After a powerful struggle with the 1400 mark, gold finally managed to break over this key resistance level yesterday.

The price hit an overnight high of $1,421 and has retraced from that point to a current $1,407. Euro Zone unemployment rose to a record high of 12.2% in April. This data has managed to weaken the Euro Currency as the U.S. dollar index has turned firmer after going through a lot of selling pressure this week.

TECHNICAL ANALYSIS

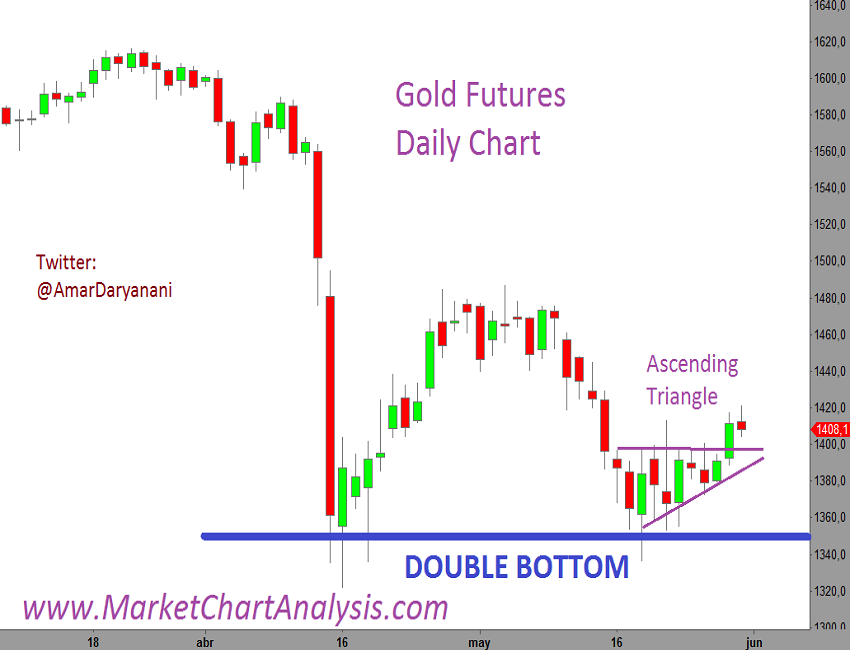

We can now clearly identify a Double Bottom pattern from which the price has managed to bounce twice, turning this level to a strong support.

The danger seems to have passed as gold is carving out of a small Ascending Triangle.

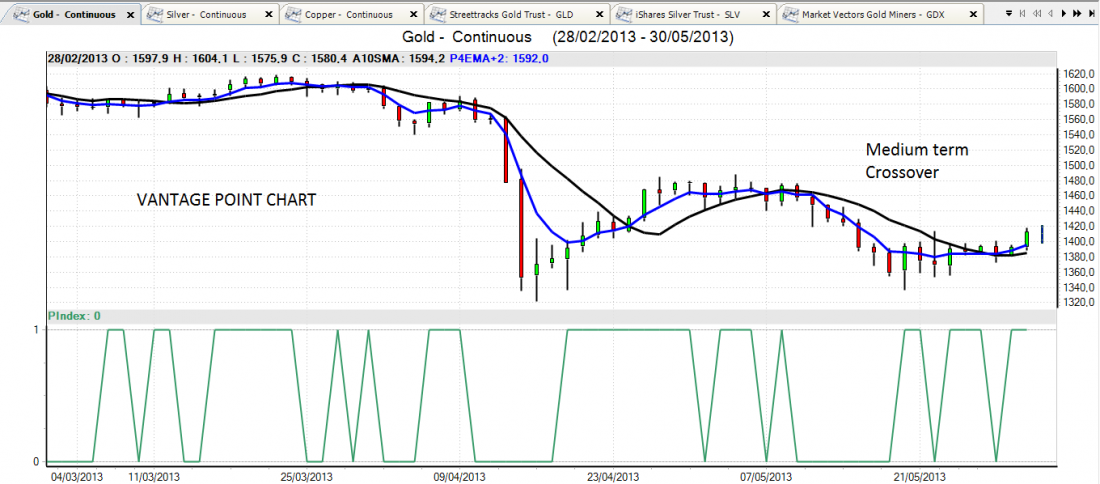

On the Vantage Point chart, we can also see a sign of new strength as the Predicted Medium Term Crossover is currently edging above the 10 day simple moving average. This is a bullish sign for gold. The Predicted Neural Index also points out that the market is expected to move higher over the next few days.

BOTTOM LINE

Although the paper gold market remains volatile, the good news is that the physical buyers and premiums remain strong in most markets.

We’ve also witnessed an increase of 55% in the trading volume of the Shanghai Gold Exchange cash contract from 10,094 kilograms to 15,641 kilograms. This exchange has also announced this week that they will start after-hours trading for gold and silver futures shortly.

This might have a positive effect on the paper market and will help to put a floor on the price of the yellow metal.

It is also important to remember that many hedge funds are holding heavy short positions on the yellow futures contract. Should there be any catalyst that might trigger these big funds to unwind their positions we could see a huge spike in gold breaking the next resistance level of $1,430.