The foreign exchange market, or forex, as it is more commonly called, is the biggest market in the world with over $4 trillion changing hands every single day. To put that into perspective, it is 12 times greater than the average daily turnover on the global equity markets and more than 50 times greater than the average daily turnover on the NYSE.

Trading in foreign currencies has been around for thousands of years. In fact, some of the first known currency traders were the Middle Eastern moneychangers who exchanged coins to facilitate trade. Given a market this size, it is no surprise that the taxation of forex remains a complexity to most traders and tax professionals.

A LITTLE BACKGROUND

The Tax Reform Act of 1986 instituted the provisions covering Section 988 transactions.

Section 988 transactions, the default method of taxation for currency traders, treats the gains or losses from forex transactions as ordinary gains or ordinary losses. If you have forex gains, they are taxed as ordinary income, subject to which ever tax bracket you fall under. Let’s look at an example:

Joe Trader is married and makes $100,000 salary a year. He has a good year trading FOREX, making $50,000 for the year. Joe falls in the 25% tax bracket, making his tax due on his FOREX gain $12,500 ($50,000 X 25%).

BUT WHAT ABOUT FOREX LOSSES?

If you lose money trading FOREX, your losses are treated as ordinary losses, and can be used to offset any other income on your tax return. Let’s use Joe as an example again:

Instead of making $50,000, Joe loses $50,000 trading forex. The $50,000 loss can be taken against his W-2 income, making his taxable income $50,000 ($100,000 – $50,000). If his forex loss were a capital loss instead of an ordinary loss, Joe would only be able to take $3,000 off of his taxes, making his taxable income $97,000. The remaining $47,000 loss would have to be carried forward and used up in future years.

So what type of FOREX trader benefits from Section 988 tax treatment? In my opinion, if a trader is not consistently profitable and has other earned income on their tax return, they should stay under the Section 988 taxation to be able to fully utilize any losses that come from FOREX trading. If you are not consistently profitable in your FOREX trading AND you have no other earned income, you should consider doing what profitable FOREX traders should do: opt out of Section 988 tax treatment. I’ll explain why at the end of the article.

IRC section 988(a) (1) (B) provides FOREX traders with a way to opt out of the ordinary gain/loss tax treatment:

“Except as provided in regulations, a taxpayer may elect to treat any foreign currency gain or loss….as a capital gain or loss (as the case may be) if the taxpayer makes such election and identifies such transaction before the close of the day on which such transaction is entered into”.

This exception gives forex traders the option to opt out of ordinary gain/loss treatment; making your forex trades taxed the same as section 1256 contracts. Section 1256 contracts are taxed at a more beneficial rate of 60/40, 60% taxed at long term capital gains rates and 40% taxed at short term capital gains rates. The maximum tax rate on ordinary income currently is 39.6%. The maximum tax rate on Section 1256 contracts by comparison is 28%, almost a 30% reduction in taxation on the gains!

Using our example above, if Joe had opted out of the Section 988 tax treatment, his tax rate on his $50,000 FOREX gain at a 60/40 rate would drop 24% (19% vs. 25%), saving him $3,000 in taxes that year!

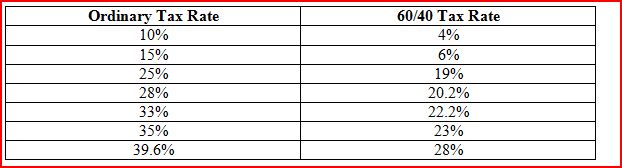

Here is a comparison of ordinary tax rates vs. the 60/40 tax rate using 2013 tax brackets:

The IRS requires a trader to make the election to opt out of Section 988 tax treatment internally, meaning you make the opt out election in your own corporate books or records. You do not have to notify the IRS in advance, as you do if you were making the mark to market election. I’d personally suggest having your opt out election notarized, which would help solidify your claim of a timely election if you got audited.

THE BOTTOM LINE

Opting out of Section 988 tax treatment for forex traders is a no-brainer decision for profitable traders due to the tax savings. However, it also makes sense for traders who are not consistently profitable yet but also don’t have any earned income on their tax returns. If a trader has an ordinary loss and no earned income to offset it against, the ordinary loss ends up being wasted as it cannot be carried forward to future tax years. If you opt out and elect Section 1256 tax treatment, the loss can be carried forward and used against future capital gains.

If you are still uncertain as to whether to opt out or not, please seek out the advice of a knowledgeable trader tax specialists to assist you with this decision.

= = =