All eyes are on today’s FOMC announcement. This could be one of the most impacting moments of the first half of 2013 as it’s the first statement since the Fed informed of its intentions to taper asset purchases.

Traders should not get confused with the initial movements of the market after the announcement and they should wait for the market to digest the news to get a clearer idea of the trend.

TECHNICAL ANALYSIS

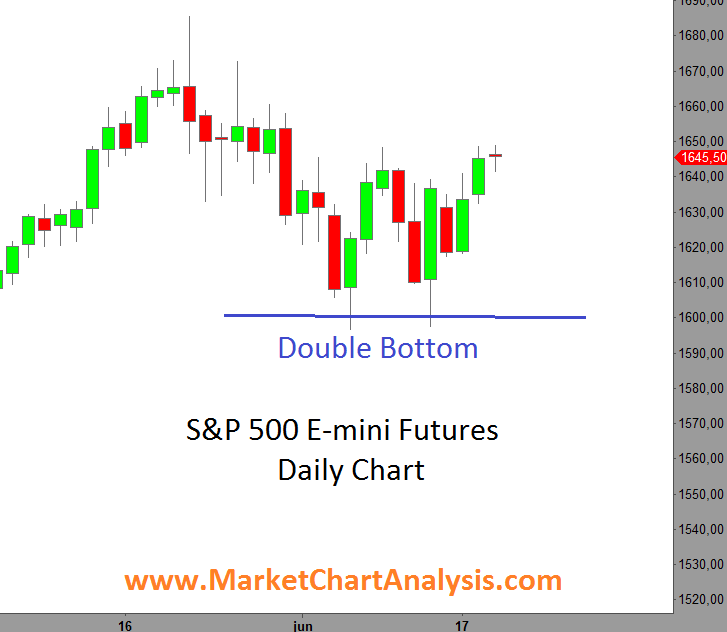

On the S&P 500 E-mini futures contract we can see a bullish pattern, which is a double bottom. The first low was hit on June 6th at 1596.50 and the second one just a week later at 1597.50. As I’ve mentioned in a previous analysis, the broad index holds a strong support at 1590.

On the Vantage Point we look at the SPDR S&P500 ETF (SPY) that is currently displaying a positive triple crossover which is quite bullish. Today we add a new indicator to our study, created by Larry Williams for Vantage Point: the Electronic Market Accumulation Index (EMAI).

It’s interesting to note that the rally we’ve seen on the SPY ETF during these past few weeks is more of a distribution rather than an accumulation from the professional investor’s point of view, and this also coincides with an underlying weakness in the true strength index.

But these two indicators (EMAI and TSI) are now hinting at the possibility that we might see new accumulation and re-strengthening in the broad market index.

BOTTOM LINE

Although there are many opinions on what the Fed will announce later in the day, we must be disciplined in our trading. Therefore, it’s important to wait and see how the market digests the news after the statement and then hop on board.

In order to confirm a positive trend and the double bottom we’ve seen earlier, one should wait for a breakout above the 1655 – 1660 level. However, if the news turns out to be bearish for the equity market, the support to watch will be once again the 1590 – 1595 area, possibly creating a new pattern of a triple bottom.