As a student of behavioral finance, incorporating “cognitive influence” into one’s portfolio analysis is both challenging and exhilarating. While difficult to execute, it is indeed necessary given the amount of empirical evidence substantiating its relevance.

When using psychology-based reasoning to explain investor behavior, studies have shown that investors are proven to be over-confident in their abilities and tend to move in herds. Positive sentiment ignites additional positive sentiment and unusually high levels of risk tolerance.

Relevant fundamental market drivers appear to have taken a backseat to an addiction to the Federal Reserve’s QE program. There is a level of risk tolerance in the market that can be very dangerous to the unsuspecting. This is perhaps a negative consequence of the Fed’s QE experiment, but clearly investors that should place equal emphasis on both portfolio returns and RISK, are leaning in one direction as viewed by investor sentiment surveys, margin balances, etc.

Last week one can make the argument that the Fed has reintroduced market risk with the possibility of tapering QE. Should this prove to be true, history has shown that over-confident investors can suddenly transition into risk averse, over-reactionary people.

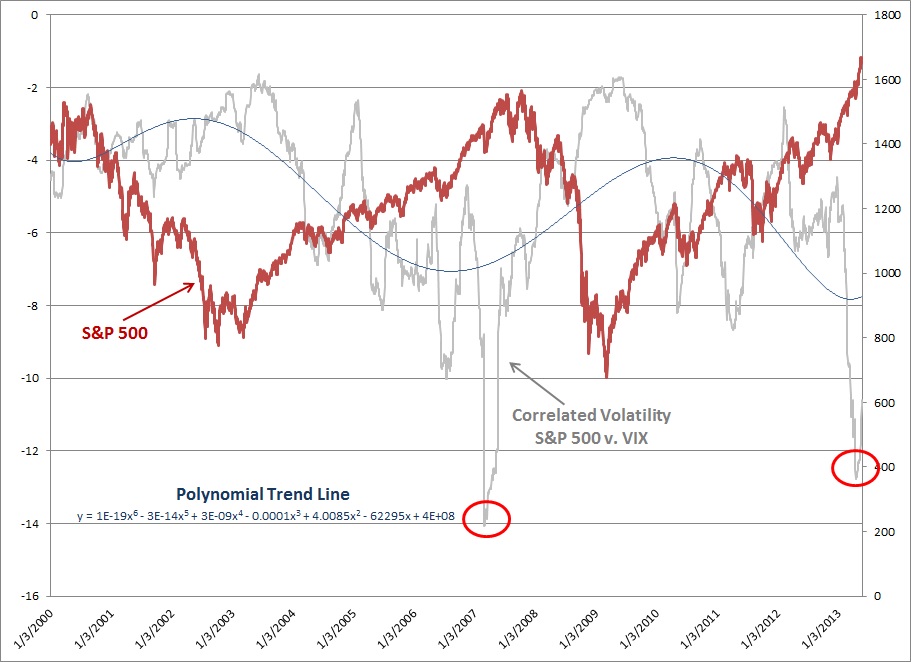

When looking at the chart provided, one will see the daily closing price for the S&P 500 back to 2000. We have overlaid the correlated volatility between the S&P 500 and the VIX. We use this model as one way to measure investor risk tolerance. As one can see, it has been helpful in predicting major market inflection points.

Correlated volatility has recently hit new lows not seen since mid to late 2007 and has started higher. The trend line attached to the correlated volatility measure has also started higher. The inverse relationship between these two measures has increased the likelihood of a market correction in the coming weeks or months.