Welcome back to the second in a series of articles I am writing on “an introduction to the Elliott wave principle.”

In this second article, I will look at the basic structure, the “three major rules” and Fibonacci retracements.

RULES, GUIDELINES AND PATTERNS

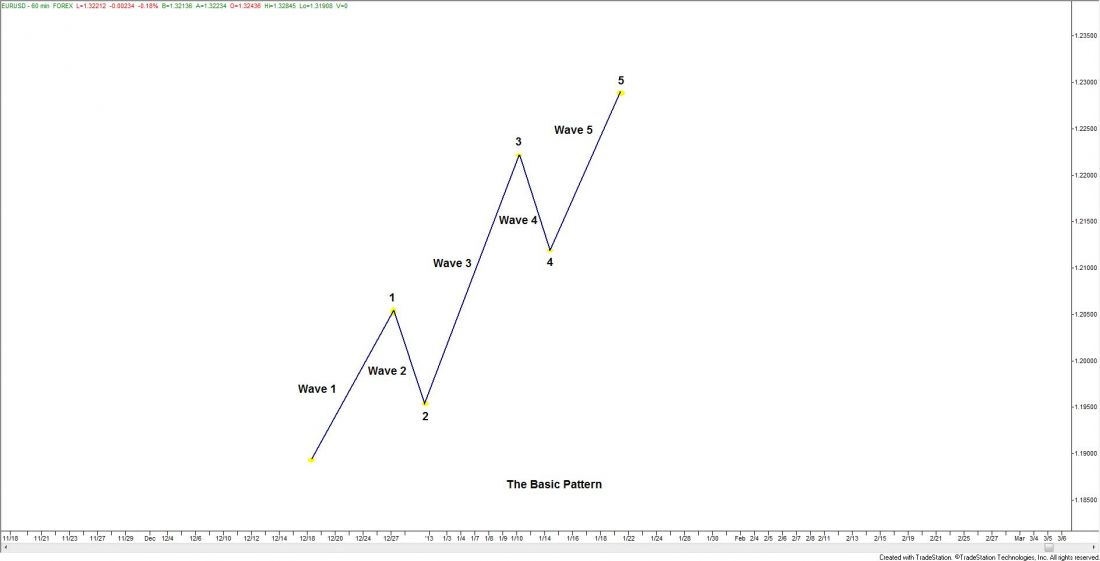

In the financial markets, progress ultimately takes the form of five Elliott waves of a specific structure. As you can see below, Figure 1, the most basic Elliott wave structure, waves (1), (3) and (5) actually affect the directional movement. Waves 2 and 4 are countertrend interruptions.

The two interruptions are a requisite for overall directional movement to occur. And though there are several variations of Elliott waves, all of them fit into the basic structure you see above. The stock market is always somewhere in the basic five-wave pattern at the largest degree of trend. Because the five-wave pattern is the overriding form of market progress, all other patterns are subsumed by it.

13 WAVE PATTERNS

Elliott isolated 13 patterns of movement, or “waves,” that recur in market price data and are repetitive in form but not necessarily repetitive in time or amplitude. He named, defined and illustrated the patterns. These patterns are Elliott waves and link together to form larger versions of those same patterns. They, in turn, link to form identical patterns of the next larger size, and so on. Remember the Robust Fractal description mentioned in the first article.

Elliott’s highly specific rules keep the number of valid interpretations (or “alternate counts”) to a minimum. The analyst usually considers as “preferred” the one that satisfies the largest number of guidelines. The top “alternate” is the one that satisfies the next largest number of guidelines, and so on. Alternates are an essential part of using the Elliott wave principle.

