Recent market action can easily be described as unhealthy. Last Monday the U.S. stock markets opened higher and later sold off due to a Financial Times article released midday speculating Fed tapering. After getting spooked, the author later tweeted out to market participants to “chill out.” The market recovered from its lows soon after.

If it wasn’t so dangerous it would be funny.

George Melloan in his 6/18 Wall Street Journal opinion piece How the Fed Turned the Markets Skittish said it best, “We are in an age where the eight male and four female members of the FOMC are responsible for whether securities markets float or sink. Traders around the world who in better times considered a range of variables now focus on a single one, Federal Reserve policy.”

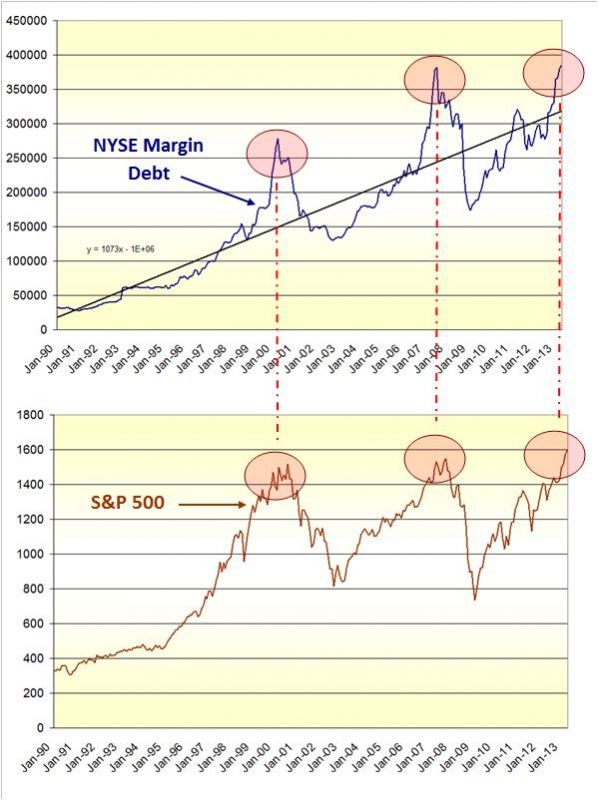

We have written in the past about a coming market correction and have attempted to provide the appropriate evidence that supports our thesis. Another concern for us, especially in this Fed risk on/off binary market are the large margin debt levels.

LOOK AT HISTORY

It’s one thing for investors to have been put in a position to abnormally seek risk, but now we are borrowing money to do so. Historically this has been shown to be disastrous.

When looking at the chart below, one can see the NYSE margin debt balance back to 1990. The problems arise when the debt levels rise well above the linear trend line. We are approaching those dangerous levels of margin debt.

DON’T CHASE THE RALLY

We hate to sound like a broken record, but we continue to advise our newer clients not to chase the rally. We are of the opinion that we will ultimately be offered a much better entry point. For our existing clients, we have taken profits on positions bought in 2012. We remain largely in cash and have been building positions that move inversely to the general U.S. indices.