Some contend that for the first time in history, the legal, financial, and societal conditions exist for social investing to happen effectively, and on a large-scale. Former financial industry consultant, Alex Blum, is one of those in this camp.

Photo Caption: Former wealth management consultant Alexander Blum in Panama.

At this time, “for-profit corporations like mine can make decisions that intend to do good and do well,” says Blum. “Impact investing not only bridges the gap between the non- and for-profit sectors, but it’s the smartest investment out there for patient money, if one diversifies properly.”

Certainly the crossover between worlds has been noticeable. Job search site Monster.com reports that the boundaries between the for-profit and non-profit sectors are blurring and notes the non-profit sector has seen gradual adoption of some corporate practices.

For many years, Blum lived what many would call the good life, and he was doing it at a relatively young age – in his 20s. Years back, Blum joined Merrill Lynch as a wealth management consultant and had a home in a gated community in Scottsdale, Arizona. This happened after he served in The Peace Corps in Panama following his graduation from Tufts University.

But these days, Blum has a foot in both worlds. “All else being equal, I think the tree-hugging Peace Corps volunteers would rather be wealthy than poor and a successful, corporate Merrill Lynch stockbroker would rather make the world a better place than destroy it,” he says.

Blum is the founder and CEO of 00-O Benefit Corporation, an entity that has the modest ambition of bringing Internet access, and therefore medical and other access, to every area of the world.

Caption: Former wealth management consultant Alexander Blum in Panama with the people of the area.

In a video made to raise funds for the project, Blum, who also sits on the board of directors for The Floating Doctors, says that after he finished his time in Panama with the Peace Corps, he thought to himself, “Man there’s a bunch of ways we could probably help.”

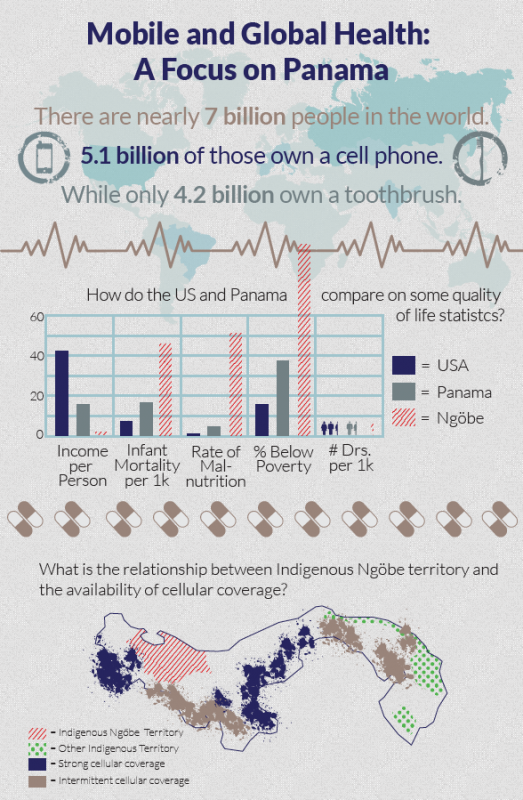

Blum’s company will be installing five solar-powered telecommunications towers in Western Panama that will connect approximately 50,000 individuals living off the grid to electricity, light, phone and Internet for about $25,000. The company has already raised the needed funds to enact the project.

Well-worn definitions of social investment, and benefit corporations – a form of for-profit charity, “don’t fully explicate the incredible financial opportunity that impact investing in developing markets presents,” he says. “For example, I am installing solar-powered telecommunications units that cost a fraction of what large telecom companies charge.” Blum adds that his company is offering a product that is needed by billions of people, has little to no competition, and that the project lacks much of the red tape that holds back these types of projects in the U.S.

He says the most popular social investment is the most obvious one: alternative energy. “Clearly, wind and solar energy business continues to grow,” he says. “With the coming end of tax benefits and increasing competition, I expect this will only increase. However, the cat is out of the bag on beating the herd into these companies.”

Blum notes that there are mutual funds comprised of “socially responsible investments” that retail participants can buy into. However, he says a retail financial advisor is often not going to steer a client toward these types of investments because they aren’t being encouraged by their bosses to do so. “Nevertheless, they are out there and, if asked, an advisor would know where to find information about it,” Blum says.

Additionally, soon retail investors will be able to invest in new, impactful businesses directly on websites that allow for alternative exchanges, he says. The Jumpstart Our Business Startups Act that President Barack Obama signed into law in April of 2012 allows for this type of investment. A large community of crowd funding and investment professionals are eagerly awaiting the go-ahead from the U.S. government on this possibility, Blum says.

Blum, who has had project postings on impact sites such as Changemakers, is well aware of his unique perspective due to his background, and he offers this insight. “The common stereotypes of these two groups [non-profit and for-profit], consist of a whimsical, hippy dippy do-gooder who lacks the ability to enact any tangible change and an amoral, money-loving, greasy-haired, slick talker who lacks the ability to care about anything beyond his solipsistic world,” he says. “It is, of course, a misconception to think either group fits their ascribed mold.”

Blum says that individuals, businesses, and governments are “all converging upon the realization that environmentally, societally, and morally sound businesses are the most robust companies out there right now… Environmental and technological factors continue to push us in this direction.”