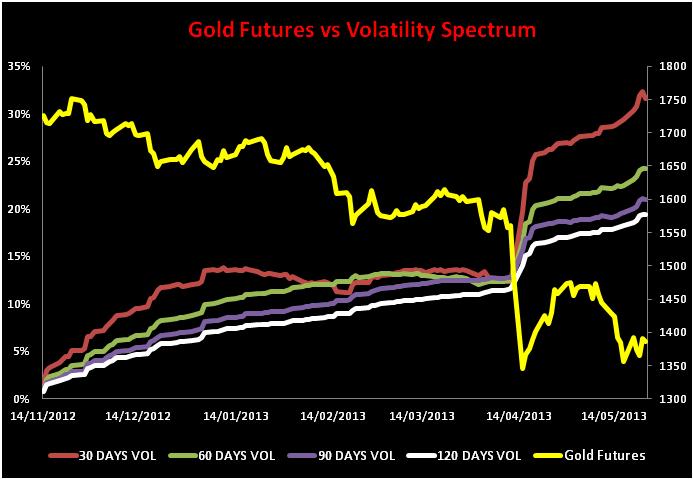

Gold prices, historically speaking, have never been very volatile and the recent fluctuations can be definitely catalogued as rare event. The realized volatility of gold, which is extrapolated from futures prices, usually oscillates between 10% and 22% but it tends to fluctuate rather smoothly while the implied volatility, which is extracted from options prices, normally oscillates within the 17% – 22% interval. The following chart plots futures prices against short, medium and long term volatilities and it suggests that the current realized volatility is above 30%:

The graph clearly shows that the collapse in the price action has been anticipated by a fall in short, medium and long term volatilities. In particular, it is evident that around the 13th – 14th of May both 30 and 60 day volatilities plunged and started to fluctuate below the 90 and 120 day volatility curves. This was the signal that a large move was about to occur because short term volatilities should always be higher than long term ones.

TWO KEY DRIVERS

The plunge in gold can have been triggered by two factors: central bank intervention and a shift in the demand/supply dynamics. The first theory is that struggling central banks (Cyprus, Greece, etc) could have started to sell their gold reserves in order to unload their balance sheets and get some fresh cash. The second one involves the fact that some recent fundamental studies highlighted that the gold extraction rate is likely to increase in the next decade while the demand will probably remain unchanged; such a phenomenon would put a lot of pressure on gold prices and it would partially explain the large drop.

SUITABLE STRATEGIES

Now, these are not trading recommendations but a basic guide under the present volatility regime. At this point the volatility is very high and it will probably start softening in the upcoming hours, hence, some iron condors or butterfly spreads could be entered in order to profit from the mean reverting process of the variance.

BOTTOM LINE

The market is still unstable and rather vulnerable therefore strategies such as straddles and strangles should be avoided.