After a long rally in the S&P Large Cap Index, we are currently beginning the correction phase. Once the 1,600 level was taken out, it seemed like the price was going to reach 1,700 points very quickly after hitting an all-time high of 1687 on Wednesday.

However, a very clear “reversal day” candle appeared on the chart that very same day after Bernanke and the Fed minutes. This very bearish engulfing pattern was accompanied by high volume, confirming the reversal move in the broad index.

MOVING AVERAGES

The 20 (green line), 50 (blue line) and 200 (red line) day moving averages are plotted on the daily chart. We can see that in past times, the 50 DMA has served as a good support level. Therefore, should the price continue to drop there’s a chance it might bounce at 1590. Should this level be broken, the situation becomes quite serious. We wouldn’t be looking at an ordinary pullback and might be facing a change in trend.

The high reading on the MACD indicator is also giving a negative signal crossover which is quite bearish.

ETF PLAY

Given the huge drops in the Asian markets, the situation could be worse than expected. This drop is unlikely to run its course in a day or two, and one might think to profit from it by buying ETF ProShares UltraPro Short S&P500 (SPXU), which is twice leveraged against the broad market index.

DIFFERENT VIEW

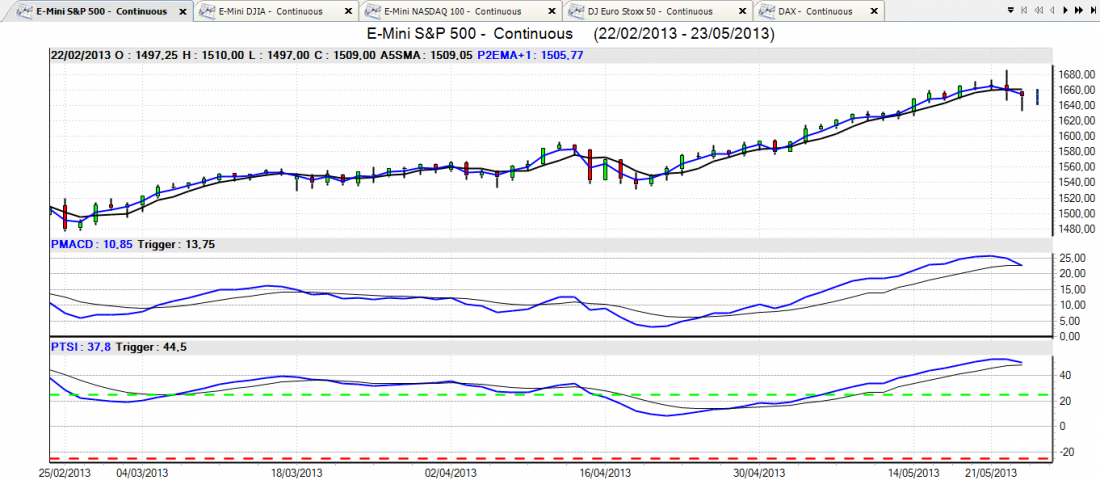

The Vantage Point Chart on the E-mini S&P500 Futures contract also shows certain weakness since the short term crossover and the Predictive MACD are currently signaling negative crossovers.

What is of certain concern here is that the True Strength Index is looking to go in the same direction shortly.

BOTTOM LINE

The first target we’re looking at is the 20 day moving average level, which is currently at 1630. Once this level is taken out we could expect the market to move lower to the 50 day moving average (1590).

It is then that the large cap index will face a key moment. Could it bounce from that level like it has done previously? Or will it fail to do so and change the trend?

Here’s wishing all TraderPlanet readers a fabulous weekend ahead.