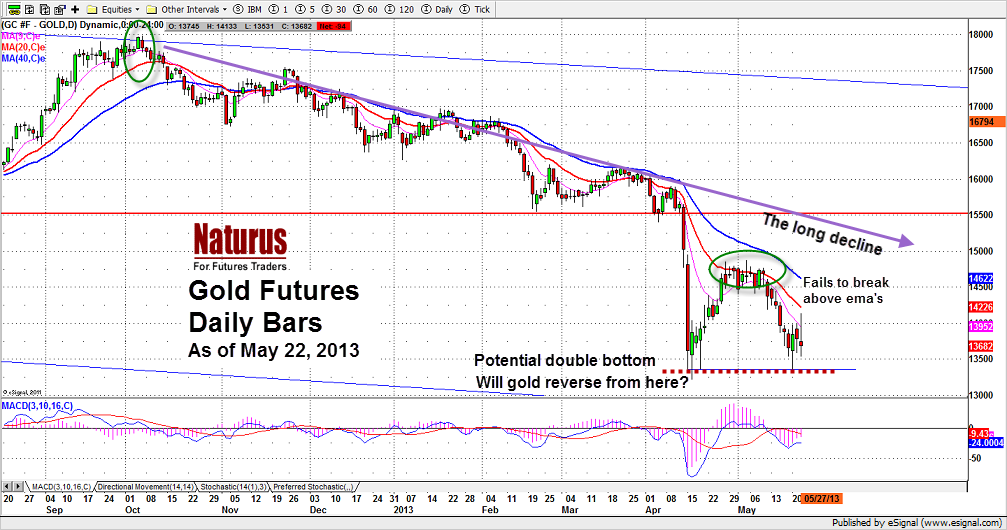

On the daily chart, the gold futures have made a double bottom below $1350 per ounce. For technicians like us, a double bottom is a powerful pattern. If gold is going to halt its long decline from the October high just below $1800, this is where it will probably make a stand.

We saw a little bounce from the potential double bottom in the past couple of days. But, the strength of the equity markets and the U.S. dollar quickly brought it back to earth.

GOLD NOW A LONG-TERM BEAR MARKET

For us, it seems clear the gold futures have entered a long-term bear market. To negate that analysis, the futures need to move decisively up above $1420. We would also like to see a bullish divergence in the MACD indicator.

We don’t think that will happen.

Instead we believe gold is headed for the long-term support around $1255-65. There may well be some profit-taking and a little slow-down in the decline – maybe even a bounce – as the price approaches our key level at $1303-09.

But a break below that level could be the cue for a drop to intermediate support at $1255-65.

HOW TO TRADE IT

Watch for price to break down through the ‘double bottom’ and test $1303-09. Short the bounce from that level.