THE RULES

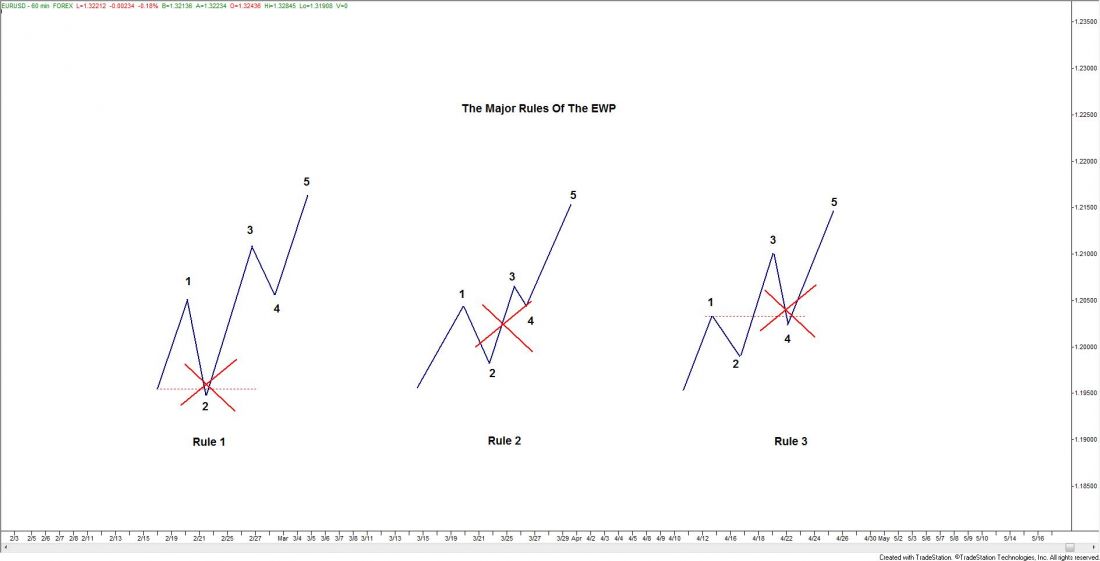

There are three MAJOR Rules that are extremely important when learning and applying the WP. Of the five waves:

1. Wave Two cannot retrace more than 100% of wave One.

2. Wave Three cannot be the shortest wave.(Does not have to be the longest)

3. Wave Four cannot retrace into the price territory of wave 1.

Figure 2 shows an example of each of these major rules.

These three basic rules are the backbone to the WP and must not be interpreted lightly. By not breaking these three rules you will be quickly on the road to understanding and using the WP.

FIBONACCI AND ELLIOTT

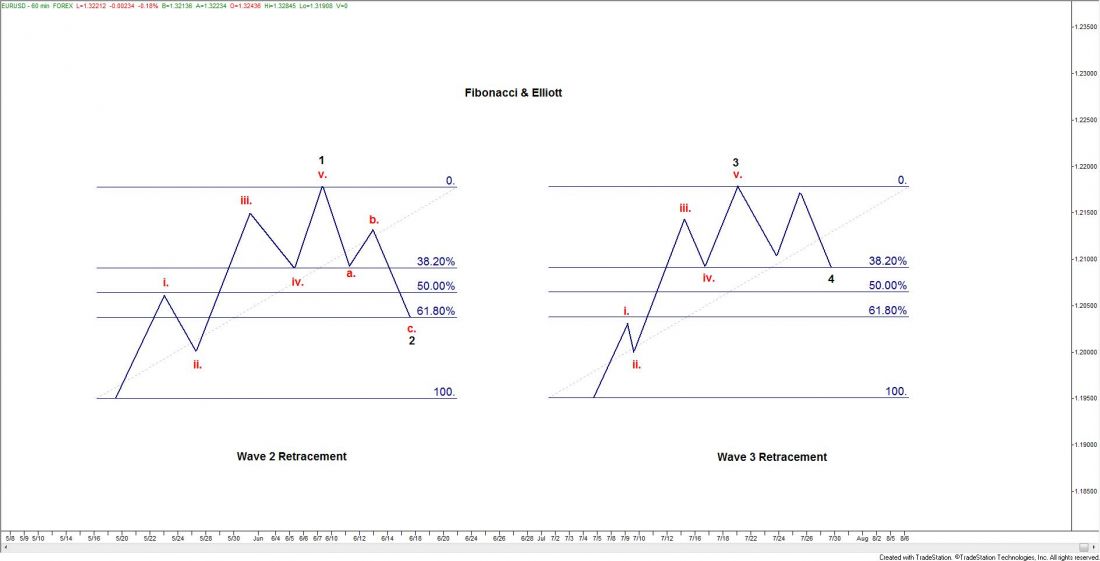

Another key to applying the Elliott wave principle is Fibonacci ratios. Few investors realize that Fibonacci analysis of the markets was pioneered by R.N. Elliott. The use of Fibonacci ratios requires a valid Elliott wave interpretation as a starting point. Elliott had two chief insights concerning Fibonacci relationships within waves.

A. Corrective waves tend to retrace prior impulse waves of the same degree in Fibonacci proportion — common wave relationships include 38%, 50% and 62%.

Figure 3 shows common Fibonacci retracement values for waves 2 & 4.

B. Impulse waves of the same degree within a larger impulse sequence tend to relate to one another in Fibonacci proportion. The distance travelled by the first wave in the structure (Wave 1) offers Fibonacci targets for waves 3 and 5.

Now we have covered the basics of the Wave Principle, and they remain as Elliott formulated them. Those basics are fully described in the standard textbook of wave analysis, Elliott Wave Principle — Key to Market Behavior, by A.J. Frost and Robert R. Prechter, Jr. That book rescued the Elliott wave principle from obscurity and propelled it to worldwide acceptance as perhaps the most sophisticated form of technical analysis.

= = Stay tuned for the next article in this series.

In article three, I will take a look at the internal structures of Corrective Waves 2 & 4 and some common Wave Structure Guidelines.